[ad_1]

Crypto-focused funding agency Pantera Capital says bitcoin has seen its lows and “we’re within the subsequent bull market cycle.” Dan Morehead, the agency’s founder and managing companion, famous: “Over the long-term, bitcoin value has been in a secular uptrend of two.3x yearly over the previous twelve years, on common.”

Pantera Capital on the Subsequent Bull Market

Pantera Capital revealed its February Blockchain Letter final week. The letter, titled “The Seventh Bull Cycle,” is authored by founder and managing companion Dan Morehead and funding associates Ryan Barney and Sehaj Singh. Pantera Capital is an funding agency that focuses on cryptocurrencies, digital belongings, and blockchain expertise.

Referencing his evaluation of bitcoin value cycles within the letter, Morehead tweeted Thursday:

I imagine that blockchain belongings (utilizing bitcoin as a proxy) have seen the lows and that we’re within the subsequent bull market cycle — no matter what occurs within the interest-rate-sensitive asset courses.

“That may be the seventh bull cycle, after six bear cycles,” he famous. Morehead defined within the letter that Pantera has been by means of 10 years of bitcoin cycles and he has traded by means of 35 years of comparable cycles.

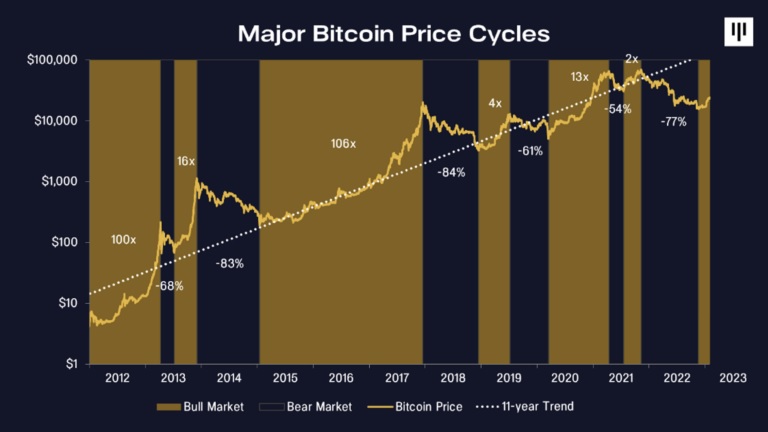

The Pantera Capital founder identified that the BTC value decline from November 2021 to November 2022 was “the median of the everyday cycle.” He added: “That is the one bear market to greater than fully wipe out the earlier bull market. On this case, giving again 136% of the earlier rally.”

“The median downdraft has been 307 days and the earlier bear market was 376. The median drawdown has been a -73% downdraft and the most recent bear market ended at -77%,” Morehead continued. “I believe we’re performed with that and starting to grind greater.”

Morehead additional famous:

Over the long-term, bitcoin value has been in a secular uptrend of two.3x yearly over the previous twelve years, on common.

Do you agree with Pantera Capital founder Dan Morehead that we’re already in a bull market cycle? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link