[ad_1]

A brand new research on digital currency-related lawsuits since 2018 exhibits a 42% enhance in crypto lawsuits in 2022. The very best variety of claims in a single 12 months was recorded final 12 months, with 41 whole claims in america. The analysis additionally exhibits that almost all of lawsuits got here from the U.S. Securities and Alternate Fee (SEC).

Rise in U.S. Crypto Lawsuits Tracked Since 2018: Report

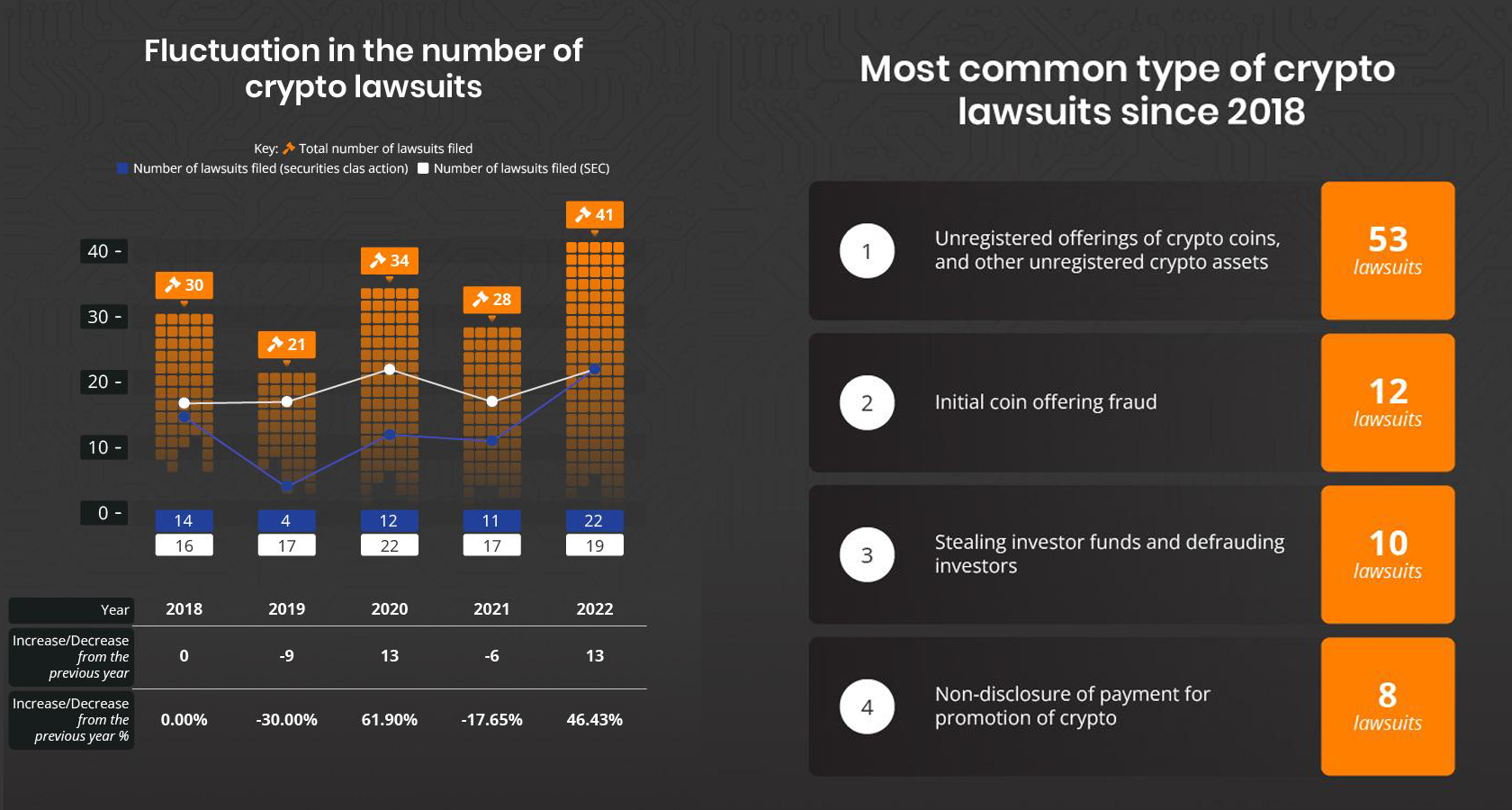

Much like the worth cycles skilled by cryptocurrencies, there are fluctuations within the variety of U.S. crypto-related lawsuits filed annually, based on new analysis printed by hedgewithcrypto.com. The study notes a 40% enhance in crypto lawsuits between 2018 and 2022, however there have been some decreases between the highs. Out of all of the years, 2022 noticed the very best variety of lawsuits in america, with a complete of 41.

“In 2019, there was a 30% lower because the variety of lawsuits dropped from 30 to 21,” the hedgewithcrypto.com researchers clarify. “This was adopted by a dramatic enhance of slightly below 62%, to 34 instances in 2020, earlier than one other drop to twenty-eight in 2021. Lastly, there was one other enhance (this time of over 46%) in 2022, with 13 extra instances than in 2021.”

Roughly 19 of the 2022 crypto lawsuits originated from the U.S. Securities and Alternate Fee (SEC), because the nation’s prime securities regulator has been cracking down on unregistered providers and securities. All through the years, lawsuits associated to unregistered providers and securities have been the most typical within the crypto trade, totaling 53 lawsuits since 2018. Preliminary coin providing (ICO) fraud accounted for 12 lawsuits, whereas theft or fraud equated to 10 lawsuits since 2018.

Non-disclosure instances or the illegal promotion of a cryptocurrency accounted for eight lawsuits, whereas making false and deceptive statements a couple of crypto product represented 5 of the full during the last 5 years. “Non-disclosure of cost for the promotion of crypto merchandise is likely one of the most notorious cryptocurrency-related lawsuits, usually involving celebrities,” the analysis says.

As an illustration, the Emax promotion case involving Kim Kardashian and the SEC generated over 50,000 articles in regards to the topic recorded on Google’s search engine. The fewest lawsuits up to now 5 years had been associated to falsifying firm income and pyramid scheme fraud. Hedgewithcrypto.com researchers compiled the U.S. lawsuit knowledge from the SEC and fits recorded by Stanford Regulation.

What do you suppose is driving the growing variety of crypto-related lawsuits within the U.S.? Do you consider that regulatory motion by the SEC is important for the trade to thrive, or does it stifle innovation? Share your ideas within the feedback beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss brought on or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link