[ad_1]

This text is an on-site model of our Disrupted Instances e-newsletter. Sign up here to get the e-newsletter despatched straight to your inbox thrice per week

As we speak’s prime tales

-

Governments and worldwide organisations are stepping up monetary assist for Turkey and Syria because the demise toll from this week’s earthquake surpassed 22,000 folks, with hundreds of thousands anticipated to be displaced.

-

Japan is predicted to nominate Kazuo Ueda, a revered financial coverage professional, as its new central bank chief, ending hypothesis amongst world buyers over the successor to Haruhiko Kuroda, who oversaw a decade of insurance policies designed to maintain rates of interest at ultra-low ranges by shopping for huge portions of presidency bonds. The yen climbed in anticipation.

-

Moldova’s prime minister Natalia Gavrilita give up, blaming an absence of assist for her authorities because it struggles with the consequences of war in neighbouring Ukraine and efforts by Moscow to destabilise the nation.

For up-to-the-minute information updates, go to our live blog

Good night.

It’s maybe an indication of the instances that information this morning of UK growth flatlining within the fourth quarter of final 12 months was hailed by chancellor Jeremy Hunt as proof that the financial system was “extra resilient than many feared”.

Output shrank greater than anticipated in December, in response to the Workplace for Nationwide Statistics, however GDP for the three-month interval was unchanged, that means the UK had, for now, dodged recession, outlined as two consecutive quarters of unfavorable progress.

It stays the one G7 member to not have recovered absolutely from the pandemic, in distinction with the US, which was up 5.1 per cent within the fourth quarter in contrast with 2019, and the eurozone, which was up 2.4 per cent.

One vibrant spot is London, the place new knowledge yesterday confirmed the capital powering ahead of other regions in England, because of progress in skilled providers, underlining the challenges forward for the federal government in delivering on its promise of “levelling up” left-behind areas.

On the optimistic facet, the outlook for inflation has improved since gasoline costs started to fall. Bank of England chief Andrew Bailey informed a parliamentary committee yesterday that public sector employees wanted to take this into consideration when asking for pay rises. The BoE predicts inflation will drop from 10.5 per cent to 4 per cent by the tip of 2023.

Home costs in the meantime are exhibiting their most widespread falls since 2009 as hovering mortgage charges hit purchaser demand. The common charge for brand new loans reached 3.67 per cent in December, the best in a decade, in response to BoE knowledge final week.

All of which can be on Hunt’s thoughts as he prepares for his Funds on March 15.

Enterprise foyer teams are calling on the chancellor to make use of his speech to pave the best way for progress by way of tax breaks for investment and insurance policies to deal with employee shortages. They’ve additionally voiced considerations that the forthcoming improve in company tax from 19 to 25 per cent will hit firms’ capital spending.

Brexit costs for business in the meantime proceed to mount, particularly in areas reminiscent of chemical compounds the place firms now have to stick to UK-badged rules in addition to present EU guidelines, for no tangible achieve. To not point out the query marks nonetheless hanging over the broader regulatory panorama because of the federal government’s intention to “overview or revoke” all leftover EU legal guidelines by the tip of this 12 months.

As UK chief political commentator Robert Shrimsley notes, the try by Hunt and his boss Rishi Sunak to stress fiscal prudence will not be made any simpler by noises off from Tory colleagues — particularly these grouped round Sunak’s predecessor Liz Truss — pining for one more dose of unfunded tax cuts, regardless of the final try ending in disaster.

Have to know: UK and Europe financial system

Spurred by the decline in money transactions, the UK authorities and the Financial institution of England have began work on the design of a “digital pound”. Read our explainer on the way it would possibly work and FT client editor Claer Barrett’s piece on whether or not it will be good for consumers.

European Fee chief Ursula von der Leyen mentioned the EU would struggle again towards “large” hidden handouts from China to its industries, in addition to responding to the US risk of inexperienced power subsidies. The finance chief of ArcelorMittal, Europe’s largest steelmaker, informed the FT that Brussels wanted to simplify the approvals process for investments.

German inflation hit a five-month low of 9.2 per cent, however the delayed knowledge may result in an upward revision to final week’s eurozone-wide determine of 8.5 per cent.

Russia mentioned it will cut its oil output by 5 per cent or 500,000 barrels a day in response to the value cap imposed by the west. High power dealer Pierre Andurand mentioned Vladimir Putin had “lost the energy war”. Putin will ship a state-of-the-union address on February 21, three days earlier than the primary anniversary of his invasion of Ukraine.

Be a part of FT correspondents and company at our subscriber webinar on February 23 from 1300-1400 GMT to mark the anniversary and what would possibly occur subsequent. Register in your free ticket at ft.com/ukraine-event.

Have to know: World financial system

China has pulled again from its participation in a subsea cable mission linking Asia with Europe as tensions develop with the US over who builds and owns the infrastructure underpinning the global internet.

Hong Kong is pulling out all of the stops to lure enterprise again after three years of lockdowns in what it referred to as “most likely the world’s biggest welcome ever”. Sights embrace set-up funds for worldwide firms, visas for international graduates and 500,000 free airline tickets to encourage tourism.

Have to know: enterprise

Adidas is going through €700mn in working losses because of its pile of unsold Kanye West “Yeezy” sneakers. The group issued its fourth revenue warning since July, laying out a worst-case state of affairs through which it must write off all of the remaining stock.

Disney is to cut 7,000 jobs, about 3 per cent of its workforce, as a part of a cost-saving restructuring. The modifications led to activist investor Nelson Peltz calling off his proxy struggle towards the corporate which was set to be one of many largest company battles in recent times.

Credit score Suisse reported its largest annual loss since the 2008 financial crisis as funding banking slumped and purchasers pulled cash from its wealth administration enterprise. Right here’s our Big Read on a make-or-break second for the financial institution.

The FT Journal dives into the bizarre final hours of FTX and the way Sam Bankman-Fried and his crew of millennial millionaires misplaced a $40bn crypto empire.

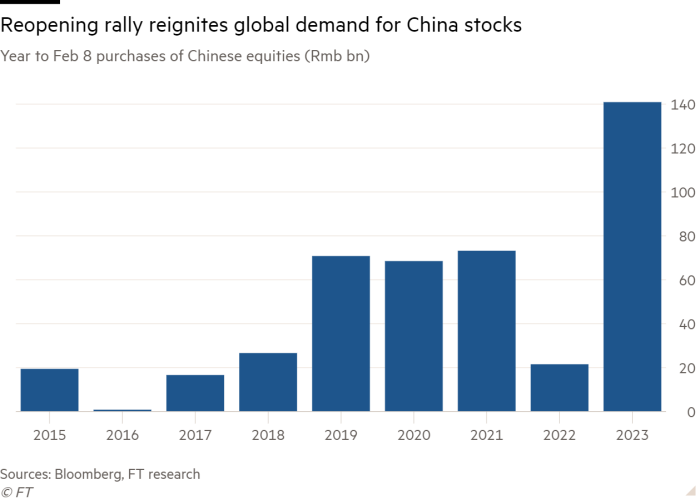

World buyers are betting massive on China’s reopening, snapping up a record $21bn of Chinese language equities because the begin of the 12 months. The development has been fuelled by optimistic financial knowledge printed after the lunar new 12 months vacation.

Science spherical up

The unfold of antibiotic resistance has revived curiosity within the bacteria-killing viruses known as phages, first found and used to struggle an infection a century in the past. Learn extra in our particular report: Future of Antibiotics.

The inventor of the silicon expertise behind solar energy informed the FT that combining different supplies with the silicon may increase the effectivity of photovoltaic cells that convert daylight into electrical energy from 25 per cent to more than 40 per cent.

The fusion power business referred to as for extra political assist to construct on final 12 months’s breakthrough by US scientists that demonstrated the potential for producing more energy from a fusion reaction than it consumed, dubbed “one of the vital spectacular scientific feats within the twenty first century”.

New expertise that makes use of fibre optics to search out the causes of coronary heart illness has begun testing at London’s St Bartholomew’s Hospital. The iKOr system measures blood flow around the heart and will finally assist many sufferers affected by issues reminiscent of chest pains, whose trigger can’t be recognized with present methods.

And eventually, the European House Company is getting ready for one of many most ambitious space projects ever, a 12-year mission to the outer photo voltaic system to analyze whether or not three of Jupiter’s moons would possibly assist life.

Some excellent news

College of California researchers have recognized tiny organisms that not solely survive however thrive through the first 12 months after a wildfire. The findings may help bring land back to life after fires which are rising in each measurement and severity.

One thing for the weekend

The FT Weekend interactive crossword can be printed here on Saturday, however within the meantime why not attempt as we speak’s cryptic crossword?

Interactive crosswords on the FT app

Subscribers can now clear up the FT’s Day by day Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Thanks for studying Disrupted Instances. If this text has been forwarded to you, please enroll here to obtain future points. And please share your suggestions with us at disruptedtimes@ft.com. Thanks

[ad_2]

Source link