[ad_1]

Following the latest court docket submitting from liquidators for Three Arrows Capital (3AC) claiming frustration with the 3AC co-founders for allegedly failing to answer subpoenas despatched by way of Twitter. Su Zhu, one of many co-founders, just lately tweeted about his new crypto enterprise, Open Change. The alternate goals to offer customers with the flexibility to commerce or use portfolio margin with claims in opposition to bankrupt cryptocurrency corporations.

3AC Co-Founders Launch Chapter-Centered Crypto Change, Neighborhood Reacts Skeptically

Su Zhu, co-founder of the defunct crypto hedge fund Three Arrows Capital (3AC), stated on Thursday that June-July 2022 was a “complete darkness” for him and his accomplice, Kyle Davies. “It was a darkish interval, and we weren’t excellent in how we dealt with the fallout, however we have been decided to do all we might,” Zhu tweeted.

He went on to emphasise that “phrases and liquidations can solely go to this point,” and the duo needs to construct one thing that “takes all of the ache, classes, and makes use of it to advance crypto.”

“It’s with humility that we announce the claims waitlist is now open, with web site UI/UX beta testing coming very quickly [at] opnx.com,” Zhu added. The information of Zhu and Davies beginning a brand new enterprise with two executives from Coinflex alternate was reported in mid-January 2023.

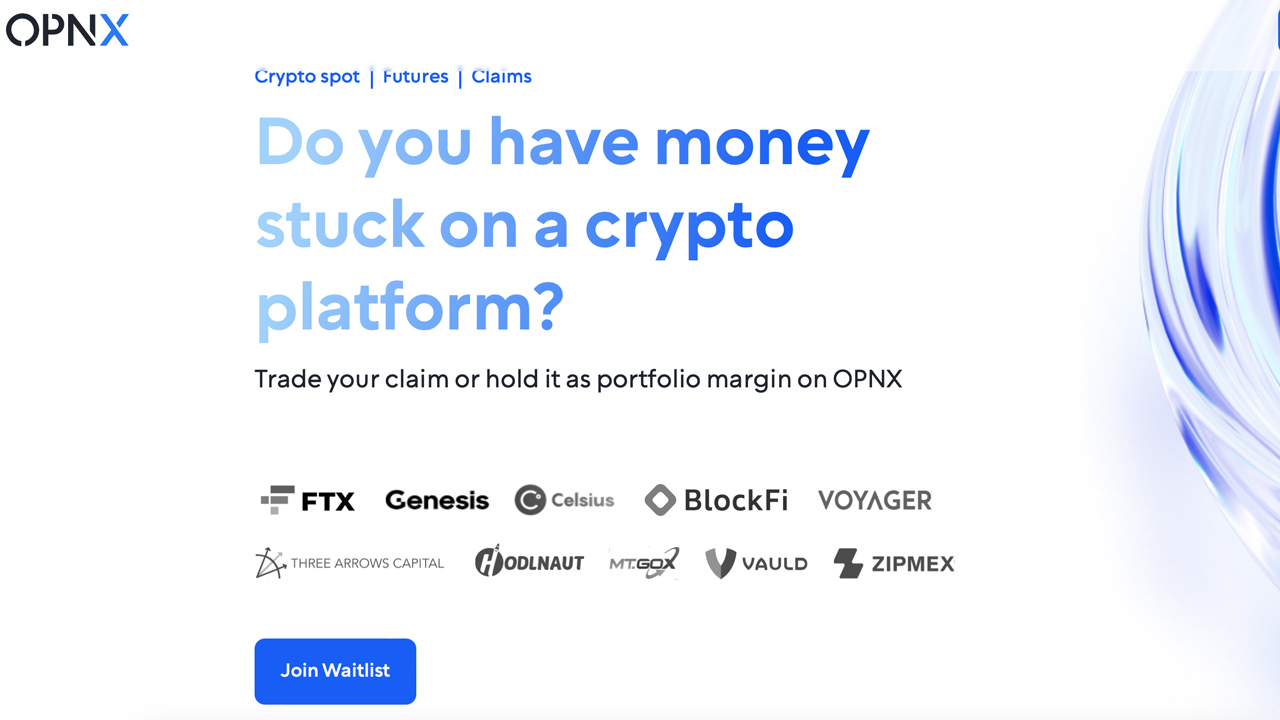

The alternate plans to permit merchants to commerce a chapter declare from a defunct crypto platform and maintain it as portfolio margin. At the moment, the alternate shouldn’t be operational and has a waitlist. Zhu additional famous that “FLEX would be the main token of the brand new alternate.”

The web site shows logos of failed platforms corresponding to Genesis, Celsius, FTX, Blockfi, Voyager, Hodlnaut, Mt Gox, Vauld, and Zipmex, in addition to the 3AC emblem. The web site’s manifesto states {that a} “$20 billion market of claimants is desperately in search of an answer.”

Zhu’s announcement was not well received on social media, as some members of the crypto neighborhood expressed disgust. “Yeah, you misplaced all rights to work on this trade once more,” wrote Magdalena Gronowska. “As a substitute of launching new scams, it’s best to concentrate on speaking to your attorneys,” she added. “Shut the hell up loser,” responded Nic Carter to Zhu’s tweet.

What are your ideas on the brand new bankruptcy-focused crypto alternate and its mission to monetize and commerce claims? Share your opinions within the feedback under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link