[ad_1]

The Reserve Financial institution of Zimbabwe just lately revealed that some 25,188 of its value-preserving gold cash had been bought between July 2022 and Jan. 13. In line with the central financial institution governor, John Mangudya, the gold cash “have proved to be an efficient open market instrument for mopping up extra liquidity within the economic system.”

Gold Cash as Different Worth Preservation Device

In line with the Zimbabwean central financial institution, about 25,188 “Mosi-oa-Tunya” gold cash valued at over $28 million (ZWD$20 billion) had been bought between July 2022 — when the cash had been initially launched — and Jan. 13. From this whole, acquisitions by the so-called corporates accounted for 84% “whereas purchases by people accounted for 16%.”

Initially launched to behave as “an alternate retail funding product for worth preservation,” for the rich, the financial institution stated decrease denomination gold cash launched in Nov. 2022 “accounted for 38% of all gross sales.”

Commenting on the gold cash’ impression since their introduction, Reserve Financial institution of Zimbabwe (RBZ) governor John Mangudya said:

The cash have proved to be an efficient open market instrument for mopping up extra liquidity within the economic system and a retail funding product for preserving worth for investable funds.

The RBZ governor added that the cash, which have a 180-day vesting interval, together with the financial institution’s high-interest rate policy, performed a component in stabilizing inflation and the native forex’s trade price versus the buck.

Zimbabwe’s Receding Inflation

In line with the native statistical workplace, Zimstats, the southern African nation’s month-on-month inflation fell from a excessive of 30.74% in June 2022 to 1.1% in Jan. 2023. Regardless of this slowdown, Zimbabwe’s newest annual inflation price of 230% stays one of many highest globally.

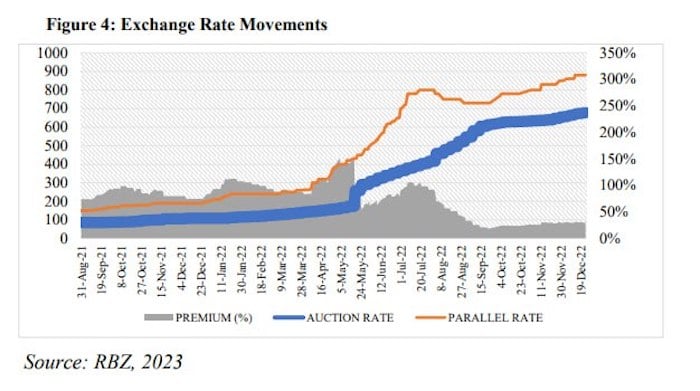

Regarding the Zimbabwean greenback’s trade price versus the U.S. greenback, the newest RBZ knowledge means that the parallel market premium dropped from a excessive of almost 100% on July 1, 2022, to nicely below 50% by Dec. 19, 2022. As proven by the info, the native forex’s public sale market trade price, which stood at simply over ZWL100:USD1 on Jan. 11, 2022, closed the 12 months at roughly ZWL700:USD1. In line with the RBZ knowledge, the native forex’s parallel market trade price on Dec. 19 stood at roughly 900:1.

In the meantime, in his 2023 financial coverage assertion, RBZ governor Mangudya stated the financial institution “will proceed to avail gold cash on a demand-driven foundation because it seeks to advertise a financial savings tradition.”

What are your ideas on this story? Tell us what you suppose within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

[ad_2]

Source link