[ad_1]

What can we be taught from monetarists about what occurred to costs after the Covid-19 pandemic struck? What can we be taught from the errors made within the Nineteen Seventies? The aim of posing these questions is to inject humility into present debates, particularly amongst central bankers. Their failure to forecast, or forestall, the massive jumps in worth ranges of latest years is critical. So, why did it occur and what would possibly historical past counsel concerning the errors nonetheless to return?

It’s attainable to argue that there’s nothing to be taught. Covid-19 was, it is likely to be steered, a singular occasion to which policymakers responded in essentially the most wise attainable manner. Equally, the Nineteen Seventies are historic historical past. Our policymakers wouldn’t make the error of letting inflation shoot up once more, so embedding expectations of completely excessive inflation. I want to consider these propositions. However I don’t.

Begin with cash. There have been two obstacles to taking the cash provide severely. The extra vital is that it was discarded as a goal and even an indicator by “respectable” macroeconomists way back. The much less vital was the hysteria of so many concerning the quantitative easing launched after the worldwide monetary disaster. This obscured what was so very completely different this time.

As I famous in a column published almost a year ago, the British economist Charles Goodhart argued again in 1975 that “any observed statistical regularity will tend to collapse once pressure is placed upon it for control purposes”. That perception proved related to the monetarism of the Nineteen Eighties. However, I steered, there’s a corollary: whether it is now not used as a goal, cash would possibly change into a helpful indicator as soon as extra.

Just lately, Claudio Borio of the Bank for International Settlements has steered how this would possibly change into the case for cash, as soon as once more. Thus, he argues, whether or not cash issues is dependent upon whether or not inflation is excessive, or not. In different phrases, the presence of “extra cash” on stability sheets influences behaviour extra when persons are delicate to inflation than when they aren’t.

In a wonderful latest submit on Money: Inside and Out, Chris Marsh of Exante Information explains how cash fell out of the pondering of financial economists and central bankers. He notes nonetheless that a big growth of the provision of cash is prone to have an effect on spending considerably. That’s much more possible if the cash created by central banks successfully funds fiscal deficits, as occurred so strikingly in 2020.

An important level is that this differed significantly from what occurred after 2008. The results of the monetary disaster was a dramatic slowdown within the creation of cash by financial institution lending. The cash created by the central banks by way of their asset purchases (QE) offset this endogenous slowdown in financial development. This considerably lowered the severity of the post-crisis financial slowdown.

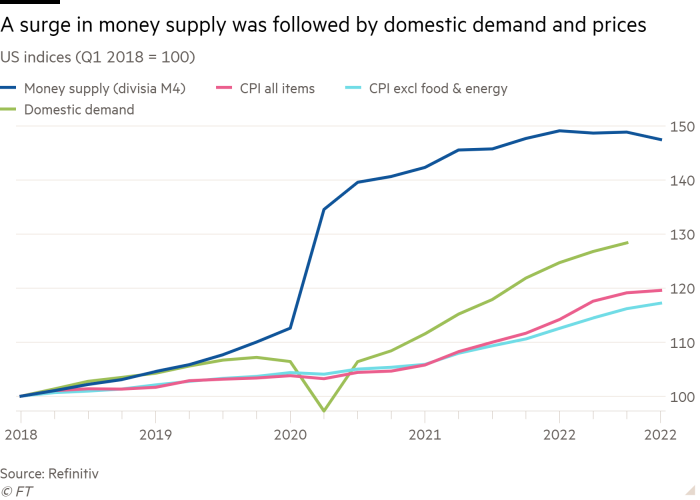

In early 2020, the other was true: personal credit score development and cash creation by the central banks have been each very sturdy. Common annual development of US M2 from finish 2008 to finish 2019 was simply 6 per cent. Within the 12 months to February 2021, it grew 27 per cent. It’s not stunning then that, with the fiscal boosts as effectively, US nominal home demand rose by greater than 20 per cent within the two years to the third quarter of 2022. That generated a robust restoration. However it additionally supported a leap within the worth degree: within the two years to December 2022, the core US shopper worth index rose 11.5 per cent, far above the 4 per cent implied by the Federal Reserve’s 2 per cent annual goal.

That was the previous. What now? Measures of US broad cash are actually really falling. In December 2022, for instance, US M2 was 2.5 per cent under its peak in March. Information on broader measures offered by the Heart for Monetary Stability present the identical image. This means that inflation would possibly fall quicker than anticipated. It’s even attainable that if the purpose is barely to stabilise inflation slightly than make the worth degree fall again, coverage is simply too tight.

But there nonetheless appears to be a financial overhang. As well as, the Danish economist, Jesper Rangvid, in his January 2023 weblog, offers a sobering comparability with the Nineteen Seventies. He notes, rightly, the relevance of comparisons with one other interval when a mix of sturdy fiscal and financial expansions interacted with provide shocks to generate excessive inflation. However within the Nineteen Seventies, there have been two spikes. Vitality costs performed a job in each. However so, too, did expansionary financial coverage.

Rangvid provides that: “As quickly as inflation began falling within the early Nineteen Seventies, the Fed lowered the Fed Funds Price. This was too early. It implied that the actual rate of interest fell too quick and an excessive amount of.” In December 2022, what the Federal Reserve Financial institution of Atlanta calls “sticky worth” inflation was operating at over 5 per cent on a one-month annualised, three-month annualised and annual foundation. Rangvid concluded that it would take even longer to get inflation again all the way down to 2 per cent than it did within the mid-Nineteen Seventies, maybe one other two years. However there’s a hazard not solely of loosening too quickly, but additionally of loosening too far beneath what is sort of prone to be fierce political stress, so producing one other upsurge.

The large level is that the inflation genie is now out of his lamp. I agree with Rangvid that financial coverage ought to have been tightened sooner. I additionally agree with Marsh that central banks mustn’t have ignored cash, as Mervyn King has additionally argued. There is likely to be a case for ready to see what occurs earlier than additional tightening, not less than within the US, particularly if one focuses on the financial information. However inflation may also show stickier downwards than hoped. No matter occurs, don’t repeat what occurred within the Nineteen Seventies: get inflation down after which hold it down.

[ad_2]

Source link