[ad_1]

The well-known creator of the best-selling guide Wealthy Dad Poor Dad, Robert Kiyosaki, has shared his view on why the costs of gold, silver, and bitcoin are rising increased. Noting that silver is affordable proper now, Kiyosaki urged traders to purchase a silver coin and begin getting richer.

Robert Kiyosaki Bullish on Gold, Silver, Bitcoin

The creator of Wealthy Dad Poor Dad, Robert Kiyosaki, has shared his ideas on why the costs of his high three funding picks — gold, silver, and bitcoin — are going up. Wealthy Dad Poor Dad is a 1997 guide co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Instances Finest Vendor Listing for over six years. Greater than 32 million copies of the guide have been bought in over 51 languages throughout greater than 109 nations.

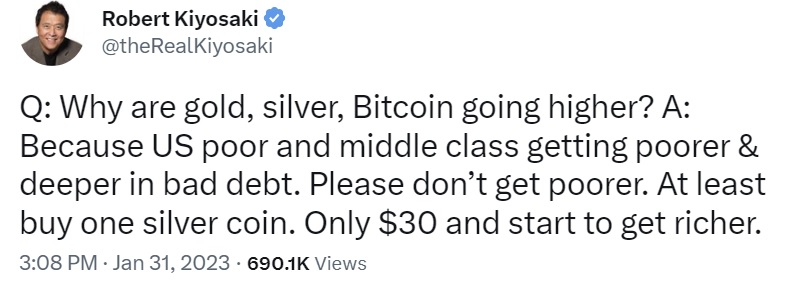

Kiyosaki tweeted a query Tuesday asking why gold, silver, and bitcoin are going increased. He then answered his personal query, stating that it’s as a result of the poor and center class within the U.S. are getting poorer and deeper into debt. “Please don’t get poorer,” he burdened, urging traders to purchase no less than one silver coin that prices solely $30 proper now to begin getting richer.

The well-known creator beforehand defined that he expects gold, silver, and bitcoin homeowners to get richer when the Federal Reserve pivots and prints trillions of “pretend” {dollars}. Noting that the inventory market will crash and ship the costs of gold and silver increased, he predicted that gold will soar to $3,800 whereas silver will rise to $75 this 12 months.

“If Fed continues elevating rates of interest, [the] U.S. greenback will get stronger inflicting gold, silver & bitcoin costs to go decrease. Purchase extra. When Fed pivots and drops rates of interest … you’ll smile whereas others cry,” Kiyosaki tweeted in October final 12 months. He has repeatedly said that the Fed’s rate of interest hikes will kill the U.S. economic system, inflicting inventory, bond, and actual property markets to crash. He urged traders to purchase gold, silver, and bitcoin earlier than the Fed pivots.

Kiyosaki Says Silver Is Low cost

Whereas the Wealthy Dad Poor Dad creator has been recommending gold, silver, and bitcoin for fairly a while, he singled out silver in his newest tweets as being low cost and reasonably priced, reiterating his earlier assertion that silver is the “best investment value in the present day.”

On Wednesday, Kiyosaki reminded his Twitter followers that he has been “saying purchase silver for years,” noting that silver is the most effective funding as a result of it has been a “worse commodity for 50 years.” He added that the gold/silver ratio is often 1 to fifteen, which suggests 1 ounce of gold should buy 15 ounces of silver. Nevertheless, he identified that in January, 1 ounce of gold should buy 80 ounces of silver. “Low cost. Virtually 1:100. Silver going up. EVs, photo voltaic, [and] greenies love silver. FOMO,” Kiyosaki emphasised.

Having repeatedly advisable bitcoin, he stated in December that he’s shopping for extra BTC. He additionally defined that he’s a bitcoin investor, not a dealer, so he will get excited when the worth of BTC plunges. In September, he urged traders to get into crypto now earlier than the largest financial crash on the earth occurs.

Final week, the Wealthy Dad Poor Dad creator warned that we’re in a global recession with hovering bankruptcies, unemployment, and homelessness. After a number of 75-basis-point price hikes, the Federal Reserve raised the benchmark rate of interest by 25 basis points this week to a variety of 4.5% to 4.75%, the best since 2008.

Do you agree with Robert Kiyosaki? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link