[ad_1]

Donal O’Riain has been struck by the welcome his firm acquired within the US — and it isn’t simply the Christmas card despatched by the Division of Power official who helps it safe federally supported loans.

The prospect of ample authorities funding due to the Inflation Discount Act is prompting Ecocem, an Irish low-carbon cement producer, to double a deliberate $120mn funding in California because it reorients spending in the direction of the US as an alternative of Europe, he says.

“They’re rolling out the carpet for inexperienced funding — we have been shocked at how private the contact was,” says O’Riain, Ecocem’s founder and managing director. The “web impact” is that Ecocem, which qualifies for IRA funding on the idea that its cement is produced with carbon emissions which are 40 occasions decrease than common, will “favour additional funding within the States [rather] than within the EU”.

Instances like that of Ecocem are prompting a brutal reckoning within the EU, as heads of presidency put together for a Brussels summit on February 9-10 geared toward determining how to reply to the large subsidies and buy-America provisions being rolled out beneath the $369bn IRA. “Europe is in panic mode,” says Dutch MEP Paul Tang.

At stake are the very fundamentals of the EU’s financial mannequin.

Since its inception, the only market has been primarily based on the concept a degree taking part in subject must be secured for each the wealthier and poorer nations, and strict limits are due to this fact wanted on state support that members provide their industries. However even earlier than the US introduced its inexperienced subsidies, the principles on state support have been already being watered down — in response to the pandemic and the impression of conflict in Ukraine.

France and its allies are pushing to additional loosen the shackles on subsidies as a part of an energetic industrial coverage geared toward securing key provide strains, embedding the drive in the direction of its local weather aims, and holding its personal within the nice energy competitors between the US and China.

However financial liberals in nations together with Sweden and the Netherlands see a danger that Brussels will, in its rush to compete with the torrent of public money accessible within the US and in China, find yourself “fragmenting” the only market by permitting huge member states equivalent to Germany and France even better latitude to lavish money on high firms. The IRA is, they concern, fuelling a wider push in the direction of a extra interventionist — some say protectionist — mindset in huge economies.

Mark Rutte, the Dutch prime minister, is among those warning Europe should not “throw the newborn [out] with the bathwater” because it makes an attempt to concoct a convincing response to America’s laws. “The concept of leaping to a form of race to the underside on state support is to not our liking, as a result of one of the crucial profitable issues within the European Union since 1957 is the inner market,” he tells the FT.

“If we make the unsuitable choices it actually may have long-term impression — far past this IRA factor.”

What makes the controversy so troublesome in Europe is the extent to which America itself has ditched fair-trade norms in its laws, which supplies tax credit and federal help to industries starting from hydrogen and electrical automotive batteries to photo voltaic panels and sustainable aviation gasoline.

The IRA, which was agreed in a shock political deal in Washington in August, provides firms billions of {dollars}, largely via tax credit, to spice up funding in new and nascent clear power applied sciences. Firms are rewarded for reorganising provide chains to be positioned both within the US or amongst allies and companions.

The EU says the IRA’s local-content necessities are incompatible with World Commerce Group guidelines that are supposed to bar discrimination in opposition to merchandise primarily based on their nation of origin. It has tried to persuade the US to chop European firms into the advantages, however talks inside a US-EU process power on the subject have yielded solely partial progress within the space of electrical autos and batteries.

Ecocem is the kind of firm that Europe desperately desires to maintain onshore. The EU is aiming to chop its greenhouse fuel emissions by 55 per cent by 2030, in comparison with 1990 ranges, whereas preventing an power disaster introduced on by dramatic cuts in provides of fuel from Russia.

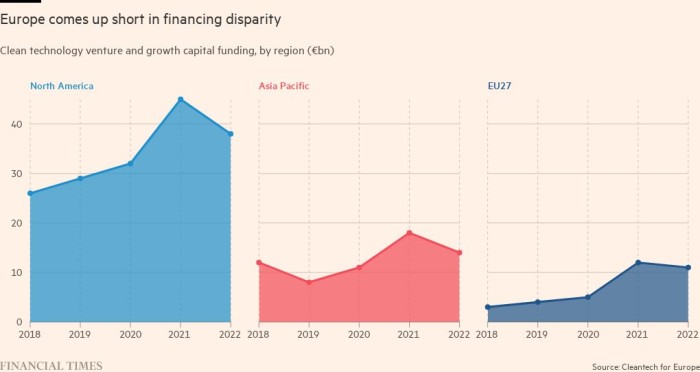

On each fronts, the bloc wants each scrap of renewable power and clear know-how it might get. However it’s competing in a worldwide market the place each the US and China are pouring lots of of billions into inexperienced industries via state funding.

O’Riain says that in France, the place Ecocem has two factories, the corporate acquired no public subsidies as they weren’t accessible on the time. State help, he provides, “means we are able to increase our horizons when it comes to how briskly we are able to scale.”

The query of state support

The stress on the EU single market has been constructing for a while.

Some EU diplomats and politicians argue the union has lengthy been responsible of a naive strategy in the direction of its inexperienced trade by allowing China, particularly, to dominate important sectors as an alternative of nurturing Europe-based champions.

They cite the rampant development of photovoltaic photo voltaic panel manufacturing in China a decade and a half in the past. Brussels imposed anti-dumping duties on Beijing in 2013, alleging Chinese language producers have been getting unfair subsidies.

France is now main the cost for a harder-headed strategy to worldwide commerce and work on securing its personal resilience and “sovereignty”. Paris in January demanded a “made in Europe” technique in response to the IRA, entailing a bolstered European industrial coverage and a far-reaching simplification of the EU’s state support framework, which curbs authorities subsidies that would distort the only market.

Throughout the fee Thierry Breton, the French commissioner for the EU’s inner market, has championed the push for European “strategic autonomy” in industries from prescribed drugs and semiconductors to important uncooked supplies. “It’s excessive time to reconcile local weather neutrality coverage with industrial competitiveness coverage,” he stated on Friday throughout a visit to Washington.

Three commissioners from free-market minded nations — Margrethe Vestager of Denmark, Valdis Dombrovskis of Latvia and Frans Timmermans of the Netherlands — are pushing again, writing in the Financial Times final week that the EU ought to deal with making a “business-friendly setting” whereas sustaining its “open strategy to world commerce”.

Vestager, the EU’s competitors commissioner, is because of unveil state support proposals on Wednesday as a part of a wider set of insurance policies aiming to streamline allowing for brand new inexperienced tasks and easing funds of EU cash. She tells the FT that adjustments wanted to be “targeted”, arguing it was solely in a couple of sectors that there was an “acute danger” of funding shifting from the EU to the US.

“If the state leads this transition then on some events state support can be professional, so long as nobody then jumps to the conclusion to say ‘nicely, let the taxpayer do all the things,’” she says. “With out personal funding, it’s not going to occur.”

The prospect of an extra loosening in state support controls has, nonetheless, brought on deep disquiet this week amongst some senior competitors officers in Brussels, the place some concern the floodgates are opening on public subsidies in Europe.

They complain these “short-term” relaxations of its state support guidelines have gotten a persistent behavior. Brussels pushed via a time-limited loosening early within the Covid-19 disaster, however then adopted that up final yr with additional flexibility in response to the Russian invasion of Ukraine and the power disaster. Constraints can be eased for the semiconductor trade by way of the proposed European Chips Act.

“There’s a joke that nothing is extra everlasting than short-term issues,” says one EU official. “This temporariness is beginning to final.”

The outcomes of those relaxations of subsidy restraints have been vastly imbalanced. EU member states have gained approval for €672bn subsidies beneath the bloc’s short-term disaster framework, of which a minimum of 53 per cent has been notified by Germany, the EU’s largest economic system, equating to round 9 per cent of its annual gross home product.

France’s share stands at 24 per cent, or simply above 6 per cent of GDP, whereas fiscally stretched Italy sought approval for under round 7 per cent of the entire — equalling lower than 3 per cent of GDP.

Specialists say this contributes to a deeper fragmentation between EU nations and certainly areas. Craig Douglas, the founding father of World Fund, a €350mn enterprise fund primarily based in Berlin, says the discrepancies between the “particular buckets of capital” in Europe accessible are sharp. “If I need to construct a producing facility in Aachen or Bavaria there’s extra regional capital accessible than doing it in Paris.”

Unlocking the cash

The talk over state support is reawakening a associated dispute over easy methods to fund subsidies.

European nations with strained public funds insist that any loosening of state support constraints must be balanced by the creation of an enormous new EU-wide pot of money to assist to help member states with restricted fiscal assets. Some, together with Italy, are pushing for rather more flexibility in how they will deploy current EU funding.

Germany, the Netherlands and different fiscally conservative states are, nonetheless, totally ready to dam any extra frequent EU borrowing, which means any recent money on faucet is prone to be modest.

They argue the bloc already has ample funding accessible for its inexperienced transition, and that it’s the US that’s taking part in catch-up with Europe’s current initiatives. Again in 2020, for instance, throughout the EU some €81bn was forked out to subsidise renewables, in response to fee figures.

That has been enhanced by the €800bn NextGenerationEU Covid-19 restoration programme, beneath which capitals are required to commit at the least 37 per cent of spending to the inexperienced transition. On high of that, about €100bn of the EU’s 2021-27 cohesion spending, which boosts regional improvement, is anticipated to be inexperienced.

Whereas the IRA’s broadly heralded client subsidies on US electrical autos quantity to $7,500, figures from the European Vehicle Producers’ Affiliation and Bruegel present that the typical within the EU is just not truly that far behind, on the equal of $6,500.

A part of the EU response to be mentioned at subsequent week’s summit can be making it simpler to redirect pots of EU cash to particularly reply to the IRA.

Some EU firms concern Brussels goes to be too cautious in its response. Ilham Kadri, chief government of Solvay, the Belgian chemical compounds firm, says her firm is already benefiting from funds from the Inflation Discount Act, plus the state of Georgia has additionally dedicated to $27mn of state and native tax incentives.

Her expertise of getting subsidies in France, against this, was a “lengthy, robust journey”, she says, with lots of forms “for nearly, I might say, nothing”. Europe, she says, must “get up” and tackle not solely state support limits but in addition prolonged regulatory processes.

Kadri’s expertise illustrates an issue many executives complain of within the EU regime: the sheer complexity of making use of for the pots of money scattered between completely different EU, nationwide and regional programmes.

The IRA distributes help by way of simple-to-obtain tax credit, that are one thing Brussels has no energy handy out given tax is a nationwide competence.

Vaitea Cowan, co-founder of Enapter, which has patented know-how to supply inexperienced hydrogen, says she would want 4 folks full time on her group simply to grasp what the EU needed to provide when it comes to funding and the way they might entry help.

“The help schemes only for renewable hydrogen are extraordinarily onerous to navigate,” she says, starting from the European Funding Financial institution to the Horizon science programme. “There are such a lot of of them . . . we’d like Europe to have rather more pragmatism.”

EU funding additionally appears to favour trade incumbents moderately than progressive start-ups. The primary call-up for large-scale tasks in 2020 via its Innovation Fund acquired 311 purposes, from which seven grants have been awarded — all to tasks led by massive firms together with BASF, a multinational chemical firm, and the Italian power firm Enel.

Cleantech for Europe, an trade physique for inexperienced know-how start-ups, famous that this represents a 2 per cent success charge for candidates. Initiatives that had been chosen largely targeted on the carbon seize and storage, a know-how which units out to take away carbon produced by fossil fuels, moderately than tasks that might stop the emission of carbon dioxide within the first place.

High EU officers readily admit allowing processes for brand new installations take far too lengthy. Jules Besnainou, Cleantech for Europe’s government director, warns that there’s a danger of “leakage” of unpolluted tech industries out of Europe “it doesn’t matter what”. The query, he says, is whether or not the EU response is available in time to scale up these industries, or “will we simply lose them?”

A broader technique

Europe’s financial liberals argue lots of the wrangling over public subsidies misses the broader level.

International locations equivalent to Sweden, which holds the EU’s rotating presidency, need the EU to focus as an alternative on underlying competitiveness, loosening regulatory constraints and boosting fundamentals equivalent to employee expertise, moderately than searching for methods of marshalling extra public cash.

Financing reforms would possibly assist. Delivering on the EU’s carbon discount aims requires extra funding of €520bn a yr in 2021-2030, in response to the fee, nearly all of which should come from the personal sector.

But the continent stays closely reliant on bank-provided finance, whereas its makes an attempt to forge stronger and extra vibrant capital markets are continuing at a snail’s tempo.

Any changes to the state support regime or creation of latest EU assets should go “hand in hand” with reforms to the inner market, argues Cecilia Malmström, the EU’s commerce commissioner from 2014 to 2019, plus a drive to conclude extra commerce offers. It could be a “harmful path” to have interaction in a tit-for-tat response to the IRA, she says.

However the EU’s band of free-market cheerleaders feels embattled, particularly following the departure of one of many UK, which had been one in all their most vocal members. Plaintive references to WTO norms sound out of contact with the good energy competitors driving the world economic system, embodied by the “decoupling” from China pushed first by President Donald Trump and continued by his successor Joe Biden.

“Even the extra liberal ones within the flock realise the world has modified,” says one senior EU official. In terms of the IRA, the message from Washington is “simply do the identical as us, as a result of we’re not going to alter something”.

Information visualisation by Chris Campbell

[ad_2]

Source link