[ad_1]

Britain is the one main financial system likely to slide into recession this 12 months, the IMF mentioned on Tuesday, predicting that UK household spending would falter beneath the burden of excessive vitality costs, rising mortgage prices and elevated taxes.

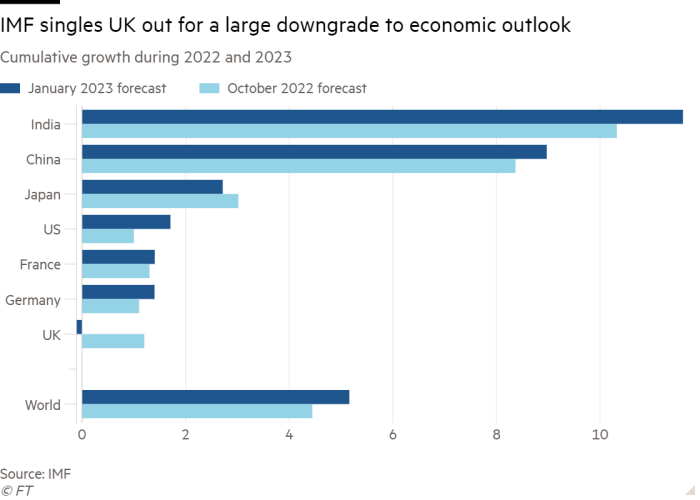

The fund upgraded its forecasts for many main economies and mentioned the worldwide outlook had brightened. Nevertheless it recognized the UK as an exception and mentioned the British financial system would shrink by 0.5 per cent between the ultimate quarter of 2022 and the ultimate quarter of this 12 months.

Even Russia’s financial system is now prone to outpace the UK’s, rising 1 per cent this 12 months, in keeping with the IMF forecasts.

Pierre-Olivier Gourinchas, chief IMF economist, mentioned the UK might anticipate a “sharp correction” in 2023, including that the nation confronted “a fairly difficult surroundings”.

The IMF prediction that UK 2023 output will contract by 0.5 per cent represents a downgrade of its October forecast of 0.2 per cent development for this 12 months. Against this, the fund upgraded its international financial forecast over the identical interval by 0.5 proportion factors.

Gourinchas mentioned eurozone economies had been “surprisingly resilient”, whereas the US had a “slender path” to keep away from recession, with inflation falling and solely modest will increase in unemployment.

The IMF additionally thinks Beijing’s resolution to ditch its zero Covid policy will assist China reach 5.9 per cent growth by the top of this 12 months, greater than double the 2022 charge of two.9 per cent.

UK chancellor Jeremy Hunt mentioned the IMF forecast confirmed that the UK was “not proof against the pressures hitting practically all superior economies”. He added that Britain outperformed many forecasts final 12 months and was on monitor to outgrow Germany and Japan in coming years if it met its objective of halving inflation.

However Gourinchas mentioned UK shoppers and firms discovered themselves unusually uncovered to excessive vitality costs. He mentioned debtors would even be hit by increased mortgage charges this 12 months because the Financial institution of England continued to boost rates of interest to counter inflation that, whereas apparently previous its peak, was nonetheless 10.5 per cent in December.

The Financial institution of England is anticipated to extend rates of interest by 0.5 per cent proportion factors on to 4 per cent on Thursday.

Gourinchas additionally famous difficulties owing to Britain’s labour market. Different European nations have skilled a rise in individuals in search of work following the peak of the pandemic — serving to hold a lid on worth will increase and boosting development.

This has not been true to the identical extent of the UK, which has been affected by better reluctance to return to the labour power in addition to post-Brexit labour shortages.

The BoE is about to revise its personal forecasts on Thursday, and is prone to produce estimates near the IMF’s. That will be an enchancment from the grim outlook the central financial institution delivered in early November at a time wholesale gasoline costs had been far increased than at the moment.

In November, the BoE forecast that development home product would fall 1.9 per cent between the fourth quarter of 2022 and the equal interval of this 12 months.

[ad_2]

Source link