[ad_1]

Demand for gold surged to its highest in additional than a decade in 2022, fuelled by “colossal” central financial institution purchases that underscored the secure haven asset’s attraction throughout occasions of geopolitical upheaval.

Annual gold demand elevated 18 per cent final 12 months to 4,741 tonnes, the biggest quantity since 2011, driven by a 55-year high in central financial institution purchases, in line with the World Gold Council, an industry-backed group.

Central banks hoovered up gold at a historic charge within the second half of the 12 months, a transfer many analysts attribute to a need to diversify reserves away from the greenback after the US froze Russia’s reserves denominated within the foreign money as a part of its sanctions towards Moscow. Retail traders additionally piled into the yellow metallic in a bid to guard themselves from excessive inflation.

Central financial institution purchases of gold hit 417 tonnes within the closing three months of the 12 months, roughly 12 occasions increased than the identical quarter a 12 months in the past. It took the annual complete to greater than double of the earlier 12 months at 1,136 tonnes.

Krishan Gopaul, senior analyst on the WGC, stated “colossal” central financial institution shopping for is a “large optimistic for the gold market”, even because the {industry} group predicted that it will be powerful to match final 12 months’s purchases due to a decelerate in complete reserve development.

“Since 2010 central banks have been internet purchasers of gold following twenty years of internet gross sales. What now we have seen just lately on this atmosphere is central banks have accelerated their purchases to a multi-decade excessive,” he stated. He added {that a} lack of “counterparty danger” was a key attraction of the metallic for central banks, in contrast with currencies below the management of overseas governments.

Solely a few quarter of the fourth-quarter central financial institution purchases have been reported to the IMF. Reported purchases in 2022 have been led by Turkey taking in virtually 400 tonnes, China, which reported shopping for 62 tonnes in November and December, and Center Japanese nations.

Gold {industry} analysts extensively imagine the rest is accounted for by central banks and authorities companies in China, Russia and the Center East, which might embrace sovereign wealth funds.

James Metal, a veteran treasured metals analyst at HSBC, stated that “portfolio diversification is the principle cause” for US dollar-laden central banks shopping for gold. He provides that “a key cause for selecting gold is that central banks are restricted in what belongings they will maintain, and so they could also be reluctant to decide to different currencies”.

Demand amongst retail traders for bar and cash additionally jumped to a nine-year excessive in 2022 above 1,200 tonnes with robust demand in Europe, Turkey and the Center East offsetting weak spot in China the place patrons have been housebound by Covid lockdowns.

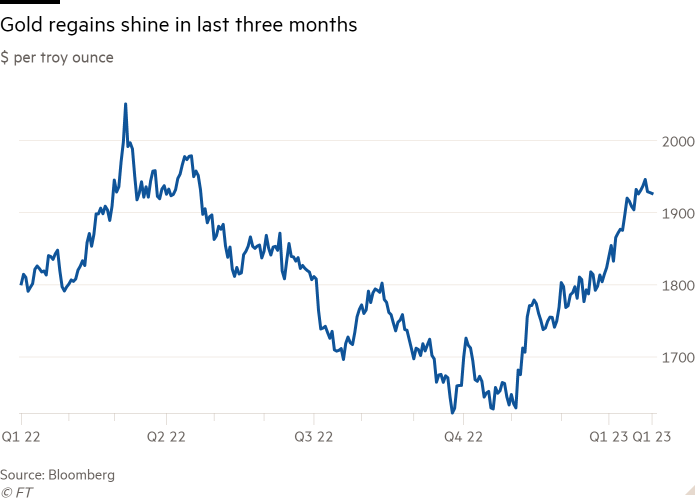

Gold costs slid from a document excessive final March above $2,000 to only above $1,600 per troy ounce in November as rising rates of interest led to outflows from gold-backed alternate traded funds equal to $3bn over the 12 months. Gold produces no yield, dulling its attraction to traders when rates of interest on low-risk bonds climb.

Nevertheless, demand from central banks and retail traders helped forestall the yellow metallic sliding additional and set the stage for a powerful rally since November.

In these three months, gold has jumped virtually a fifth to $1,928 per troy ounce — its highest stage in 9 months — helped by the US Federal Reserve signalling that it will decelerate the tempo of charge hikes.

The WGC expects a revival in gold demand from institutional traders this 12 months as rates of interest in foremost economies strategy their peak, whereas falling inflation may damp demand for bars and cash.

Because of distinctive central financial institution shopping for and an anticipated return of inflows for gold-backed ETFs, UBS raised its year-end goal for the dear metallic to $2,100 per troy ounce, up from $1,850 beforehand.

[ad_2]

Source link