[ad_1]

This text is an on-site model of our Commerce Secrets and techniques e-newsletter. Enroll here to get the e-newsletter despatched straight to your inbox each Monday

Welcome to Commerce Secrets and techniques. Typically it looks like I would like a weekly “Manchinations” part devoted to the senator for West Virginia and the intricate manoeuvrings across the electrical car tax credit within the US Inflation Discount Act. Final week, senator Joe introduced a bill to delay the handouts to attempt to cease the Europeans and Japanese getting their arms on them. Associated to this, Treasury secretary Janet Yellen appeared to accept that the EU and Japan would wish to signal an precise “Free Trade Agreement” (as opposed to having a “free trade agreement”) with the US to profit from the important minerals little bit of it. Given the US isn’t signing commerce offers with anybody proper now, that’s a contact disingenuous, like asking somebody to leap by way of a hoop you refuse to carry up for them. Right now’s e-newsletter touches on one other tense US-EU-Japan situation, Washington’s demand for export controls on semiconductors, however first I think about the Zambia check case for sovereign debt restructuring. Charted waters appears at how China’s reopening is fuelling an increase in base steel costs.

Get in contact. Electronic mail me at alan.beattie@ft.com

Going bust in fashion

Final summer time I wrote about the wave of sovereign bankruptcies breaking amongst middle- and low-income international locations, and the way the world hadn’t created a system to restructure debt easily and constructively. It nonetheless hasn’t. Particularly, it’s confirmed as onerous as all of us feared to include China, now continuously low-income international locations’ largest official creditor (see this chart from JPMorgan), into the system.

The G20 got here up with the “Common Framework” for restructuring debt after the Covid-19 pandemic hit, which was presupposed to enshrine rules of openness and burden-sharing. Zambia, the place China was closely concerned within the copper mining sector and elsewhere, emerged as a test case.

It’s not going brilliantly. Final week the US took the weird step of going public and saying China was a barrier to the negotiations on restructuring Zambia’s debt. See also this thread by former US Treasury debt guru Brad Setser and his piece for Alphaville final October, whence comes this useful chart of who owes what.

A few of the issues with getting China to take part in a debt restructuring are cultural and organisational, others extra basic. To be honest to China, it’s not precisely practised at this recreation, being outdoors the Paris Membership of creditor nations and never having many years of observe at restructuring. It additionally lends by way of a mish-mash of state-owned or state-influenced companies with completely different charges, phrases and situations, which makes negotiating burden-sharing significantly troublesome.

However there are reportedly some serious differences of principle, notably China’s insistence that debt owed to multilateral growth lenders such because the World Financial institution be included within the restructuring. Apart from one-off individually funded workouts such because the closely indebted poor international locations (HIPC) debt aid schemes of the 2000s, MDBs (and the IMF) rightly don’t take part in writedowns. They’re the closest issues the worldwide monetary system has to lenders of final resort, and writing down their debt would destroy help for them amongst shareholder international locations, particularly the US.

There’s a basic conflict of rules there. China insists on seeing itself as a creating nation serving to low-income economies with development-focused infrastructure finance, not a rich-world creditor. (For a similar motive China additionally all the time shrunk from taking a management position within the IMF, truly lobbying to maintain its voting share on the board beneath the US and Japan.) By that token it makes good sense for China to withstand writedowns except the MDBs are additionally concerned. But it surely’s not suitable with seeing the world the best way the opposite official collectors do. One thing fairly substantial goes to have to provide.

A block of the outdated chips

A giant victory for the US, on the face of it. The Netherlands and Japan, the previous after huffing and puffing according to the EU’s well-known dedication to strategic autonomy, have reportedly acceded to American calls for additional to limit exports of semiconductors and semiconductor tools to China.

You’ll recall that is one thing the US has been urgent European and Japanese corporations to do for some time. The Dutch are significantly vital due to ASML, the world’s main maker of photolithography machines. It’s now not sufficient for the US to maintain China a era or two behind with tech — it desires to determine as a lot of a lead as potential.

So, rating one for US high-pressure securocratic diplomacy, Biden with chips succeeding the place Trump (and Biden) didn’t fairly succeed with Huawei and 5G? Effectively, let’s be a bit cautious on this one, and await the precise particulars of the deal to be launched.

As I’ve written before, the Netherlands and Japan already co-operate intently with the US on export controls. They’re additionally healthily suspicious of a number of the motives for these measures, which have blocked their sales to China whereas permitting in US opponents. Japan specifically, whose corporations are at a lower-value-added a part of the provision chain, will lose numerous gross sales to China they may struggle to make up elsewhere.

Agreeing to make a tripartite announcement, assuming it comes, might be a symbolic achieve for the US, and for the Biden administration’s continuous makes an attempt to construct coalitions towards China. In substance, I think the Dutch and the Japanese might be scrutinising the authorized commitments of any deal very intently and figuring out precisely the way it will have an effect on their corporations. The precept of co-operation is established: the observe of what will get blocked will, nonetheless, be a continuing course of.

In addition to this article, I write a Commerce Secrets and techniques column for FT.com each Thursday. Click on right here to learn the newest, and go to ft.com/trade-secrets to see all my columns and former newsletters too.

Charted waters

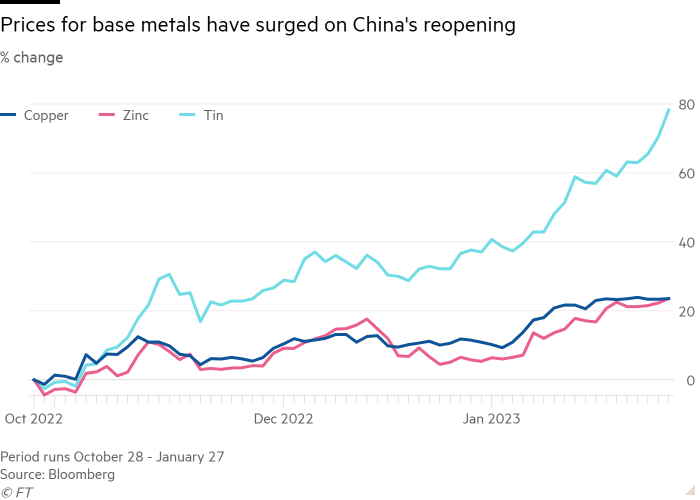

The reopening of China after its pandemic lockdown has been presumably the perfect items of stories for the worldwide financial system — in addition to the Chinese language inhabitants — of the yr to this point. It is usually more likely to be excellent news for miners, because the chart beneath illustrates.

A bunch of “base metals” led by tin, zinc and copper have surged greater than 20 per cent since November on bets that China’s reopening will enhance demand for uncooked supplies.

We don’t simply have the Chinese language Communist get together to thank for this, as my colleagues Harry Dempsey and George Steer explain. The bullish sentiment driving up costs can also be supported by the US Federal Reserve signalling a slowdown within the tempo of rate of interest rises and a softening within the US greenback, which importers use to purchase commodities. (Jonathan Moules)

Commerce hyperlinks

The checklist of strategic belongings within the US expands by the day, in some lawmakers’ eyes extending in direction of farmland, which they wish to keep out of the hands of Chinese language buyers.

FT colleague Martin Sandbu argues that the EU should welcome a green subsidy race.

A pleasant summary FT Q&A explainer on the Inflation Discount Act and what all of the fuss is about.

A fun NPR piece on monitoring the costs in a single Walmart retailer for years and what they stated in regards to the US financial system, commerce and globalisation.

The Commerce Talks podcast explains the recent history of export controls, and the way they had been formed by chilly warfare scandals about supplying delicate know-how to the Soviet Union.

Commerce Secrets and techniques is edited by Jonathan Moules

[ad_2]

Source link