[ad_1]

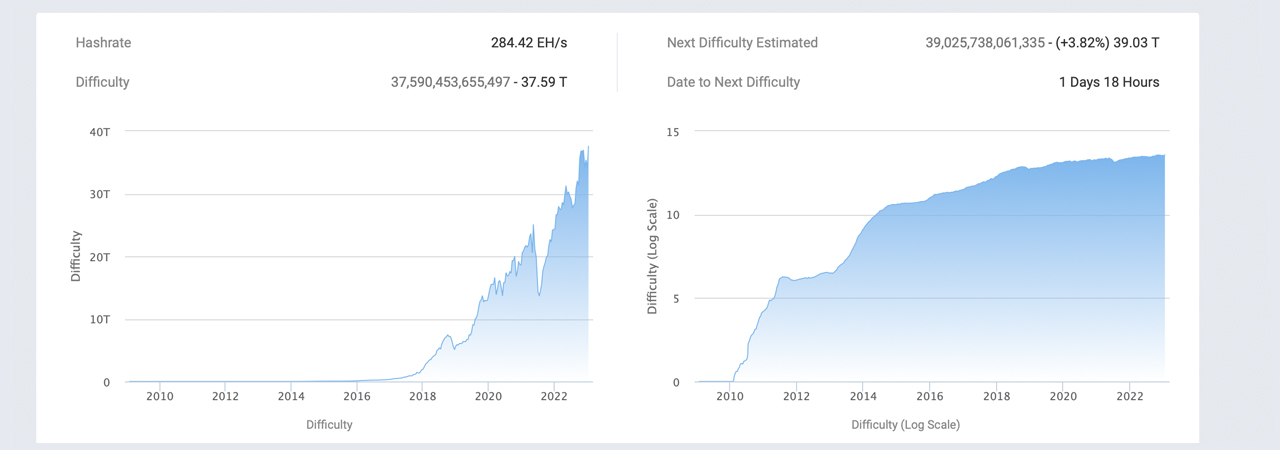

The Bitcoin community is about to report one other significant issue improve on Sunday, Jan. 29, 2023, as present estimates count on it to rise 3.82% larger. The change follows the final issue retarget, which superior by 10.26% to the present all-time excessive of 37.59 trillion.

Block Time Breakdown: How Quicker Discovery is Impacting Bitcoin Issue

In simply over a day, the Bitcoin community will see an issue improve of round 3.82%, in response to present estimates. Proper now, the mining issue is already at an all-time excessive (ATH) at 37.59 trillion, and with a 3.82% jump, it’s anticipated to be round 39.03 trillion. The variety of hashes wanted to mine a block is instantly proportional to the issue degree, which implies every taking part miner must carry out 39.03 trillion hashes as a way to mine a block at that degree.

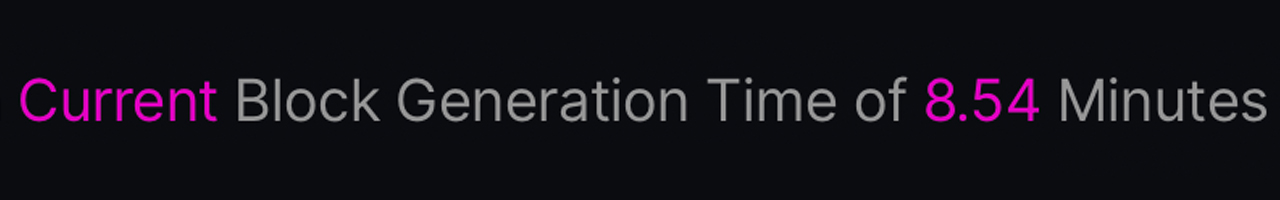

The typical Bitcoin block time has been round 8:54 minutes to 9:31 minutes, which has been decrease than the 10-minute common. This too is linearly associated to the estimated improve anticipated on Jan. 29.

It is because when blocks are found quicker than the 10-minute common, the two,016 blocks in between issue retargets are additionally discovered quicker than the two-week common. Consequently, the Bitcoin protocol’s mining issue rises. With BTC’s value larger, much more hashrate has been devoted to the blockchain.

Bitcoin’s hashrate is working excessive with a median of 278.2 exahash per second (EH/s) over the last 2,016 blocks. Foundry USA instructions the top position by way of mining swimming pools with probably the most quantity of devoted SHA256 hashrate. Foundry has round 93.82 EH/s, over a three-day interval, which accounts for 32.99% of the community’s computational energy. The Bitcoin mining pool Antpool has devoted 49.57 EH/s to the Bitcoin community over a three-day span, accounting for 17.43% of the hashpower.

What impression do you suppose this issue improve may have on the general Bitcoin community and its miners? Share your ideas within the feedback under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link