[ad_1]

Fairness markets started the day within the pink following the most recent company earnings studies from among the world’s largest companies, together with Microsoft. The tech large’s current convention name was thought of disappointing, and earnings from companies equivalent to Boeing, Texas Devices, and 3M had been additionally lackluster. Gold and silver costs had been down between 0.43% and 0.72% on Wednesday, and the cryptocurrency economic system dropped 2.79% in opposition to the U.S. greenback up to now 24 hours.

Considerations of US Recession Mount as Company Earnings Disappoint

After a few bullish weeks, shares, valuable metals, and cryptocurrencies had been down on Jan. 25, 2023. As traders awaited the next U.S. Federal Reserve assembly, the state of the U.S. economic system confirmed quite a lot of weak spot. Earnings studies from Microsoft, Union Pacific, Texas Instruments, and others on Wednesday indicated that the economic system was not bettering and added to lingering considerations a couple of potential U.S. recession.

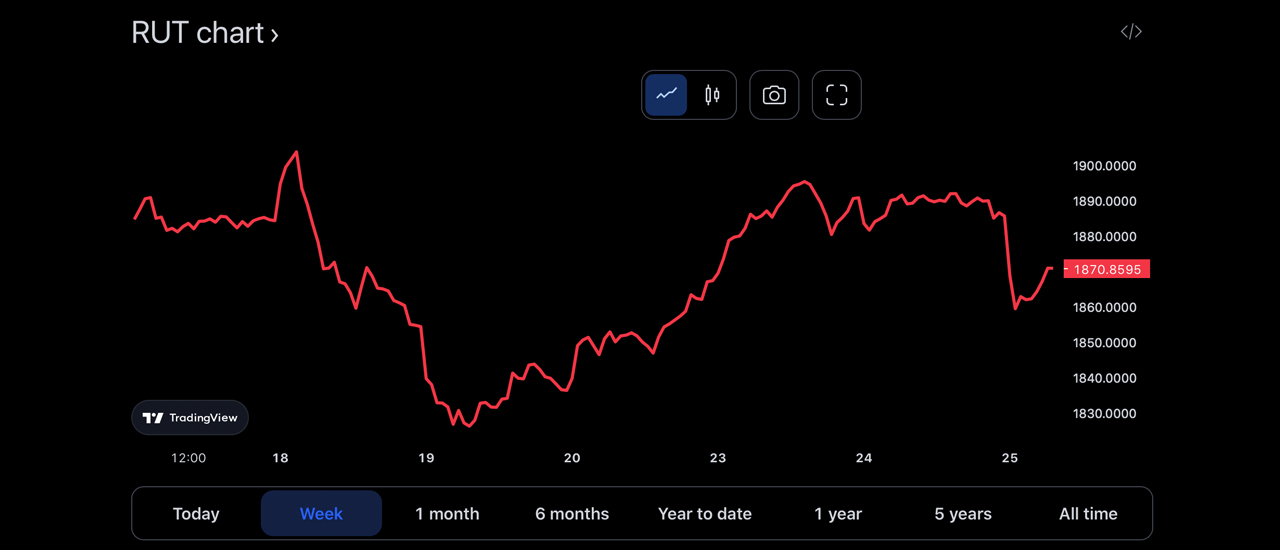

On Wednesday morning into the afternoon, the 4 benchmark inventory indexes the U.S. — the Dow Jones Industrial Common (DJIA), the S&P 500 (SPX), the Nasdaq Composite (IXIC), and the Russell 2000 (RUT) — had been all down between 1% and a couple of.05%. Along with lackluster earnings studies from among the nation’s largest companies, industrial manufacturing within the U.S. slipped roughly 0.7% in December 2022.

Industrial manufacturing additionally dropped in November 2022, falling 0.6% year-over-year. One other shocker was the truth that retail gross sales in the course of the vacation season had been additionally low in November and December 2022. Knowledge signifies that retail gross sales slipped 1.1% last month and, whereas the vacations had been in full impact, it was the biggest drop of the yr.

Valuable Metals and Crypto Belongings Proceed to Decline Amid Financial Uncertainty

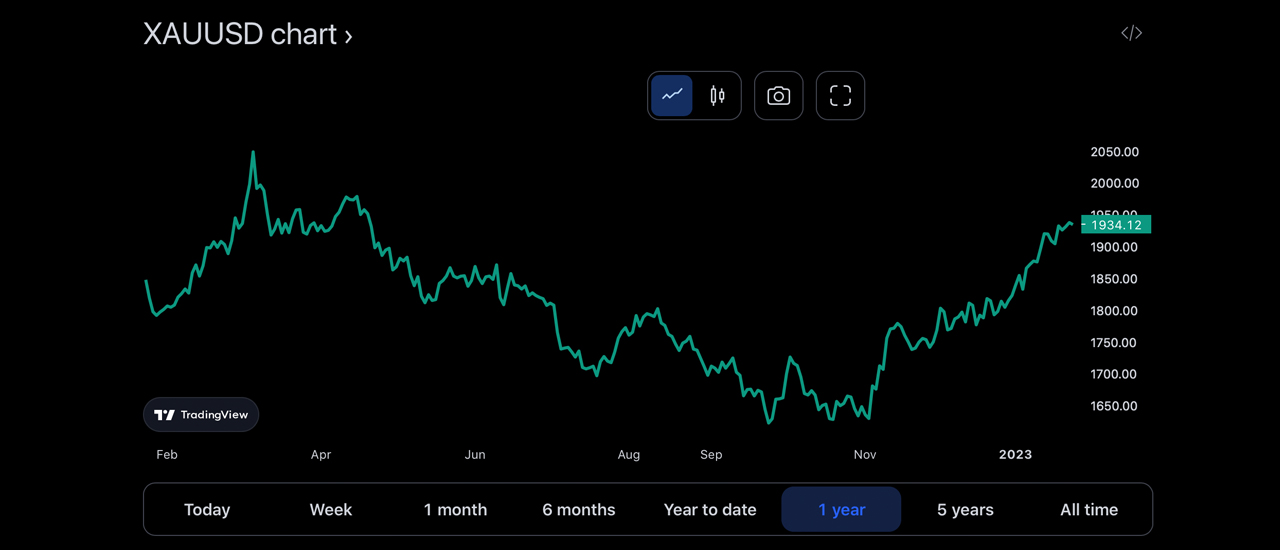

Valuable metals equivalent to gold, silver, and platinum all noticed losses in opposition to the U.S. greenback within the final 24 hours as effectively. The New York spot price on Jan. 25, 2023, signifies that gold is buying and selling for $1,931.70 per troy ounce, down 0.43%. An oz. of silver is down 0.72% and buying and selling for $23.59 per unit on Wednesday at 11 a.m. Jap Time. Kenneth Broux, a strategist at Société Générale, says that escalating tensions in Ukraine, low company earnings, and recession fears are plaguing traders.

“The market is unquestionably apprehensive about slowing earnings progress, particularly in tech, so there was a way the market needs to maintain promoting tech and the greenback,” Broux remarked on Wednesday. “However an enormous tail threat now could be what occurs in Ukraine, if there’s an escalation within the battle and Europe will get drawn into the battle,” the strategist added.

The cryptocurrency economic system is hovering simply above the $1 trillion mark at $1,019,712,653,474, in keeping with Wednesday’s recorded metrics. Crypto markets are down 2.79% as a complete, and bitcoin (BTC) has shed 1.49% on Wednesday. The second-leading cryptocurrency, ethereum (ETH), has misplaced much more, with 4.66% erased from its worth since Tuesday.

International cryptocurrency commerce volumes had been above the $100 billion area per day not too way back, however at present, international commerce quantity is round $55.98 billion throughout your complete cryptocurrency economic system. Regardless of the pullback on Wednesday, valuable metals, equities, and cryptocurrency property are nonetheless doing significantly better than they had been final month. By 11:30 a.m. (ET) on Wednesday, gold elevated in opposition to the U.S. greenback however remains to be down 0.2% and silver rose as effectively and is presently up 0.13%.

What do you suppose the long run holds for markets and the economic system? Share your ideas within the feedback.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link