[ad_1]

There’s a purpose centralized exchanges have dominated regardless of being antithetical to crypto’s core tenets.

The next opinion editorial was written by Bitcoin.com CEO Dennis Jarvis.

The gross mismanagement and outright fraud in 2022 by many opaque centralized exchanges are driving folks again to the core tenets of crypto, comparable to decentralization, self-custody, transparency, and censorship resistance. Persons are naturally turning to DeFi (decentralized finance). Sadly, a lot of DeFi will not be but able to act as an acceptable substitute.

On this article, I’ll speak about two of a very powerful challenges: learn how to make DeFi extra accessible to new customers and learn how to enhance its efficiency when in comparison with centralized companies.

The Onboarding Downside and Its Resolution

The issue with getting new customers to undertake DeFi is partly on account of consumer expertise (UX). Bitcoin.com’s Head of Product Expertise Alex Knight did a wonderful job outlining the issues and options of the UX challenges in web3 functions. To summarize: the self-custodial web3 mannequin usually results in builders making a consumer expertise that’s essentially totally different from the one individuals are used to within the custodial web2 mannequin — and that creates big friction.

Fixing the UX drawback is a mixture of intelligent design, training, and incentives.

On the design entrance, the problem is to create merchandise which can be as acquainted and easy-to-use as the perfect web2 analogs. At Bitcoin.com our self-custodial multichain pockets app has long-provided an intuitive expertise, however solely for easy actions like shopping for, promoting, sending, and receiving crypto. As we combine extra advanced DeFi options, together with our personal decentralized trade Verse DEX, proper into the app, it’s crucial that the consumer expertise stay as indistinguishable from web2 as potential whereas utilizing web3 rails solely.

But even when web3 manages to succeed in parity with web2 by way of ease-of-use, there may be nonetheless the problem of convincing folks to make the swap. That is the place training and incentives are available. Training will do two issues: rebuild confidence in crypto, and put together customers to make the transfer. Incentives will present the push that’s typically wanted to attempt one thing new.

Fortunately, the cryptocurrency house is ideally suited to supply the proper mixture of training and incentives. I’ve written about the power of loyalty tokens in crypto, and the importance of getting them right, and we’ve thought lengthy and laborious about learn how to combine them within the Bitcoin.com ecosystem.

Now that we’ve launched our personal ecosystem token VERSE, we’re in a position to begin experimenting with methods to make use of financial incentives to soundly information folks into decentralized finance, the place they’ll profit from its benefits over CeFi (centralized finance). A method we’re planning on doing that’s to reward newcomers with VERSE tokens for taking actions like securely backing up their pockets.

That is supported by our newly launched CEX Education Program that can reward folks affected by centralized crypto firm insolvencies whereas encouraging the adoption of decentralized finance and self-custody.

The Execution Downside

Even in case you resolve the issue of onboarding new customers, DeFi in its present iteration fails in responsiveness and market measurement. If both of those is missing, folks won’t come, or abandon quickly after.

DeFi responsiveness has seized up beneath what could be thought of mild site visitors in web2. On-chain capability has not been in a position to deal with peak 2021 DeFi utilization. Even with the proliferation of alt-L1’s and the beginnings of reside L2’s, on-chain block house was simply swamped.

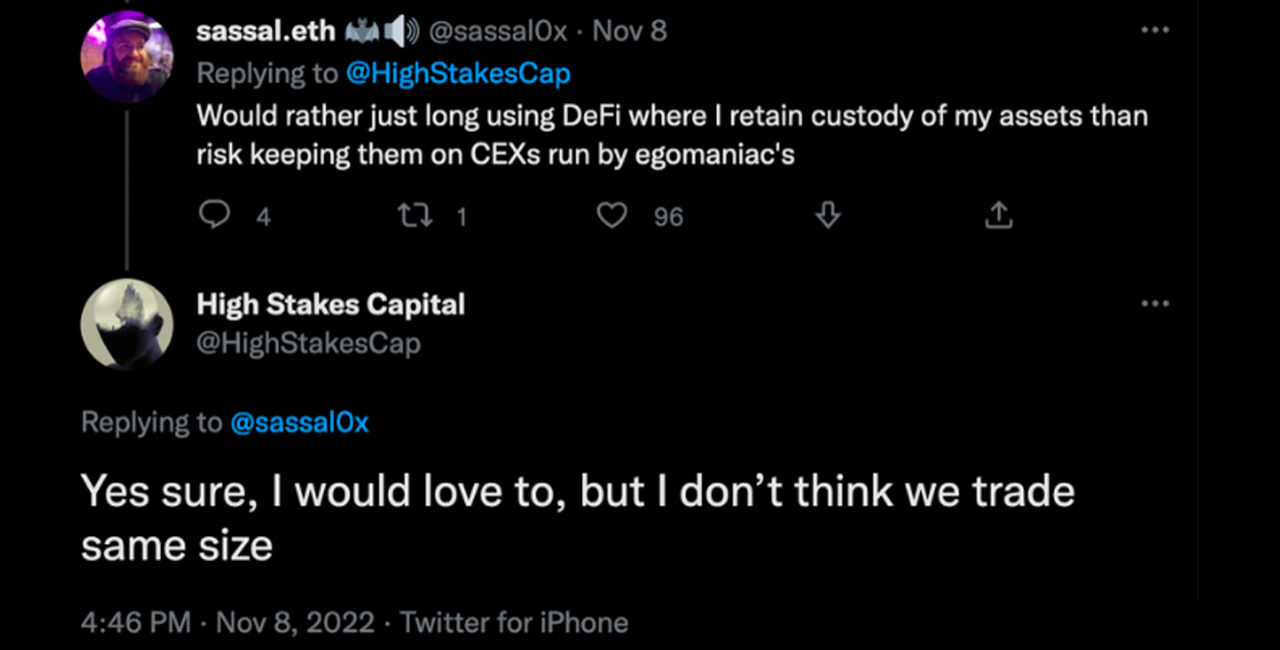

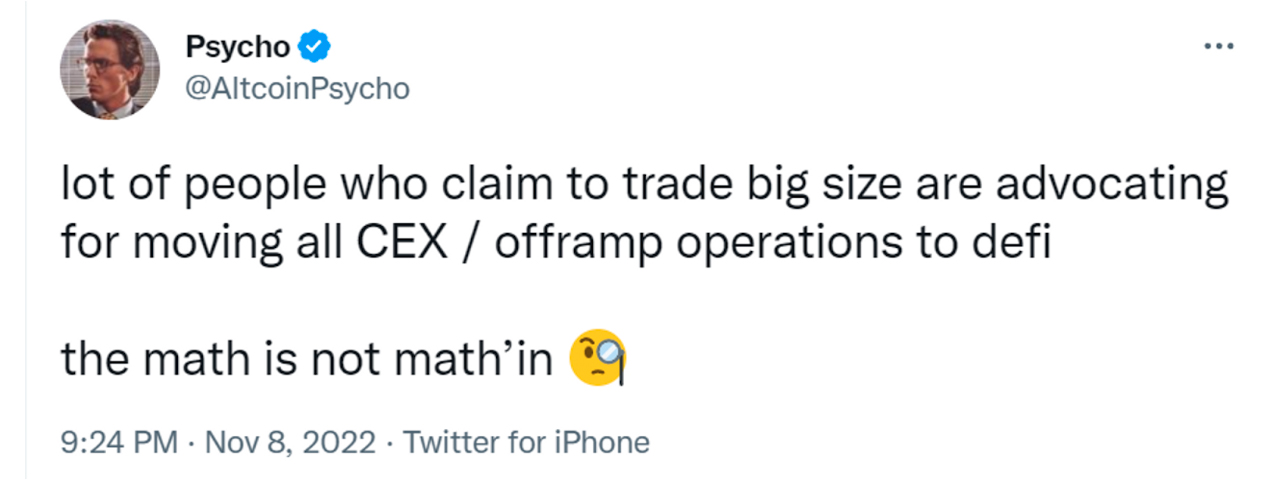

DEX market measurement encapsulates DeFi’s capability drawback. I’ll let crypto Twitter assist me out right here:

Observe that these feedback had been posted simply earlier than FTX imploded. It’s potential that the tweets’ authors’ views have modified since then. Nonetheless, their criticisms ring true: Present DeFi merchandise merely can’t substitute CEXs by way of liquidity, quantity, and order matching.

It’s an issue for the crypto trade when lots of the greatest merchants, market makers, and proponents of crypto can’t execute trades or take part in measurement on decentralized platforms. They’re pressured to collect on dangerous centralized exchanges, which creates a self-reinforcing cycle of dependence on CEXs.

Up to now, CEXs appeared like an agreed upon stop-gap till crypto expertise was at a spot the place it was succesful to take over. As crypto garnered extra consideration, I really feel just like the trade as an entire turned complacent, distracted by the amount of cash pouring in. The sensation was one thing like, “These issues will probably be solved in time.”

Resolution to the Execution Downside

I consider that the bottom crypto technological instruments are all right here, or practically so. An instance of a DEX that may compete on an appropriate degree with a CEX, is the layer 2-based dYdX trade. Leveraging zero-knowledge proof techniques, dYdX can execute transactions cheaply and rapidly sufficient to match with the responsiveness of CEXs. Currently, “the present dYdX product processes about 10 trades per second and 1,000 order locations/cancellations per second, with the objective to scale up orders of magnitude larger.”

Now the one factor it lacks is comparable liquidity. Since good liquidity begets higher liquidity, a constructive first step is that dYdX makes use of an order ebook and matching engine, a way more environment friendly and worthwhile approach to make markets. Utilizing an order ebook ought to entice market makers to supply the liquidity adequate to make DEXs akin to CEXs.

Moreover, liquidity will come now that it’s apparent (once more!) you could’t belief these centralized intermediaries. Large gamers in crypto must make a concerted effort to maneuver out of CEXs into DeFi protocols. Bitcoin.com, for one, is proud to offer intensive DeFi options. The Bitcoin.com Pockets, with over 35 million self-custodial wallets created so far, continues to be an necessary onboarding instrument, organising newcomers to simply and securely work together with decentralized finance.

The Future Is DeFi

Don’t be disillusioned by the shortcomings I’ve recognized right here. The reality of the matter is that each one of DeFi’s shortcomings are trivial compared to its strengths. DeFi permits self-custody of your belongings however with the utility we’ve come to depend on from centralized monetary establishments; for instance, swapping between belongings, incomes yield in your belongings, or utilizing your belongings to take out loans. Till now, these monetary actions have all the time required trusted intermediaries. The options to DeFi’s issues are attainable, which is in stark distinction to the entrenched issues in conventional finance. In the end the reply to conventional finance’s issues is DeFi.

What are your ideas on the potential for decentralized finance to switch centralized finance? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link