[ad_1]

sponsored

2022 was one of many roughest years within the crypto trade, which noticed the collapse of Terra LUNA, Celsius, and FTX, consequently wiping out over $2 trillion from the crypto market. Nevertheless, the darkish horse within the face of those ugly occasions was the crypto change – Bitget.

Regardless of the hardships out there, Bitget grew in all features; the corporate made nice strides in constructing our group, model, and enterprise during the last 12 months through the crypto winter. The change expanded its providers to the worldwide Web3 marketplace for the primary time in 2022. This effort pushed its enterprise velocity past bounds, making it one of many fastest-growing exchanges with the most effective enterprise momentum.

Some key growth areas of the corporate included:

- Climbing the chart ranked because the High 3 change in accordance with the Boston Consulting Group report, when it comes to the crypto spinoff buying and selling quantity.

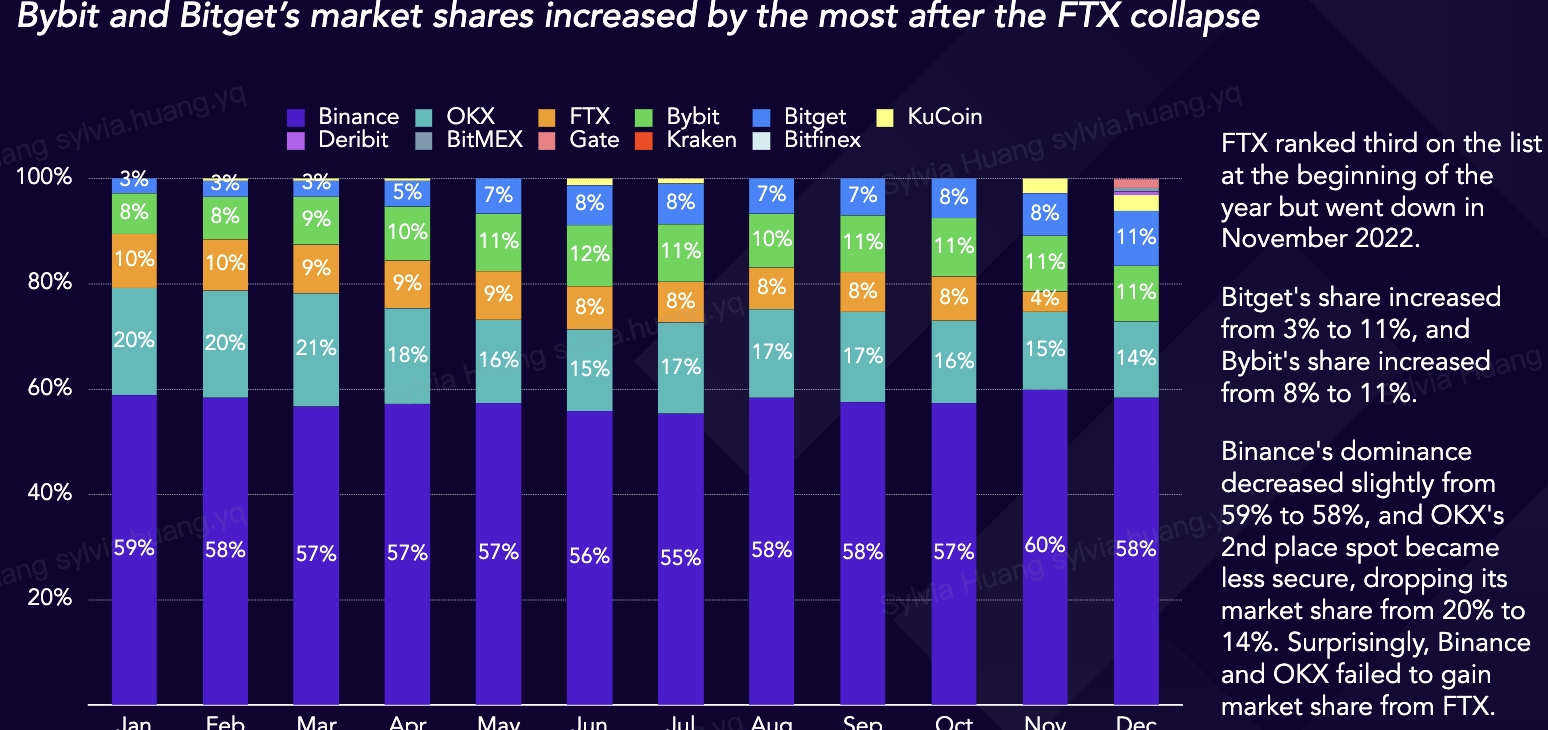

- Based on the most recent TokenInsight report, Bitget’s market share within the spinoff market elevated from 3% to 11% after the collapse of FTX

- Over 300% enhance in whole transaction quantity, with the recognition of copy buying and selling merchandise

- The workforce grew from barely 200 individuals at first of 2022 to over 1100 workers in Jan 2023

- Grew to become the unique crypto change associate with Lionel Messi

Trying on the Numbers

Beforehand, the corporate centered on serving prospects from just a few Asian nations alone. Nevertheless, by the tip of 2022, the change had acquired over 8 million customers in additional than 100 nations, with footprints in Turkey, Southeast Asia, Latin America, and Europe.

Bitget noticed an over 300% enhance in whole transaction quantity with greater than 4.2 million worthwhile trades. The platform’s on-chain information reveals that 100,000 plus merchants shared a revenue of over 9.7 million US {dollars} with its copy buying and selling merchandise.

Based on the most recent information shared by the TokenInsight report, Bitget’s market share elevated dramatically from 3% to 11% after the collapse of the previous second-largest change, FTX, which marked the only largest market share development within the crypto derivatives sector. On the finish of 2022, the highest 10 exchanges’ whole every day open curiosity had dropped by 27.1% from January and 41% from its peak in April of the identical 12 months. Among the many exchanges, solely Bitget achieved a major enhance in open curiosity, from $841 million to $3.74 billion, representing a 344% whole enhance.

Whatever the bearish market, the change attained these quite a few figures when another trade gamers went bankrupt. Bitget beat the trade pattern as a result of they did 4 issues accurately.

1. Outlined Copy Buying and selling

The platform spent the final 4 years perfecting its infrastructure and merchandise for copy buying and selling to offer probably the most excellent social buying and selling expertise.

One-click Copy Commerce, the flagship social buying and selling product, which permits prospects to execute trades mechanically, shadowing orders and techniques from the skilled merchants of their selection, has labored wonders for its enterprise and customers. The change noticed many merchants shifting funds from different main crypto exchanges to Bitget to benefit from the ease of copy buying and selling.

The One-click Copy Commerce characteristic streamlined the entire technique of crypto buying and selling to a single click on, eliminating human errors in value fluctuations and offering a great start line for everybody to get into the sport.

In 2022, the corporate launched Bitget Insights and Technique Plaza, the place customers can discover extra methods of maximizing their yields. These options on the location assist customers select probably the most profitable buying and selling strategies to subscribe to.

Modern copy buying and selling merchandise and social buying and selling providers are Bitget’s quintessential attributes and have made Bitget the biggest crypto copy buying and selling platform.

2. Safety and Safety for Customers

The corporate have additionally taken many safety measures to make sure customers can commerce with ease and luxury, as demonstrated by the next:

- Prior to now 4 years, Bitget virtually achieved zero accidents regardless of the assorted market circumstances. This feat was the inevitable results of the day and evening monitoring and steady development in our IT and safety system up to now 4 years. Consequently, the change has set virtually probably the greatest data within the trade.

- Bitget additionally launched a 300 million Safety Fund that the corporate pledged no withdrawal within the subsequent three years in case of emergency. Nevertheless, no emergency instances have been noticed within the 4 years of the platform’s operations.

- The corporate’s Merkle Tree Proof of Reserves monitoring web page updates our snapshot month-to-month, making certain a 1:1 reserve ratio of buyer funds. Bitget has additionally developed an open-source software, ‘Merklevalidator,’ out there on GitHub. This useful resource reveals our on-chain information on third-party platforms like Nansen, CoinGecko, and extra, in addition to supplies a software for its customers to confirm their account reserve data.

3. Equal Precedence to Retail Buyers

The corporate has constantly adhered to the philosophy of placing our retail customers first, going in opposition to many related companies within the trade as most worth institutional and VIP customers extra. However Bitget is extra prepared to serve retail customers, so when designing product attributes, curiosity safety mechanisms, and product thresholds, the corporate all the time has retail customers in thoughts.

At Bitget, retail prospects get higher providers and extra beneficial charges. The corporate believes retail buyers are an important momentum driver within the growth of the crypto trade, which may be very completely different from conventional finance.

4. Working intently with Influencers

Bitget collected extremely motivated Key Opinion Leaders (KOL) and associates over the previous 4 years and has a community of over 100,000 shut KOL companions worldwide.

The corporate was probably the most pleasant platform for KOL and Key Opinion Customers (KOC) within the trade. Along with these influencers, the corporate spreads probably the most skilled buying and selling methods and high-quality content material with customers.

Social buying and selling is likely one of the essential elements of Bitget’s system. The corporate discovered a definite growth path that fits the platform’s traits and stays centered. Due to this fact, though many achievements have solely manifested this 12 months, it’s certainly the results of the group’s steady efforts over the previous 4 years.

The Recommendation for Fellow Builders within the Bear Market

- Create a product with distinguishing qualities and grow to be a pacesetter within the subject: individuals are naturally drawn to primary within the trade for all the proper causes.

- Safety and safety is probably the most vital side of blockchain companies. Guarantee customers that their funds are all the time theirs and are withdrawable at request. This manner, everybody will probably be prepared to retailer belongings with the product.

- Each enterprise determination ought to be created from the customers’ perspective. For instance, a product that gives customers advantages and actual use instances will ultimately succeed as a result of customers will naturally stick round.

MD’s Imaginative and prescient for the Crypto Business in 2023

“As macro liquidity continues to have an effect on the crypto market, the rate of interest spike is anticipated to decelerate in 2023 progressively. Though we’re not positive when the rate of interest cuts will occur, the influence of the Consumed macro liquidity will even proceed to have an effect on buyers’ expectations for the crypto market.

As well as, the variety of locked positions in DeFi is anticipated to extend slowly in 2023. Whatever the decline within the worth of fashionable blockchain tokens, the variety of energetic customers and new pockets addresses on chains like Polygon, Ethereum, and BSC has remained on the rise.

As extra DeFi blue chips slowly rework into the ecosystem’s infrastructure, the lock-up quantity and TVL of DeFi are anticipated to proceed to rise in 2023. Due to this fact, I look ahead to seeing the way it will play out in 2023!

Hopefully, my speech has been capable of give some inspiration and confidence to the trade. If Bitget may nonetheless obtain regular development within the bear market, fellow trade companies can accomplish the identical. So, we’ll construct the trade with wholesome competitors and continued userbase development collectively!”

It is a sponsored put up. Discover ways to attain our viewers here. Learn disclaimer beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link