[ad_1]

Two days in the past, chapter directors and FTX debtors revealed an replace for unsecured collectors claiming the invention of $5.5 billion in liquid belongings. Roughly $3.5 billion of those funds are cryptocurrency belongings, with 11 totally different digital currencies categorized as “liquid belongings.” Nonetheless, two of the agency’s prime cryptocurrency caches are usually not liquid as the corporate’s 47.51 million SOL tokens are locked and the agency’s FTT steadiness distorts the conclusion of precise liquidity on account of FTX’s management of greater than 80% of the provision.

Locked Solana and Illiquid FTT Property to Complicate FTX’s Chapter Course of

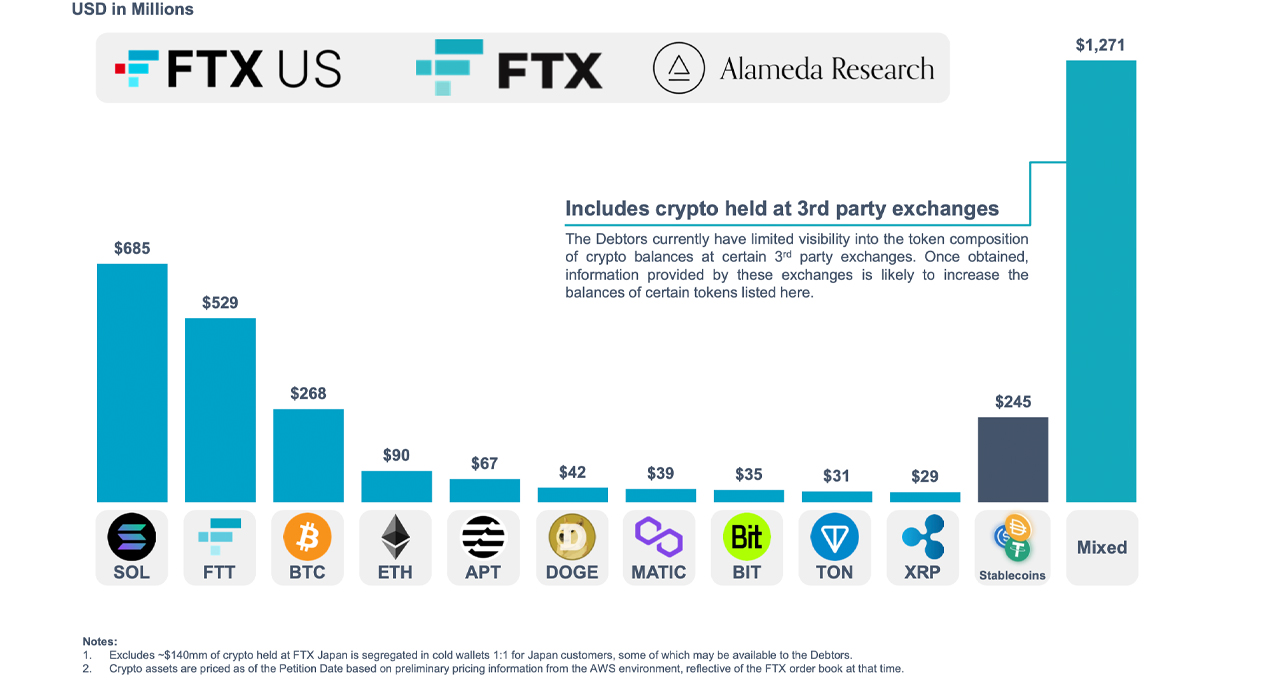

On Jan. 17, 2023, FTX debtors published a press launch and visible presentation of belongings found because the firm filed for Chapter 11 chapter safety on Nov. 11, 2022. The FTX debtors declare to have discovered $5.5 billion by way of a “herculean investigative effort,” with $3.5 billion reportedly being crypto belongings. The visible presentation explains that FTX controls round $685 million in solana (SOL) tokens, roughly 47,511,173 SOL, and utilizing as we speak’s SOL trade price, that cache is price rather more than $685 million.

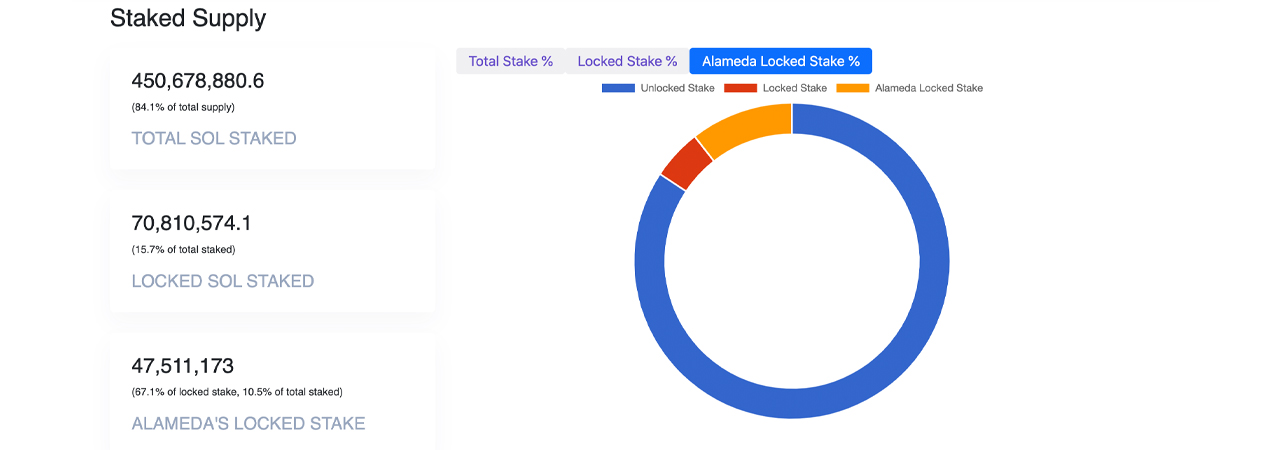

Nonetheless, the SOL owned by FTX debtors is locked and this side will not be talked about within the visible presentation proven to unsecured collectors. It has been reported that FTX/Alameda managed to buy 16% of the SOL provide from the Solana Foundation, however there’s a lockup schedule. The present stash of 47.51 million SOL equates to eight.82% of the overall provide the Solana community will finally situation over time. Presently, there may be solely 370,992,365 SOL in circulation and that doesn’t account for the 47.51 million locked SOL owned by the liquidators.

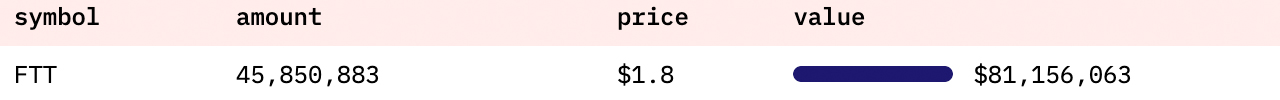

The issue with calling this cache of SOL liquid is that it’s locked and topic to linear vesting via 2025-2027, and it may take years earlier than the funds may be accessed. Moreover, the debtors’ cache of ftx token (FTT), a coin initially created by the core FTX workforce, can also be not liquid as a result of FTX controls greater than 80% of your complete provide. For instance, the Ethereum (ETH) handle “0x97f” controls 45,850,883 FTT, price greater than $1.8 billion utilizing as we speak’s trade charges. The FTX debtors’ presentation reveals the FTT as being price $529 million price of FTT tokens.

The locked Solana situation and the truth that FTX owns a lot of the FTT in circulation places these tokens extra on the facet of being illiquid. This might complicate the chapter course of and funds to collectors as a result of it will be tough to transform these belongings into money or different crypto belongings with out considerably impacting the market value.

Even when the SOL had been unlocked, dumping 47.51 million SOL in the marketplace would trigger disruptions. Moreover, FTT suffers from low buying and selling quantity, restricted trade listings, few use instances, and the corporate controls a lot of the FTT provide. As a result of FTX holds a major quantity of the overall FTT provide, it could actually simply have an effect on the flexibility to commerce it. Calling these caches of SOL and FTT tokens “liquid” is questionable as information doesn’t assist that definition.

What are your ideas on FTX’s discovery of $5.5 billion in liquid belongings, regardless of the presence of locked SOL and illiquid FTT holdings? How do you assume it will influence the chapter course of and funds to collectors? Share your ideas within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss brought about or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link