[ad_1]

This text is an on-site model of Martin Sandbu’s Free Lunch publication. Enroll here to get the publication despatched straight to your inbox each Thursday

The Financial institution of Japan’s assembly this week had been hyped up by a lot of the monetary group, which thought the ultra-dove of world central banking would possibly throw within the towel on its coverage of “yield curve management”. To remind you all, the BoJ targets the extent of the 10-year authorities bond price — at the moment zero plus or minus 0.5 per cent — along with fixing the brief coverage price at 0.1 per cent. That long-term yield repair had come underneath market stress — the BoJ needed to buy a huge number of bonds to defend it — by way of the financial institution’s unforced personal aim of widening the fluctuation band across the yield goal final month. As with foreign money pegs, it was an invite for merchants to take a position in opposition to the central financial institution’s resolve.

Within the occasion, the BoJ did nothing; if something, it dedicated extra strongly to YCC by announcing some technical tweaks to make it work extra easily. Those that had wager in opposition to it misplaced; with enormous strikes down within the 10-year yield and the yen. So if markets had equalised the rating with the BoJ for the reason that December assembly — even pushing the yield barely above the central financial institution’s permitted band at one level — the financial institution’s governor Haruhiko Kuroda has now pulled forward once more.

However the debate on whether or not it is smart to maintain the coverage continues. Megan Greene’s recent FT comment units out most of the financial arguments.

The issue is that many of the commentary I’ve seen mixes up two very various things: what are the correct financial coverage devices and what’s the finest financial coverage stance (ie how ought to the central financial institution wield no matter devices it has adopted). So the query of what the BoJ ought to do with YCC is handled as a matter of whether or not it’s time to tighten. And particularly, many argue from a hawkish viewpoint: the present financial coverage stance is inappropriately unfastened (so the argument goes), subsequently it’s time to put together for the retirement of YCC.

But when we conflate issues on this method, we lose sight of one other potential coverage improvement, specifically to maintain YCC however regulate the focused yield stage upwards when it’s proper to offer much less financial stimulus to the financial system. The truth is, I feel that is probably the most engaging path of all.

Take the second query first: is it time to tighten Japan’s financial coverage? Recall that Japan has been in a low-inflation (and even deflationary) lure for many years, and getting the financial system out of it has been Kuroda’s quest all through his tenure. With below-target inflation so lengthy entrenched, and with Japan even within the present disaster experiencing weaker worth pressures than different superior economies, absolutely the BoJ ought to err on the facet of stimulating an excessive amount of reasonably than too little.

Whereas there are signs that Japan’s employers and employees could lastly have put a disinflationary mindset behind them, the nation has seen a false daybreak earlier than — a spike in inflation in 2014 proved shortlived. The BoJ’s own forecasts are for inflation to fall beneath its goal once more within the subsequent two years. All this makes me conclude that till all actors within the financial system internalise long-term expectations for regular inflation, there needs to be no rush to withdraw financial stimulus.

However as I’ve stated, the diploma of stimulus is a distinct query from how finest to ship it. So we must always assess YCC as an instrument for doubtlessly delivering an entire vary of potential financial stances. Understood as one amongst many potential central financial institution devices, the query is whether or not it’s higher suited than the options. And all of the indicators are that it’s.

We should always consider YCC as an alternative to quantitative steadiness sheet insurance policies — that’s, focusing on a sure amount of bonds that the central financial institution ought to maintain. The place different central banks have caught with “quantitative easing” — shopping for authorities bonds to drive down long-term curiosity within the broader financial system — the BoJ has moved to instantly focusing on the benchmark 10-year price on the low stage it thinks it must be, committing to purchasing as a lot because the market needs to promote at that price.

In two methods, focusing on the yield itself has labored so much higher than the focusing on the amount of bonds purchased, offered or held, which is the technique pursued by virtually each different central financial institution. (Australia is the one different nation that has lately employed YCC. The US did it within the Nineteen Forties. All three examples show that YCC is a workable coverage device to be judged on its deserves.)

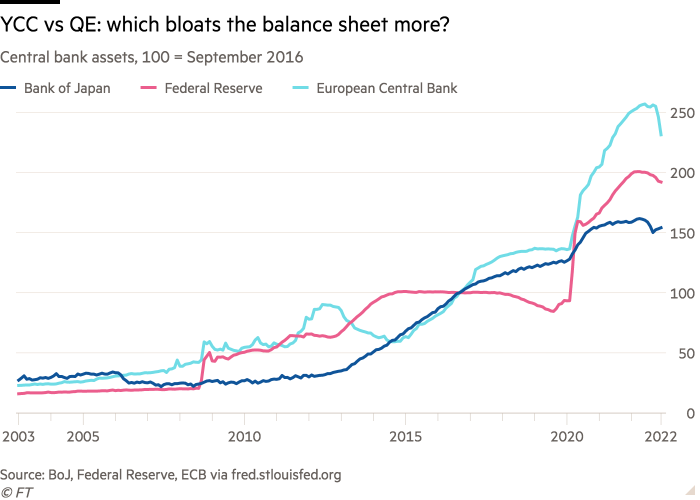

The primary is that YCC appears to ship the specified financing circumstances with a way more efficient use of the central financial institution’s steadiness sheet. The chart beneath exhibits the property held by the world’s three largest central banks, listed to 100 in September 2016 when the BoJ adopted YCC. (Keep in mind that this doesn’t imply the three had equally sized steadiness sheets — the Fed has at all times absorbed much less of its securities markets than the others — however what I’m excited about is the evolution over time.) It exhibits two essential issues: that the BoJ slowed down its property purchases when it moved from quantitative to yield-targeting coverage, and that it shifted from rising its steadiness sheet quicker than its counterparts to doing so extra slowly when the most recent crises hit.

Those that fear about bloated central financial institution steadiness sheets and the related cash creation ought to, in different phrases, want YCC to quantitative insurance policies.

The second method through which YCC is superior to quantitative insurance policies is that financing circumstances (that’s to say, rates of interest) within the broader financial system are in any case what central bankers attempt to affect. With quantitative insurance policies you must hope that you simply select the correct quantity of bonds to carry to get rates of interest the place you need them, after which for that stage of charges to get inflation to the correct place. With YCC you solely have the latter uncertainty; you don’t want to fret that the long-term benchmark price behaves in a different way from what you need.

That fear has been critical. One large problem for many central banks is to handle and talk their present tightening insurance policies with out (a) being second-guessed by markets that offset their insurance policies with opposite asset worth strikes; and (b) disorderly shifts in long-term yields attributable to dysfunctions in market plumbing (see the US’s 2020 “sprint for money” or the UK’s 2022 pensions funds debacle) or self-fulfilling dynamics (see the rise in Italian borrowing prices). Ask this query: if the central banks in these circumstances had been utilizing YCC, would the disruptions have occurred within the first place and would there have been a necessity for the advert hoc interventions every required? It’s onerous to see how.

And that exhibits why YCC shouldn’t be seen as financial loosening, however as an instrument that may work in each instructions. Very like decreasing the 10-year yield goal is an alternative to quantitative easing (shopping for a pre-determined amount of bonds), so elevating the 10-year yield goal is an alternative to quantitative tightening.

So let me give the other recommendation from many others: the BoJ and the Japanese authorities ought to not use the approaching change of the guard (Kuroda’s time period ends quickly) as a possibility to retire YCC, however reasonably to normalise it as an everyday device within the financial toolbox. Slender the fluctuation hall once more, and take the primary good alternative to indicate YCC can be utilized for tightening by elevating the goal yield. And as I argued two years ago, different central banks ought to — once more — study from Tokyo: if it really works for the BoJ, it may work for them too.

On Sweden and the euro

My latest FT column is on Sweden, which I visited final week to take the heart beat on the nation now chairing the EU’s ministerial councils. Astute readers could have seen I didn’t point out the euro; nor did I point out Sweden in my defences of the euro in final week’s column and newsletter. Sweden, after all, is a small open EU financial system that has managed very effectively outdoors the euro. Whereas it clearly has not prevented a burst of inflation that’s worldwide in trigger and character, it has not required the punitive rates of interest of the central European non-euro international locations, and its public funds are among the many most strong in western Europe (with public debt about 30 per cent of nationwide earnings and falling). It appears to be doing fairly effectively with the krona.

And but. The euro query shouldn’t be fairly lifeless — although it has lengthy been in suspended animation, as one economist put it to me. On the new 12 months, financier Christer Gardell sparked a debate by arguing in an interview that Swedes have been made poorer by having a “shitty little currency”. Gunnar Hökmark, a former MEP, marked Croatia’s euro accession by noting {that a} nation that solely joined the EU a decade in the past has now come nearer to Europe’s core than Sweden. Newspapers have pricked up their ears and began to solicit arguments for and in opposition to.

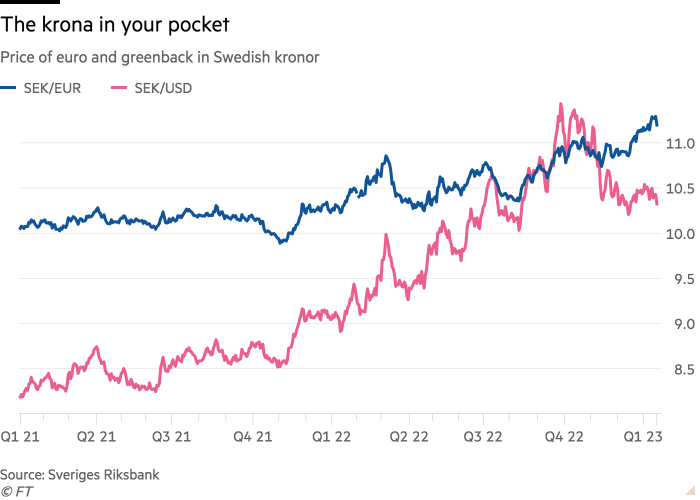

Little doubt the stirring is expounded to the beautiful terrible efficiency of the Swedish krona lately, which makes it a superb time to return as a customer however a foul time to be both a Swedish shopper or a Swedish policymaker fearful about inflation.

It’s unlikely that Sweden will change its standing any time quickly. However it’s clear that the query shouldn’t be definitively settled.

Different readables

-

The New Yorker asks whether or not 3D printing can change home development.

-

I discovered John Naughton’s touch upon ChatGPT to be an especially helpful dialogue for lay readers like myself of the brand new machine studying bot that has taken the world by storm. It’s the simplest explanation I’ve seen of what it does (“next-token prediction”) and makes the essential level that the person must be educated to take advantage of out of it. His analogy with spreadsheet software program is enlightening — it makes me word that Excel didn’t take over the world, nevertheless it did make numerous clerical jobs out of date.

-

Toby Nangle is a fund supervisor who confronted the philosophical inconsistency between holding sure values of politics and even primary human decency — eg don’t put folks in focus camps or kill and torture your opponents — and managing the monetary property for regimes that do (you understand who they’re). His FT op-ed on the dilemma and what to do about it’s glorious.

-

We should always put together for potential energy abundance, not simply shortage, writes Andrew Sissons.

-

Martin Wolf interviews Philip Lane, the European Central Financial institution’s chief economist.

[ad_2]

Source link