[ad_1]

Arbitrum and Optimism raked thousands and thousands in revenue regardless of the prolonged bear market that hammered decentralized finance (DeFi) actions and Ethereum (ETH) valuation in 2022.

Arbitrum And Optimism Win Massive

Per on-chain knowledge shared on Twitter, Arbitrum, and Optimism, general-purpose Ethereum layer-2 platforms, made 2,906 ETH and a pair of,086ETH, respectively. In USD phrases, it interprets to round $4.6 million and $3.3 million for every protocol.

L2s are wonderful companies

Arbitrum made 2,906ETH ($4.6M) of revenue in 2022

Optimism made 2,086ETH ($3.3M) of revenue in 2022 pic.twitter.com/ViOkPA0Juv

— Kofi (@0xKofi) January 17, 2023

Primarily based on person exercise and the variety of dApps launched on Ethereum, stable statistics present that builders want the primary sensible contracting over rivals. Since launching, the community has grow to be a hub of exercise, spearheading thrilling improvements in decentralized finance (DeFi), NFTs, metaverse, and gaming.

Trackers in mid-January 2023 state that the entire worth locked (TVL) in Ethereum stands at $26.88 billion, representing greater than half of the belongings locked throughout DeFi. The drop in TVL mirrors the autumn in ETH costs in 2022.

In essence, Ethereum dominates with DeFi exercise over the Binance Smart Chain (BSC), trailing at lower than 1 / 4 of the TVL of the main platform, at $4.65 billion.

Regardless of this dominance, Ethereum’s scaling drawback immediately impacts Gasoline charges. As demand picks up, Gasoline charges fluctuate, resulting in as a lot as $50 on this blockchain to submit a easy transaction. Deploying sensible contracts price way more, generally upwards of $80, when the community is congested. As an illustration, the common transaction charges on Ethereum stood at $0.63 on January 17. Nonetheless, on Could 1, 2022, this determine stood at over $23.

Ethereum layer-2 protocols are a part of the scaling makes an attempt made by builders to alleviate the mainnet. By routing transactions off-chain, layer-2 options may also help scale Ethereum however, most significantly, scale back Gasoline charges by a number of magnitudes.

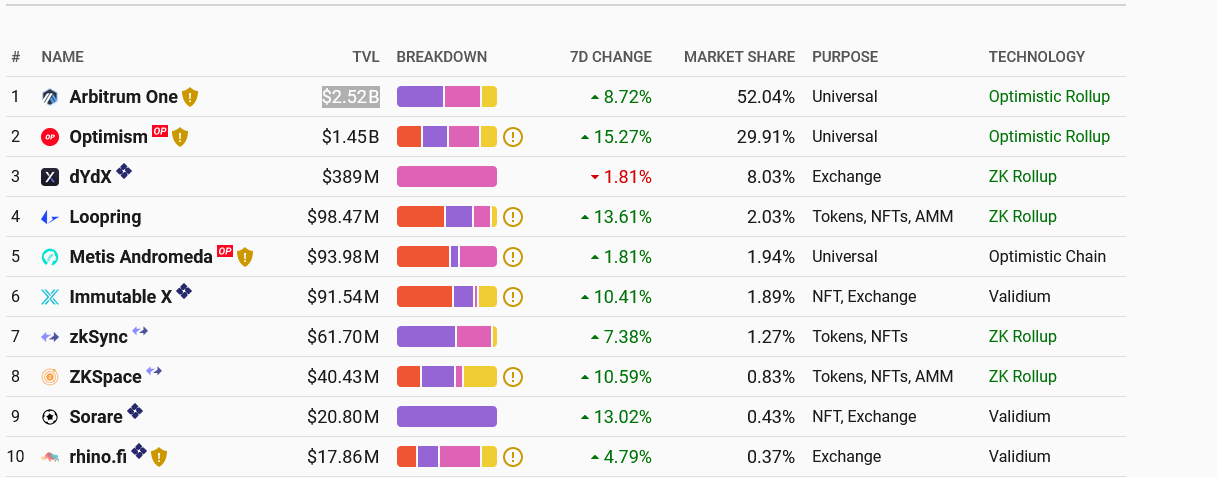

In Ethereum’s layer-2 realm, Arbitrum and Optimism dominate. In accordance with L2Beat statistics, Arbitrum and Optimism had TVLs of $2.52 billion and $1.45 billion, with a market share of 52% and roughly 30%, respectively.

Using on Community Results

Though related charges in Arbitrum, Optimism, and all different layer-2 networks are negligibly low, these protocols can revenue primarily based on exercise. For each switch or sensible contract execution of Arbitrum and Optimism, there’s an related price.

Arbitrum and Optimism charge $0.11 and $0.23 for easy transfers, payable in ETH. If a wise contract is deployed, the charges rise to $0.30 and $0.35. They make extra charges as extra customers deploy sensible contracts or provoke transfers. Accumulating these quantities over months translate to a tidy revenue for the protocol operator.

In 2022, Ethereum layer-2 TVL fell roughly 40% from $7.45 billion to $3.3 billion in July 2022. Outflows have been decrease in comparison with layer-1 DeFi. Because the market recovers, layer-2 operators could possible submit increased income as customers transfer belongings to dApps launched on these scalable and low-fee protocols.

Featured picture from Flickr, Charts from TradingView.com.

[ad_2]

Source link