[ad_1]

On Jan. 17, 2023, FTX Buying and selling Ltd. and affiliated debtors up to date the general public and detailed that the agency’s present directors have found $5.5 billion of liquid property so far. Prime-level executives, together with the brand new FTX CEO and chief restructuring officer, John J. Ray III, met with the chapter case’s committee of unsecured collectors to share the information.

FTX Uncovers $5.5 Billion in Liquid Belongings Via ‘Herculean Investigative Effort’

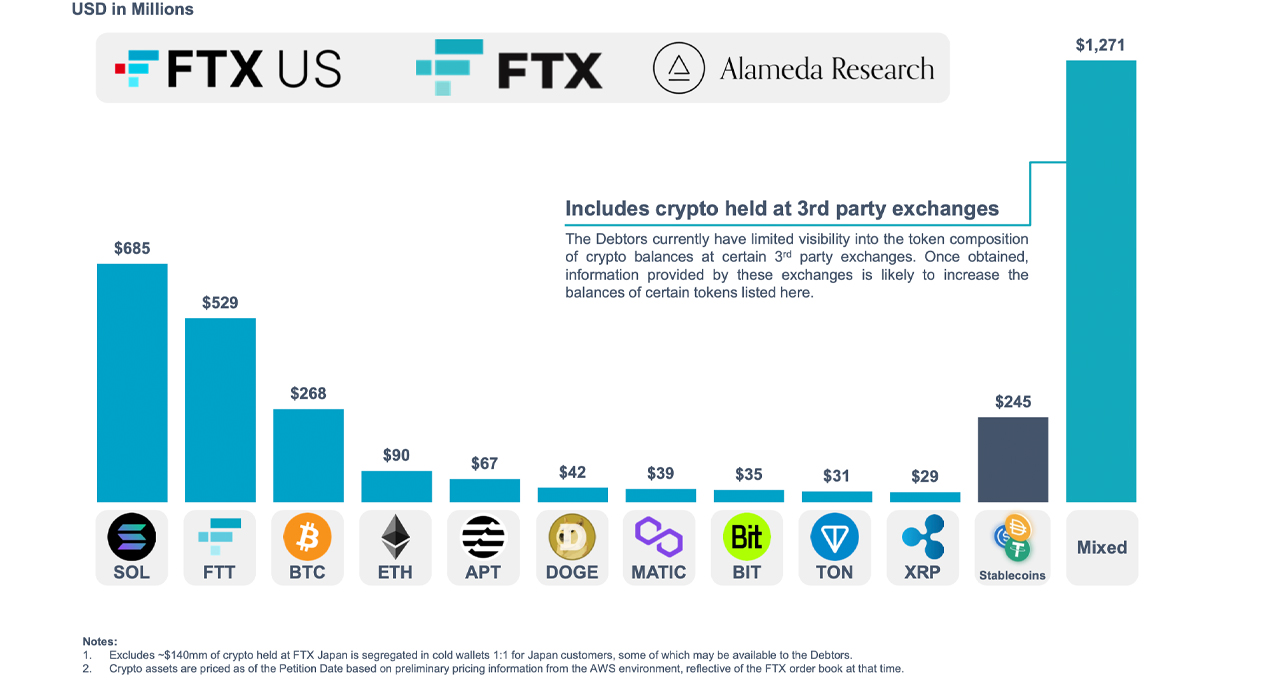

FTX has found $5.5 billion in liquid property, based on a press assertion launched at 2:40 p.m. Japanese Time, Tuesday. The debtors, together with FTX CEO John J. Ray III, introduced that the crew recognized the funds by way of a “herculean investigative effort.” The corporate’s press launch particulars that the crew discovered $3.5 billion in cryptocurrency property, $1.7 billion in money deposits and roughly $3 million in securities.

The press launch additional famous that the FTX crew found $323 million was misplaced to unauthorized third-party transfers earlier than the Chapter 11 chapter submitting was registered on Nov. 11, 2022. Moreover, $426 million “was transferred to chilly storage below the management of the Securities Fee of The Bahamas,” the debtors’ assertion particulars.

FTX debtors disclose that crypto property at present held by FTX executives and the restructuring groups are additionally held in chilly storage. “We’re making essential progress in our efforts to maximise recoveries, and it has taken a Herculean investigative effort from our crew to uncover this preliminary data,” Ray defined within the replace. “We ask our stakeholders to know that this data remains to be preliminary and topic to alter. We are going to present further data as quickly as we’re ready to take action.”

FTX Debtors Examine Historic Transactions, Together with Voyager and Blockfi Offers, and $93M in Political Donations

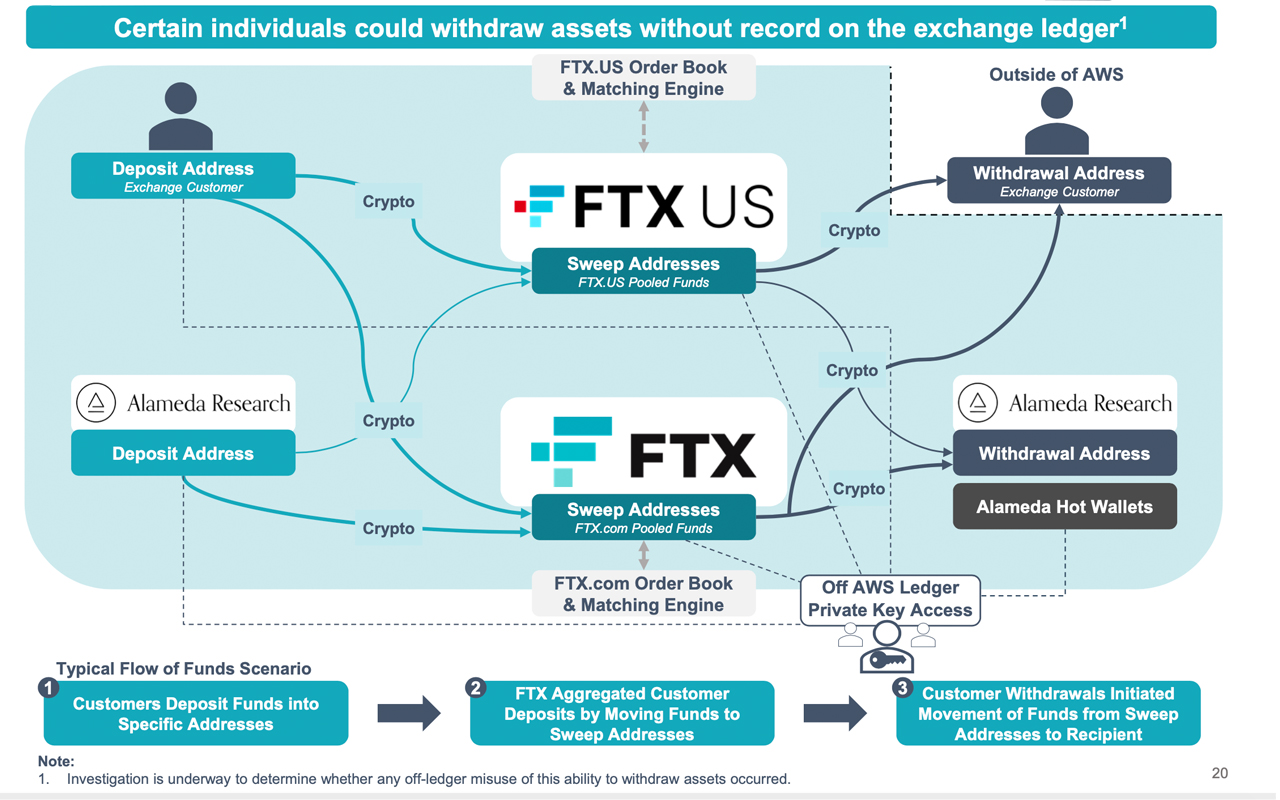

The presentation shared with the committee of unsecured collectors can be connected to the FTX press launch, and it notes that an investigation “confirmed shortfalls at each worldwide and U.S. exchanges.” Moreover, the investigation “uncovered the mechanics behind how Alameda Analysis had the power to borrow with out collateral successfully limitless quantities from clients.” The debtors’ report insists {that a} “small group of people” had the power to take away property from FTX with out it ever being “recorded on the alternate ledger.”

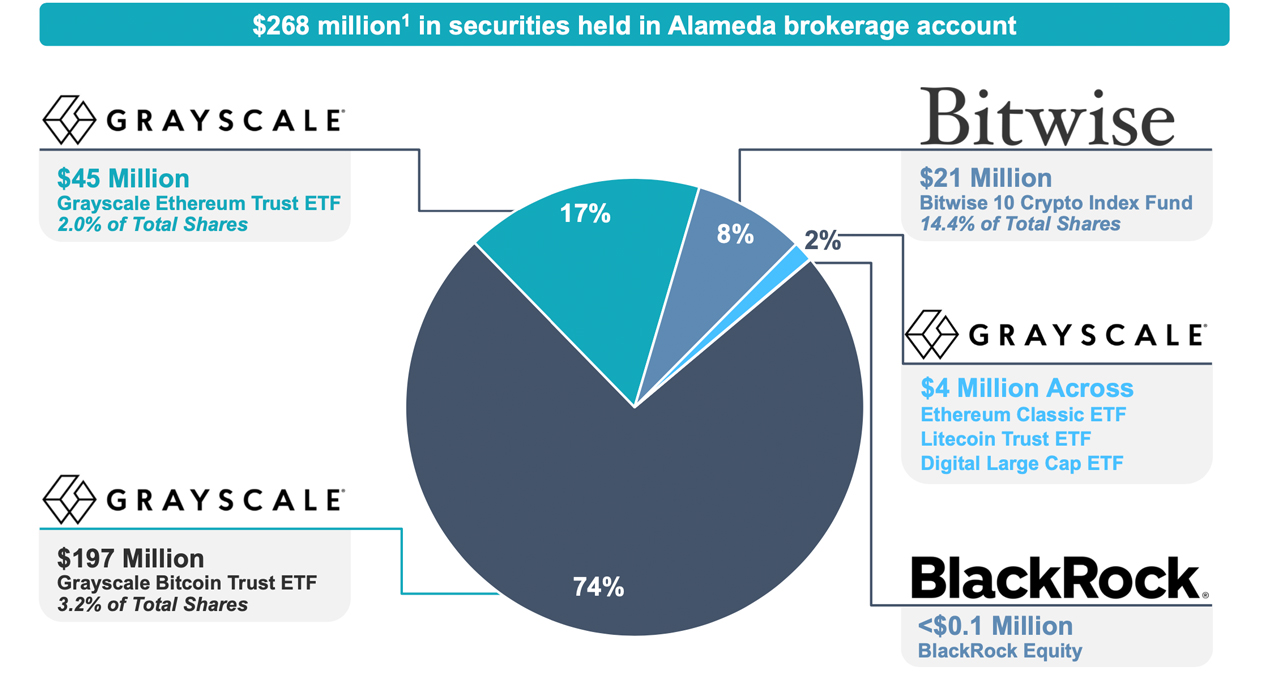

Along with the recovered $5.5 billion, FTX debtors are exploring a number of aspects to maximise the restoration course of by way of the “potential sale” of 4 subsidiaries. The crew is exploring methods to monetize the a whole lot of investments made that at present maintain a ebook worth of round “$4.6 billion.”

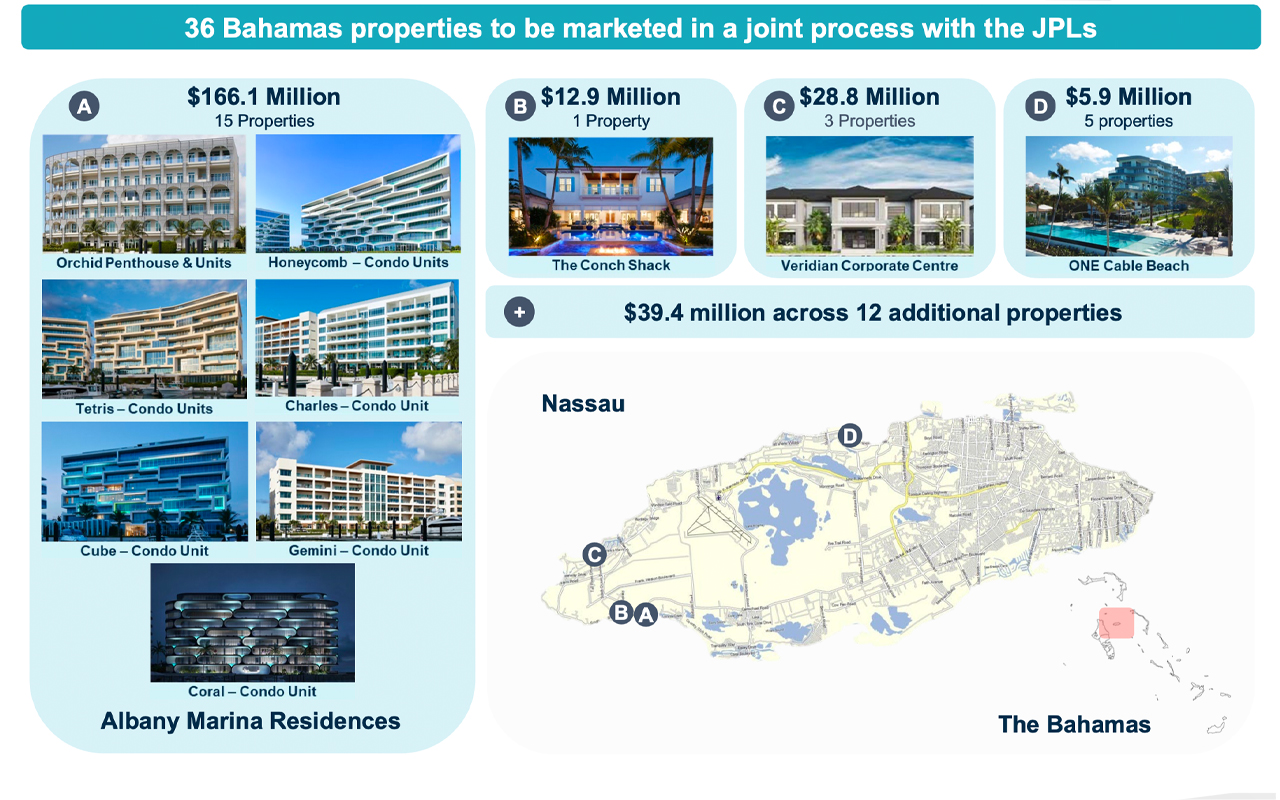

FTX debtors need to maximize restoration by “advertising and marketing actual property within the Bahamas,” and investigators intention to probe “all historic transactions” associated to the enterprise.

The actual property owned by the internal circle is value round $205.5 million, stretched throughout 27 totally different properties positioned in The Bahamas. The historic transactions being investigated contain the Voyager and Blockfi offers, alongside $93 million value of political donations FTX executives made between March 2020 and November 2022.

“Lots of of [mergers and acquisitions] M&A and different transactions below evaluation,” the presentation explains. The presentation additionally offers an in depth visible map of how the internal circle, largely Alameda Analysis, may “withdraw property with out [a] file on the alternate ledger.”

What are your ideas on FTX’s efforts to maximise restoration and uncover the reality behind the unauthorized transfers and historic transactions? Share your insights within the feedback under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Editorial photograph credit score: Poetra.RH / Shutterstock.com

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link