[ad_1]

Economists on the Financial institution of Worldwide Settlements (BIS) have really helpful three insurance policies regulators worldwide may undertake as a way to take care of the dangers posed by cryptocurrencies. “Authorities can now think about quite a lot of coverage approaches and on the similar time work to enhance the prevailing financial system within the public curiosity,” they suggested.

BIS Economists Focus on Crypto Insurance policies

The Financial institution of Worldwide Settlements (BIS) printed a bulletin final week titled “Addressing the dangers in crypto: laying out the choices.”

Authored by BIS economists Matteo Aquilina, Jon Frost, and Andreas Schrimpf, the report discusses the dangers related to cryptocurrencies and the assorted choices obtainable to regulators and central banks for addressing these dangers.

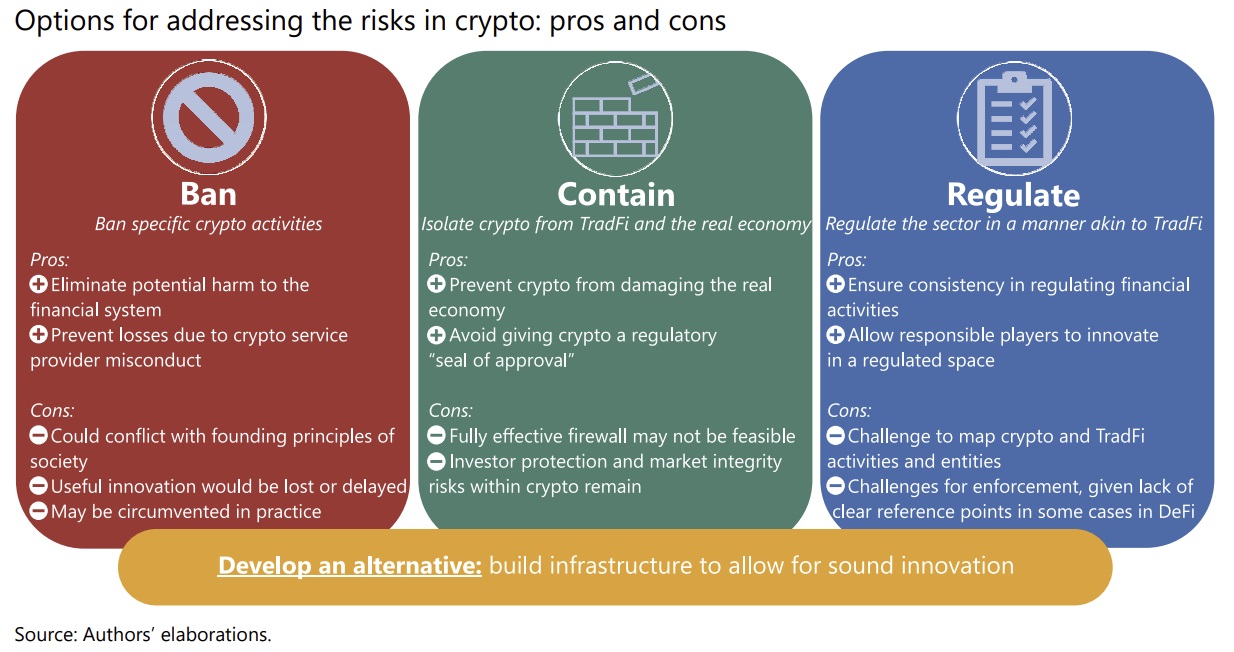

The authors outlined “three potential strains of motion.” The primary is to “ban particular crypto actions.” An alternative choice is to “isolate crypto from tradfi [traditional finance] and the actual financial system.” The third is to “regulate the sector in a fashion akin to tradfi.” Nevertheless, the report clarifies that the three choices aren’t mutually unique and may very well be “selectively mixed to mitigate the dangers emanating from crypto actions.”

Whereas noting that crypto markets “have skilled a outstanding sequence of booms and busts, typically leading to giant losses for traders,” the BIS economists concluded that “these failures have to this point not spilled over to the standard monetary system or the actual financial system.” Nonetheless, they cautioned:

There isn’t a assurance that they won’t accomplish that sooner or later, as defi (decentralized finance) and tradfi turn out to be extra intertwined.

“Authorities can now think about quite a lot of coverage approaches and on the similar time work to enhance the prevailing financial system within the public curiosity,” the BIS report concludes.

What do you consider the BIS economists’ crypto-policy suggestions? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link