[ad_1]

This text is an on-site model of our Commerce Secrets and techniques e-newsletter. Enroll here to get the e-newsletter despatched straight to your inbox each Monday

Welcome to Commerce Secrets and techniques. This week is the World Financial Discussion board in Davos, which suggests the same old blather about ESG and local weather change, with any conversations of substance behind closed doorways and the results solely changing into apparent months later, if ever. Shifting on, in as we speak’s e-newsletter I have a look at the tough place Sweden is in chairing the Council of the European Union for the subsequent six months, stuck in a moment it can’t get out of. I additionally do one in all my occasional drop-ins to see what the Brits are as much as and discover an uncommon diploma of attachment to actuality, essentially coupled with a discount in ambition. Right this moment’s Charted waters highlights Russia’s shocking export income earner: fertiliser.

Get in contact. Electronic mail me at alan.beattie@ft.com

Swede goals, bitter EU actuality

My Brussels colleagues have noted the tricky situation that Sweden finds itself in having simply taken over the presidency of the council. It’s one of many final real free-trading nations in a union more and more heading in the direction of dirigisme, symbolised by the energetic French inner markets commissioner Thierry Breton.

The scenario underlines, as I’ve written before, the peculiar impact of the rotating EU presidency whereby the nation in cost can management the method however doesn’t get to alter coverage.

Sweden needs to counterbalance all of the “defensive” (that is, potentially protectionist) tools the EU has armed itself with over the previous few years — the anti-coercion instrument, the international subsidies regulation and so forth — with a progress agenda together with streamlining rules and signing extra commerce agreements to permit European firms to diversify their markets and supply from overseas fairly than being pressured to reshore.

Final week I talked to Anna Stellinger of the Confederation of Swedish Enterprise, who’s Commerce Secrets and techniques’ longtime Stockholm-whisperer and often proper about all the pieces. She reckons the rebalancing course of was making progress till the US Inflation Discount Act and its trade-distorting tax credit received individuals scared.

“The US IRA has made a optimistic competitiveness agenda a lot more durable — many within the EU have gone into reactive mode,” Stellinger says. “The ‘like-minded nations’ group [mainly northern economically liberal states] is in a state of flux, with extra member states shifting in the direction of a seemingly interventionist agenda and Germany’s place nonetheless unsure.”

One massive win can be completing the EU-Mercosur deal, which stays signed however unratified. Together with updating the EU’s current offers with Chile and Mexico, it might give European multinationals anxious about China a diversification choice. However the deal’s destiny is essentially within the palms of Brazil’s Luiz Inácio Lula da Silva, who would possibly need to renegotiate the settlement, and Argentina, whose president doesn’t like the sound of it in any respect. Good luck to Sweden, however they’ve been given a hospital pass right here for positive.

Welcome humility in post-Brexit Britain

After years of embarrassing boasts about International Britain main the best way in commerce diplomacy, some encouraging indicators of reattachment to actuality within the UK. One, the federal government in December deserted its fantasy that it might someway handle to shift the US’s place on the IRA tax credit by having a quiet chat to get America to alter its methods — symptomatic of the acquainted British delusion about getting concessions out of Washington by chuntering on concerning the particular relationship, one thing, shared transatlantic future, one thing, 5 Eyes, one thing, Winston Churchill one thing, one thing.

As an alternative, the UK managed to voice some actual criticism. It gained’t have any impact, clearly. Britain was almost exactly a year behind the EU in talking up, and in contrast to the bloc, Japan or South Korea, it doesn’t have massive automotive trade investments within the US to offer a leverage point for lobbying. However nonetheless, it’s cheering to see one phantasm apparently on the wane.

The opposite excellent news is the UK easing off the pretence that rolling over EU preferential commerce offers plus signing new ones with economies on the opposite aspect of the planet, plus non-binding memoranda of understanding with particular person US states, someway constitutes blazing a path totally free commerce. As an alternative, Politico reports, it’s now all about ensuring British firms use the entry they have already got. Once more, it’s nothing the UK couldn’t have executed contained in the EU (along with utilizing Brussels’ souped-up enforcement regime), however not less than it’s a reachable ambition — that’s, a modest one.

There’s nonetheless the odd ridiculous claim about Brexit and trade after they can’t assist themselves, clearly. However together with an obvious outbreak of common sense over the Northern Eire Protocol, the UK seems to be shifting in the direction of implicitly (clearly not explicitly) accepting it’s made itself a second-rank buying and selling energy and performing accordingly. Progress, of a form, setting issues up properly for a debate about returning to the EU single market sooner or later.

In addition to this text, I write a Commerce Secrets and techniques column for FT.com each Thursday. Click on right here to learn the most recent, and go to ft.com/trade-secrets to see all my columns and former newsletters too.

Charted waters

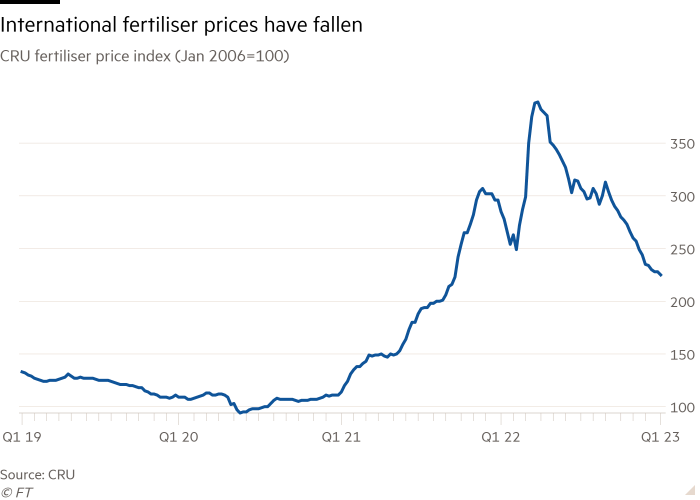

Russia’s weaponisation of its vitality provides is not going so well, however its coffers are being helped (some would say appropriately) by raking it in from muck.

My colleague Emiko Terazono writes that Russia’s revenues from fertiliser soared final yr, regardless of a decline in whole gross sales volumes. The nation’s success on this market may be attributed to the invasion of Ukraine, which despatched crop nutrient costs hovering.

Import statistics from Moscow’s commerce companions present that, in quantity phrases, abroad gross sales by the world’s largest fertiliser exporter solely fell 10 per cent from the identical interval the earlier yr, evaluation by the UN Meals and Agriculture Group discovered.

This contrasts with analysts’ predictions on the time of Russia’s invasion that the worth of fertiliser would collapse. Russia has been capable of money in on the rising costs as a result of fertiliser, together with meals, has been exempt from sanctions.

The excellent news within the battle to tame Russia is that the fertiliser growth is more likely to finish quickly, because the second chart exhibits. Hotter temperatures have helped deliver down gasoline costs and in flip the price of fertiliser as different producers have ramped up manufacturing. Excellent news for farmers. Unhealthy information for the Kremlin. (Jonathan Moules)

Commerce hyperlinks

Nikkei reports how Thailand, a giant automotive manufacturing centre within the area, has grow to be a check case for the Chinese language auto trade competing in opposition to Japan.

Sweden’s state-owned mining firm says it has found Europe’s biggest deposit of rare earths, probably decreasing dependence on imports from China.

The Economist analyses how funding in ports presages the future of world commerce.

The FT’s editorial group identifies the reopening of China after the Covid-19 lockdowns as one of many greatest uncertainties within the international financial system.

Japan, which has simply taken over as chair of the G7 of superior economies, has stated it needs the grouping to take a united stand against economic coercion by China.

Commerce Secrets and techniques is edited by Jonathan Moules

[ad_2]

Source link