[ad_1]

A few of the world’s greatest firms are dealing with multibillion-dollar writedowns on latest acquisitions as a wave of dealmaking offers strategy to a brand new period of financial uncertainty and better rates of interest.

With a 3rd of the worldwide economic system forecast to be in recession this yr, world leaders will this week collect in Davos, Switzerland, to debate what the World Financial Discussion board has known as a “polycrisis” as enterprise leaders interact in a painful reckoning over their empire constructing.

US media and healthcare firms are amongst these to have slashed the worth of enterprise models up to now few months and accountants are warning that extra cuts might be imminent because the annual reporting season will get underneath approach.

Firms are required to evaluate the carrying worth of intangible belongings not less than every year, utilizing assumptions about future money flows and comparisons to inventory market valuations, which fell sharply in 2022.

With greater prices owing to inflation and a weaker outlook for demand, many lately acquired companies might battle to justify their valuations, even earlier than factoring in greater rates of interest, which additional scale back the current worth of future money flows.

“It’s a fairly lethal mixture,” mentioned Jasmeet Singh Marwah, managing director at Stout, a valuation companies firm. “For a lot of companies . . . they made the acquisition and the efficiency has not been at par with what they anticipated or budgeted for.”

International dealmaking hit a file $5.7tn in 2021, however slowed sharply as 2022 progressed. In keeping with Refinitiv, $1.4tn of transactions have been agreed within the second half of final yr in contrast with $2.2tn within the first, marking the most important swing from one six-month interval to the following since data started in 1980.

The premium paid for an acquisition over the worth of its web belongings known as goodwill and is recorded on the acquirer’s steadiness sheet. Goodwill writedowns grew in measurement within the US final yr, to the purpose the place they have been sometimes sufficiently big to wipe out an organization’s income within the quarter by which they have been recorded.

The ten largest goodwill writedowns at S&P 500 firms in 2022 totalled $35.4bn, in line with knowledge gathered by consultancy Kroll, in contrast with $6.1bn in 2021.

Launching a bid to hitch the Disney board this week, investor Nelson Peltz highlighted the round $50bn in goodwill on Disney’s steadiness sheet attributable to the acquisition of Fox, which he predicted must be largely written down.

Enterprise and political leaders in Davos for the WEF’s first winter assembly since earlier than the coronavirus pandemic confront a vastly totally different panorama to a few years in the past.

Forward of the assembly, the WEF’s annual danger report warned of a “polycrisis” because the hovering price of dwelling and an financial downturn mix with continued failures to sort out inequality and local weather change.

Kristalina Georgieva, the IMF’s managing director, who shall be in Davos to current the fund’s newest financial outlook, predicted earlier this month that one-third of the world economic system shall be in recession this yr, together with half the EU.

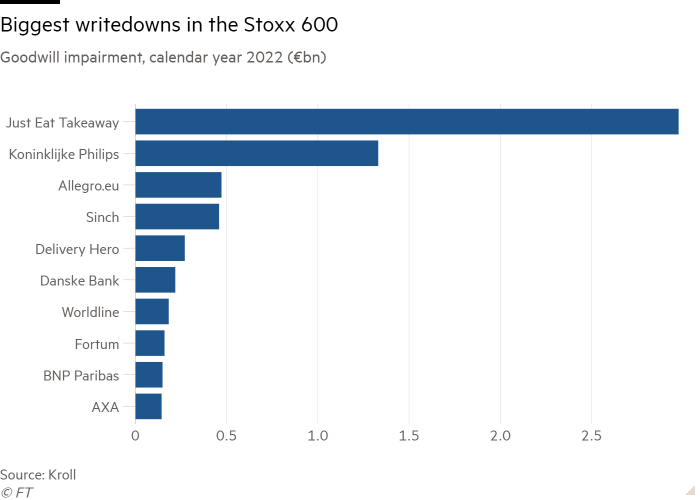

The scale of goodwill writedowns in Europe has not thus far risen. The ten largest within the Stoxx 600 totalled €6.4bn final yr, in line with Kroll, down from €17bn in 2021.

European firms have later monetary year-ends and fewer frequent reporting, mentioned Carla Nunes, a Kroll managing director, suggesting that extra goodwill impairments might come within the spring.

Dan Langlois, companion at KPMG, mentioned latest acquisitions might be susceptible to writedowns even when they’re at present performing to plan.

“Once you consider price inflation that possibly wasn’t anticipated, while you consider greater rates of interest, which drive up the speed you would possibly use in a reduced money stream evaluation, after which consider a few of the uncertainties related to a possible recession, these issues in totality will affect honest worth,” he mentioned.

In October, Comcast reported a more-than-$8bn writedown of the broadcaster Sky, which it acquired in 2018, citing difficult financial situations within the UK and different European markets and plunging the media group right into a $4.6bn quarterly loss.

Earlier final yr, Teladoc Well being, which acquired digital care supplier Livongo for $13.9bn in 2020, recorded two consecutive quarters of writedowns totalling near $10bn.

Whereas firms are required to subtract goodwill writedowns from their revenue, many exclude them from the “adjusted” numbers they spotlight in earnings stories.

That doesn’t imply traders ought to ignore them, mentioned David Zion, founding father of Zion Analysis.

When an organization cuts the worth of its belongings, its debt to fairness ratio goes up, which in flip will increase the chance of breaching covenants on its debt, he mentioned. It will possibly additionally flatter future returns.

“Administration will let you know it’s non-cash, it’s one-time, don’t fear about it. Don’t overlook that, when return on belongings is so good two years down the road, that’s as a result of they took a large impairment.”

Kroll’s Nunes added that goodwill impairments present a readout on the standard of an organization’s dealmaking. “You possibly can inform in case you are getting a return in your funding,” she mentioned, “or if the client could also be overpaying for these companies.”

[ad_2]

Source link