[ad_1]

An obvious gulf has opened up between central banks on both aspect of the Atlantic over their function in battling local weather change.

Jay Powell, chair of the US Federal Reserve, mentioned the guardians of the world’s currencies ought to “follow our knitting and never get lost to pursue perceived social advantages that aren’t tightly linked to our statutory objectives”.

“We aren’t, and won’t be, a local weather policymaker,” Powell informed a conference organised by the Swedish central bank this week.

On the similar occasion, Isabel Schnabel, a member of the six-person government board of the European Central Financial institution, advocated greater action to deal with local weather change. The German economist pledged to “make sure that the entire ECB’s insurance policies are aligned with the goals of the Paris Settlement to restrict international warming to properly beneath 2C”.

The stark distinction in approaches raises questions over whether or not financial policymakers ought to lead the combat towards international warming or play a a lot much less lively function.

Are environmental points behind diverging attitudes to inflation management?

No. It is very important look previous the large rhetorical divide and focus on what they’re saying about inflation.

The ECB’s place is obvious, if a bit of convoluted. It worries that top rates of interest to manage inflation will undermine the inexperienced transition by elevating the price of investing in wind, photo voltaic, hydrogen and different clear energies obligatory for shifting to a internet zero carbon world.

However Schnabel was clear that this concern was subordinate to the ECB’s mission to manage inflation. Whereas she recognised a “dilemma” concerning the harm excessive charges pose to inexperienced funding, the reply was to manage inflation so borrowing prices may come again down.

“By bringing inflation down in a well timed method, financial coverage restores the circumstances which are obligatory for the inexperienced transition to thrive,” she informed the convention, demonstrating the ECB’s settled stance on financial coverage after elevating charges quickly to 2 per cent in latest months.

The Fed’s governors do not need an identical dilemma to resolve, so the US coverage is easier. “Restoring worth stability when inflation is excessive can require measures that aren’t widespread within the quick time period as we increase charges to sluggish the economic system,” Powell mentioned, including that the Fed’s independence allowed it to take the mandatory measures on charges.

The place else are Fed and ECB coverage basically aligned?

They’re aligned on two different necessary points. First, that the first function for inexperienced intervention lies not with impartial central banks however with governments. Powell mentioned that “in a well-functioning democracy, necessary public coverage selections needs to be made, in virtually all circumstances, by the elected branches of presidency”. Schnabel concurred, saying, “governments should stay within the lead in accelerating the inexperienced transition”.

Second, they agree central banks have a task when supervising the banking system in guaranteeing business banks perceive and handle monetary dangers from international warming. These embody weather-related dangers to infrastructure that banks have financed or fossil fuel assets that might become near-worthless in future.

It is a “slender, however necessary” accountability, in keeping with Powell. ECB president Christine Lagarde pledged in 2021 to “make sure that each financial institution is making swift progress in embedding local weather dangers into their organisations”.

And the place do their insurance policies differ?

Essentially the most vital divergence is in how a lot they need to discuss their function in addressing local weather change.

In sticking to its “knitting”, the Fed doesn’t need to make any waves on the topic, whereas the ECB has made a dedication to analyse, advise and act to scale back carbon emissions. Addressing local weather change was an necessary final result of its 2021 technique overview, the place it made a dedication to additional incorporate environmental issues into its financial coverage framework.

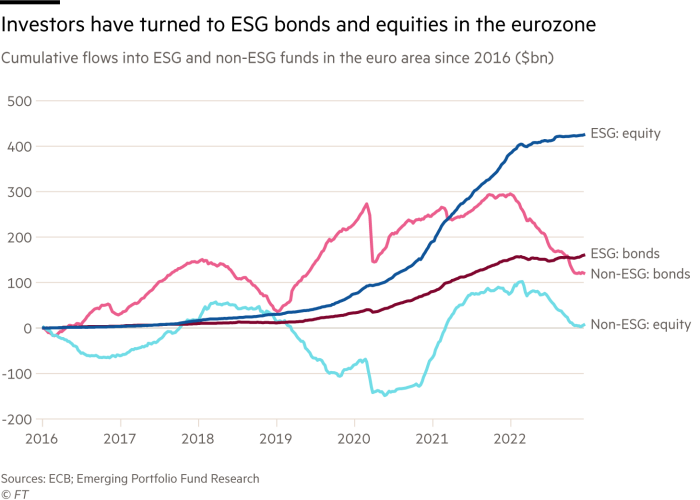

Concrete motion is extra restricted, however the ECB has begun to tilt its portfolio of company bonds in the direction of corporations with higher local weather scores, one thing Schnabel dedicated to extending this week. The ECB can be taking a look at setting harder environmental circumstances if banks need to use bonds as collateral within the central financial institution’s financing operations.

The Fed doesn’t have a company bond portfolio, having unwound its coronavirus programme in 2021, and has no plans to “inexperienced” its collateral framework.

Why do these variations persist?

The Fed has a tightly outlined mandate of looking for “most employment and worth stability”, whereas the ECB has a wider remit, which says it must also assist the eurozone’s financial insurance policies as long as worth and monetary stability are maintained. These insurance policies embody a inexperienced transition, so ECB rate-setters have concluded they’ve a accountability to take some motion towards local weather change.

The variations, although small in contrast with the rhetorical gulf, relate to totally different political pressures. The Fed should reveal it isn’t straying from its clearly circumscribed freedom to behave on inflation and employment; the ECB faces stress to do extra to help the transition — as long as it doesn’t lose management of inflation.

Nick Robins, professor on the London College of Economics, mentioned all central banks now recognised local weather change’s “materials dangers” to monetary techniques. “The place they diverge relies upon very a lot on the differing mandates they’re given by legislators and the political setting they function in — and these variations had been on show this week.”

However the ECB’s looser interpretation of its remit comes with dangers. Paul Tucker, former deputy governor of the Financial institution of England, mentioned inexperienced insurance policies may backfire on unelected European central bankers in the event that they grew to become controversial.

“Though local weather change is vitally necessary, Powell is true that impartial central banks can not decently make discretionary selections on this space with a view to, because it had been, tax polluters,” Tucker mentioned, warning that “elected governments may impose authorized constraints on the property that central banks should purchase or lend towards”.

[ad_2]

Source link