[ad_1]

This text is an on-site model of our Unhedged publication. Enroll here to get the publication despatched straight to your inbox each weekday

Good morning. The appointment of Bernard Arnault’s daughter Delphine to run Dior has raised some eyebrows. That is subsequently a very good time to announce that Elsie Armstrong, now a precocious 13, might be taking up management of Unhedged when Rob strikes on. We really feel that is essential to make sure the continuity of the model. Ship proxy ballots to: robert.armstrong@ft.com & ethan.wu@ft.com.

Has Japan overcome deflation?

Japan’s long-running quest to slay deflation has had one huge, cussed impediment: what the Japanese themselves anticipate. A protracted historical past of negligible worth development entrenches the expectation that companies can’t increase costs. Those who step out of line are punished with falling gross sales. So firms preserve costs down, which results in puny wage will increase. And since costs have a tendency to remain flat, shoppers are in no rush to spend their (stagnant) earnings. The entire economic system falls into ennui.

Breaking this sample could be very exhausting. However since final yr’s commodity shocks, a believable path out of the deflationary muck has appeared. It would look one thing like:

-

An exogenous commodity price shock pushes the value of issues akin to power and meals means up.

-

The yen weakens as Japan, pressured to spend extra of its buying energy on power and meals imports, enters a commerce deficit; this will increase the value of different imported items, too.

-

Producer-side inflation rises, however terrified of pushing aside prospects, firms bear the upper import prices for some time.

-

However ultimately this turns into unsustainable, and as firms are pressured to cross alongside worth will increase, shopper inflation rises.

-

Customers, left to reckon with the brand new inflationary actuality, begin demanding offsetting wage will increase; they put newfound spending energy to work, a virtuous wage-price spiral ensues.

This, kind of, has occurred — apart from the final bullet. The chart beneath reveals Japan shopper and producer inflation. Discover that it took PPI reaching 9-10 per cent over many months earlier than CPI even broke 1 per cent:

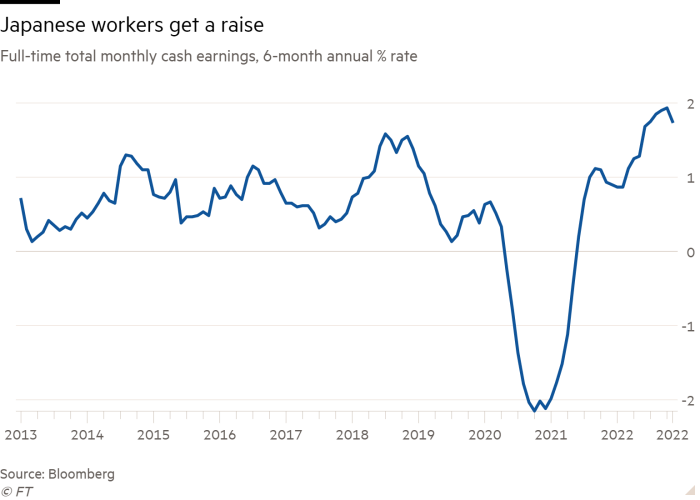

Can Japan take the final step? Can imported cost-push inflation, which gained’t final for ever, be parlayed into home demand-pull inflation? That is what the Financial institution of Japan desires, and why it has moved mountains to maintain its ultra-accommodative yield curve control policy in place. The issue is that inflation nonetheless seems largely cost-driven. Wage development, although it has risen noticeably, fell within the newest November studying, and stays beneath the three per cent charge the BoJ thinks is needed to maintain 2 per cent inflation:

However there may be excellent news. The FT’s Kana Inagaki and Eri Sugiura report:

Quick Retailing, Asia’s largest clothes retailer and proprietor of the Uniqlo trend model, will enhance worker wages in Japan by as a lot as 40 per cent as inflation within the nation rises at its quickest tempo in a long time …

Whereas many Japanese firms depend on a seniority-based pay construction, the retailer will consider staff based mostly on their efficiency and skill to contribute to the enterprise, it added …

To deal with the upper prices, the group elevated the costs of flagship merchandise at Uniqlo shops in Japan final yr, with its fleece jackets leaping from ¥1,990 to ¥2,990.

Quick Retailing isn’t alone. Forward of annual union wage talks within the spring, a spate of massive Japanese firms have recently announced proactive pay will increase, together with staid companies akin to Nippon Life Insurance coverage (a 7 per cent bump). Bandai Namco, a online game maker (and writer of my favourite game of 2022), is elevating beginning salaries by 25 per cent.

Pelham Smithers of Pelham Smithers Associates, our go-to Japan watcher, thinks that is all heralding a grand shift in inflation psychology. As he identified to us yesterday, the headline inflation charge in all probability understates how profoundly wage-price dynamics are altering:

Two issues have occurred during the last yr. The primary is that inflation in Japan has been fairly a giant media story. It could be very troublesome to observe the day-to-day information with out getting caught up within the inflation story.

The second factor is that high-street [retail] inflation has been basically operating at double the nationwide charge. [In contrast to, for example, rent inflation near zero] should you’re somebody procuring on the excessive road, you’ve seen one thing round 6 to 7 per cent inflation. So that you’ve been feeling like costs have been rising . . . you don’t suppose, “Oh, my lease hasn’t gone up” as an vital issue. You’re simply wanting on the worth of flour and eggs and considering, “Oh, God” …

As a result of main elements of Japanese family spending haven’t gone up, the headline charge isn’t as excessive. However the psychology the Japanese have had about inflation might be worse than the height within the US or the UK, as a result of they haven’t skilled it for 30 or 40 years.

An inflation regime change would possible remake the nation’s sluggish inventory market: nominal income, in the end, may increase. That might make the attraction of investing in Japan a lot clearer for international buyers. (Ethan Wu)

Are we heading for a company debt disaster? (Half 1)

Individuals for Monetary Reform, the buyer advocacy group, could be very frightened in regards to the proliferation of dangerous company debt, and simply launched a meaty paper on the subject, “A Big In The Shadows”. There’s a lot in it to agree and disagree with, and it’s price a learn. The creator, Andrew Park, thinks the fast development low-quality company debt is worrisome for 5 causes:

-

It’s overwhelmingly used for buyouts, dividend funds, refinancings and buybacks — not increasing firms’ productive capability.

-

Its riskiness is hid by poor reporting practices: rampant changes to ebitda, already a non-GAAP measure, imply regulatory tips on leverage are recurrently flaunted.

-

It’s usually issued and/or owned by poorly regulated establishments, relatively than banks or mutual funds that function with correct oversight.

-

A lot of it’s securitised and/or packaged into collateralised debt obligations, which means that originators should not consuming their very own cooking and have incentives to hide low high quality.

-

It’s more and more owned by insurance coverage firms or, worse, private-equity owned insurance coverage firms, which creates systemic dangers.

Many of those are acquainted, as they’re echoes of the issues underlying the mortgage disaster that started 15 years in the past. And whereas every of them deserves particular person consideration, I’m most serious about a wider situation that underlies all of them: the concept there may be simply an excessive amount of low-quality debt floating round, and it’s going to explode in our faces eventually, or as AFR puts it:

The explosion of low-quality lending has introduced debt masses in company America to report highs, a growth that’s more likely to convey, within the coming years, a wave of defaults, slower development, future job losses, and potential instability stemming from the utter opacity of this enterprise

I feel that is at all times a very good situation to convey up, and it’s a significantly good situation to convey up proper now. It’s at all times vital as a result of human beings, left alone, will at all times preserve including debt till one thing breaks. The return-multiplying energy of leverage is sufficient to guarantee this; legal guidelines that give debt financing an enormous edge over fairness make it worse. It is very important take into consideration the query proper now as a result of charges have risen shortly, and would possibly keep excessive. We don’t understand how the massive inventory of excellent debt, issued when charges have been low, will reply to this.

The issue with fascinated with the issue typically phrases is that it’s exhausting to trace how a lot debt there may be and the way dangerous it’s. AFR estimates that the whole US inventory of “subprime” company debt (junk bonds, leveraged loans, direct lending) is price $5tn. In keeping with the national accounts, whole non-financial company debt (bonds and loans) stands at $12.7tn, making low-quality debt slightly below 40 per cent of the whole. However I don’t but have a time sequence for “subprime”, so I don’t understand how a lot 40 per cent is relative to historical past.

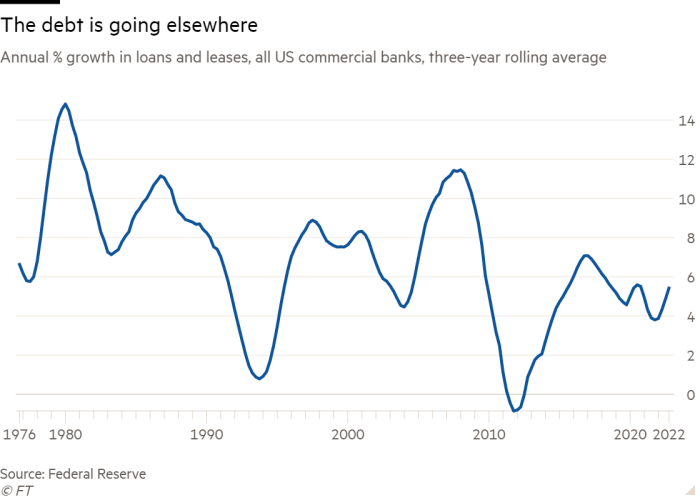

So what can we are saying in regards to the riskiness of company debt within the US? One factor we will say is that much less and fewer debt is held in essentially the most fastidiously regulated and supervised entities: banks. Here’s a chart of the expansion of whole loans and leases held by all US business banks, for the reason that mid-70s (the info is quarterly, and introduced as a three-year rolling common):

As the expansion in company debt has picked up, development in financial institution lending has been slowing down. It was crushed after the housing disaster and has not recovered, taken away by the bond and securitisation markets. Park is subsequently fairly proper to say that US company debt is regulated an increasing number of loosely.

However whether or not leverage is actually growing is a extra advanced query. The subsequent chart reveals company debt as a share of GDP, which is on a transparent long run rising pattern, and company debt as a a number of of income, which isn’t:

Debt to pre-tax revenue varies with the financial cycle, as one would anticipate, but it surely has not been rising, and isn’t traditionally excessive now. One may be tempted to conclude that American firms have added extra debt as a result of they’ve grow to be extra worthwhile, and may carry extra.

(Ideally, the sunshine blue line would present debt relative to income earlier than tax and curiosity funds, however that is tougher to extract from the nationwide accounts. The chart as it’s ought to seize the precise pattern, however will mirror the affect of decrease rates of interest, which might be good to exclude. I’m engaged on it).

The chart doesn’t seize modifications within the high quality of debt over time, which is Park’s level. However it does increase a very good query. As an alternative of asking whether or not there may be an excessive amount of debt, ought to we not ask as a substitute whether or not traditionally excessive company income are sustainable?

There’s far more to be stated right here, and we’ll say a few of it in coming days and weeks.

One good learn

The suburban identity crisis, or why shifting from New York to the ’burbs is tough.

[ad_2]

Source link