[ad_1]

The U.S. Federal Reserve has raised the benchmark financial institution fee seven instances throughout the course of 2022, main many to query when the central financial institution will stop or change course. The Fed has acknowledged that it goals to deliver inflation all the way down to the two% goal, and the will increase to the federal funds fee are supposed to maneuver towards this objective. Nonetheless, Zoltan Pozsar, a U.S. macroeconomist and observer of the Fed, predicts that the central financial institution will begin quantitative easing (QE) once more by summer time. Invoice Baruch, an government at Blue Line Futures, a futures and commodities brokerage agency, anticipates that the Fed will halt fee hikes by February.

Consultants Weigh In on Risk of Pausing Price Hikes and Restarting Quantitative Easing

Inflation within the U.S. noticed a major improve final 12 months, however has since slowed. After seven fee hikes from the central financial institution, buyers and analysts anticipate that the Fed will change course this 12 months. In an interview with Kitco Information, Invoice Baruch, president of Blue Line Futures, told Kitco’s anchor and producer David Lin that the U.S. Federal Reserve is prone to halt financial tightening in February. Baruch pointed to the lower in inflation and cited manufacturing information as one think about his prediction.

“I feel there’s a good probability that we don’t see the Fed hike in any respect in February,” Baruch informed Lin. “We may see one thing from them that will shock the markets within the first week of February.” Nonetheless, Baruch emphasised that markets shall be “risky,” but in addition will see a robust rally. Baruch acknowledged that the speed hikes “had been aggressive,” and he famous that “there have been indicators in 2021 that the economic system was able to gradual.” Baruch added:

However with the Fed climbing these charges proper via, that’s what slam-dunked this market down.

Repo Guru Predicts Federal Reserve Will Restart Quantitative Easing within the Summer time Below the ‘Guise’ of Yield Curve Controls

There’s some uncertainty amongst analysts as as to if the Federal Reserve will select to lift the federal funds fee or pivot in its plan of action. Invoice English, a finance professor on the Yale Faculty of Administration, explained to bankrate.com that it’s tough to make certain concerning the Federal Reserve’s plans for fee hikes in 2023.

“It’s not exhausting to think about eventualities the place they find yourself elevating charges a good quantity subsequent 12 months,” English stated. “It’s additionally doable they find yourself reducing charges extra if the economic system actually slows and inflation comes down rather a lot. It’s exhausting to be assured about your outlook. The most effective you are able to do is stability the dangers.”

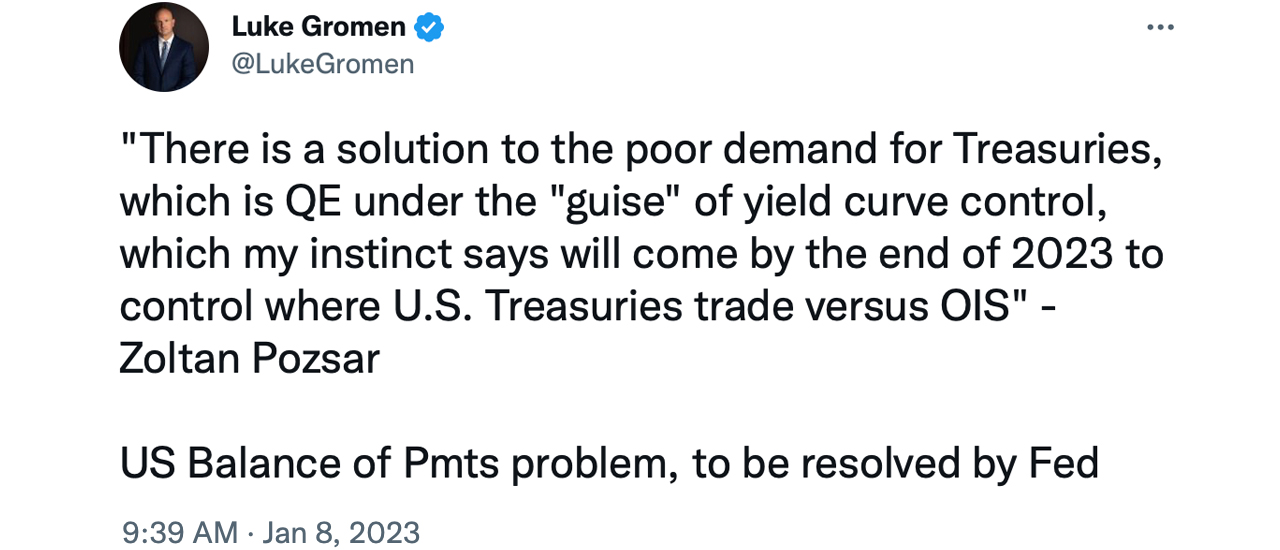

U.S. macroeconomist and Fed watcher Zoltan Pozsar, for his half, thinks the Fed will restart quantitative easing (QE) once more by the summer time. Based on Pozsar, the Fed gained’t pivot for some time and Treasuries will go underneath duress. In a latest zerohedge.com article, the macroeconomist insists the Fed’s ‘QE summer time’ shall be underneath the “guise” of yield curve controls.

Pozsar believes that this may occur by the “finish of 2023 to manage the place U.S. Treasuries commerce versus OIS.” Citing Pozsar’s prediction, zerohedge.com’s Tyler Durden explains will probably be like a “‘checkmate-like’ state of affairs” and the upcoming implementation of QE will happen throughout the framework of dysfunction within the Treasury market.

What do you concentrate on the Fed’s strikes in 2023? Do you anticipate extra fee hikes or do you anticipate the Fed to pivot? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link