[ad_1]

Gold is on the rise in 2023 and within the first week of the brand new 12 months alone, the valuable metallic has jumped 2.36% in opposition to the U.S. greenback. Over the previous 65 days, gold has soared 14.55% whereas silver has skyrocketed 22.31% in opposition to the dollar since Nov. 3, 2022. Based on the top of metals technique at MKS Pamp Group, there’s a “first rate quantity of bullish ‘pent-up’ demand that has been carried over from final 12 months” for gold.

Central Financial institution Demand and Ongoing Geopolitical Tensions Proceed to Drive Gold’s Ascent

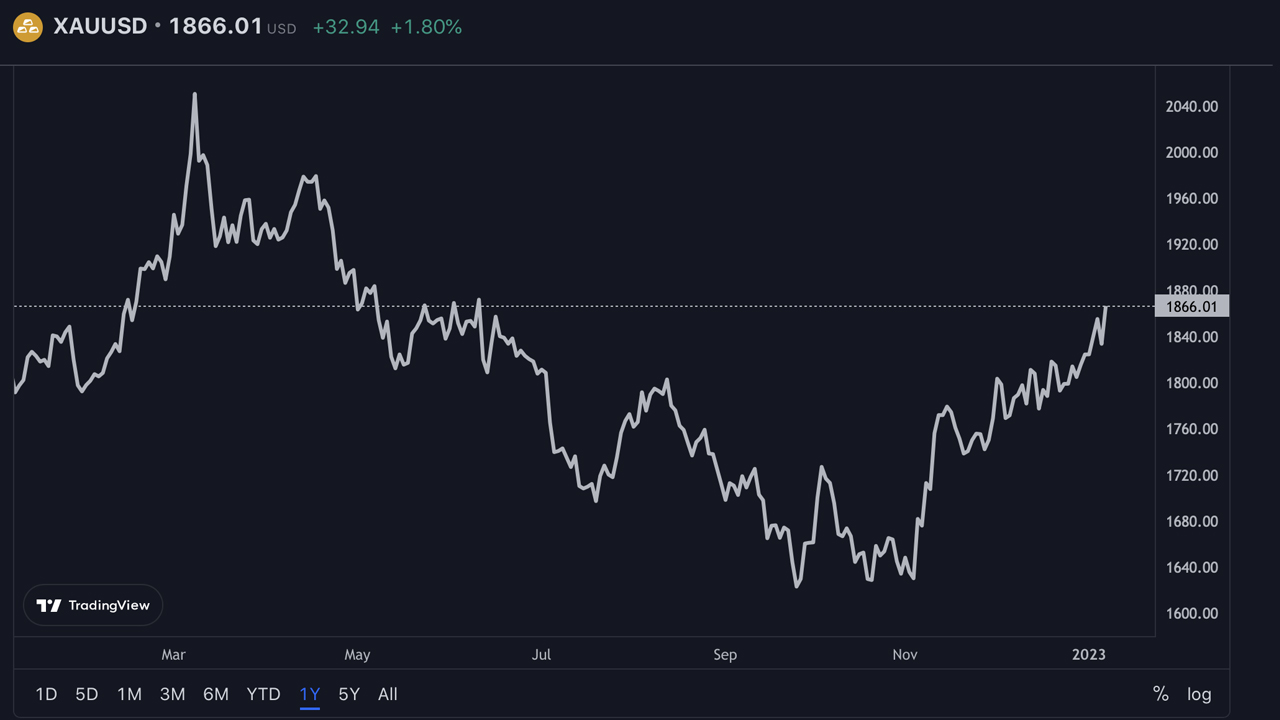

The insistence for gold has continued to rise in accordance with market costs throughout the previous seven days. Gold jumped from $1,823 per troy ounce to $1,866 in that timeframe. Whereas gold is up 2.36% in opposition to the U.S. greenback, a troy ounce of fine silver is down roughly 0.58% because the begin of the 12 months.

Over the previous two months, each gold and silver have risen a fantastic deal, with gold leaping 14.55% and silver rising 22.31% in opposition to the dollar. With treasured metals on the rise, ‘gold bugs’ consider the yellow metallic is “set to shine in 2023.”

In a two-part series, “Gold Mining Bull,” an creator for In search of Alpha, argues that gold will carry out higher in 2023. The creator cites central bank demand and “ongoing geopolitical tensions” as causes for optimism. Gold Mining Bull is paying notably shut consideration to central financial institution gold purchases this 12 months.

“Central banks all over the world, notably in China, Turkey, and India, have been shopping for gold at a report tempo,” the creator explains. “This pattern has been happening for the previous 13 consecutive years, however not too long ago the tempo has accelerated.” The analyst provides:

They’ve been rising their gold reserves lately as a option to diversify their overseas change holdings and scale back reliance on the U.S. greenback.

Moreover, the creator additionally believes there are six extra issues that might enhance gold’s worth, together with a rebound in jewellery demand, the Federal Reserve’s eventual pivot, the escalation of the Ukraine-Russia war, a weaker U.S. greenback, a restricted new mine provide, and the potential for China invading Taiwan.

Central financial institution gold purchases have been a very influential issue by way of gold curiosity over the previous 12 months. Based on analysts cited by the Monetary Instances, Russia and China amassed probably the most gold in 2022 by way of demand.

MKS Pamp Group’s Head of Metals Technique Feedback on Gold’s Constructive Market Development

Nicky Shiels, head of metals technique and macro for MKS Pamp Group, told Kitco Information on Friday that there was pent-up demand for gold, which may point out a optimistic market pattern. Shiels mentioned this week’s rising U.S. nonfarm payrolls and stated there’s “merely nothing recessionary” concerning the report.

As for gold, it is determined by whether or not the valuable metallic can keep its weekly appreciation. “Relying on whether or not gold can maintain its weekly good points (which is trying more and more possible), it solidifies the offensive approach gold has been buying and selling because it established a light bull pattern since early November – all the time searching for causes to rally,” she stated. Shiels continued:

There’s a good quantity of bullish ‘pent-up’ demand that has been rolled over from final 12 months and may get ignited on the suitable knowledge level (CPI & PCE) can be much more telling.

On Jan. 5, 2023, Shiels additionally shared MKS Pamp Group’s 2023 precious metals forecast, which reveals a mean worth of $1,880 for gold and $22.50 for silver. Based on the forecast, gold may attain a excessive of $2,100 and silver may attain $28 per ounce in 2023. ABN AMRO expects gold to be round $1,900 per ounce in 2023, and Saxo Financial institution has detailed that gold may attain $3K per ounce this 12 months.

“2023 is the 12 months that the market lastly discovers that inflation is ready to stay ablaze for the foreseeable future,” stated Ole Hansen, head of commodity technique at Saxo. Juerg Kiener, managing director and chief funding officer of Swiss Asia Capital, thinks gold may probably even surge to $4K per ounce in 2023.

What do you concentrate on the 2023 gold worth predictions? Tell us your ideas about this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

[ad_2]

Source link

Bonuses for new players

Bonuses for new players