[ad_1]

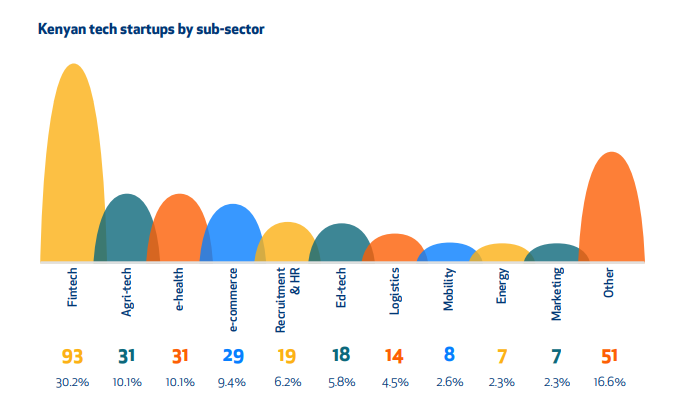

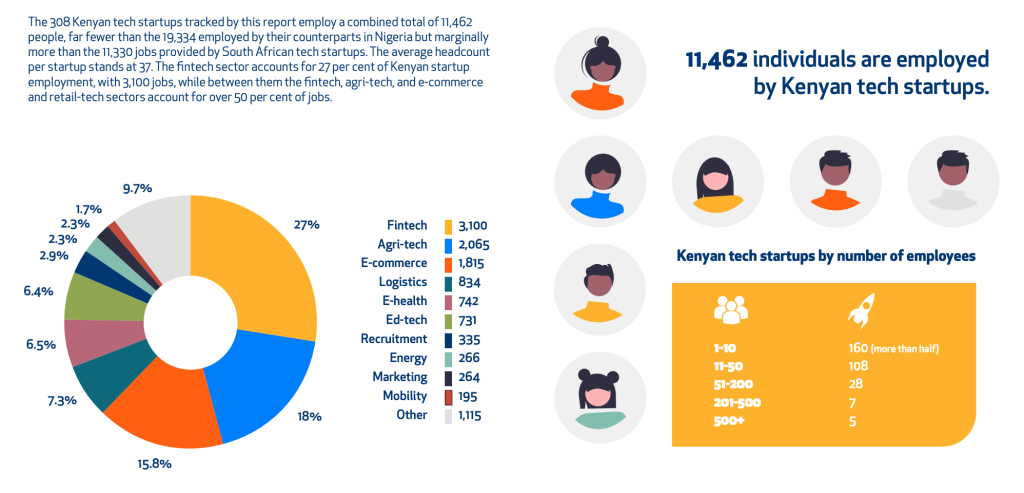

As of November 2022, Kenyan fintechs accounted for 30.2% or 93 out of the 308 tracked tech startups, a Disrupt Africa examine not too long ago discovered. As well as, the examine findings present that the fintech sub-sector alone accounted for 3,100 or 27% of the 11,462 those who had been employed by tech startups throughout the identical interval.

Fintechs Fixing Basic Issues

Based on the findings of a examine on Kenya’s startup house, fintech ventures alone accounted for simply over 30% or 93 out of the 308 tracked startups. This determine is nearly thrice greater than that of the closest challengers, particularly agri-tech and e-health, which each accounted for 10.1% of Kenya’s tech startups that had been tracked between January and November 2022.

Nevertheless, as defined in Disrupt Africa’s examine report on the Kenyan startup ecosystem, the dominance of fintechs is just not uncommon.

“Fintech takes the highest spot in most African international locations because it solves basic issues for the populace, is an space by which novel tech options are typically nicely acquired and rapidly adopted, in addition to providing engaging returns for traders,” the report stated.

Remittances and Lending Extra Widespread Classes

Apart from accounting for the most important share of tech startups, fintechs additionally employed extra employees (3,100) than different sub-sectors. Agritech and e-commerce are the one different tech sub-sectors that employed greater than a thousand employees.

In the meantime, as proven by the examine’s breakdown of the fintechs’ areas of focus, remittances (24%), in addition to the lending and financing (21%) house, seem like the extra standard classes. Based on the report, a part of the rationale for that is that “these areas cowl most of the most basic monetary companies which can be nonetheless missing for a lot of the inhabitants.” The report added that such classes have been “the jumping-off level for fintech ecosystems continent-wide.”

Regarding the tech startups’ use of blockchain, the examine discovered that 12 of the 30 blockchain-based ventures are fintechs. E-health (6) and agri-tech (5) are ranked second and third, respectively.

Register your e mail right here to get a weekly replace on African information despatched to your inbox:

What are your ideas on this story? Tell us what you assume within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link