[ad_1]

Speaking to leaders today in any stroll of life, I’ve a way that persons are frozen. They see that inflation is again in a severe means for the primary time in many years, forcing central banks to lift rates of interest on the quickest tempo for the reason that early Eighties. They perceive that this sudden change within the worth of cash — an important driver of financial and monetary behaviour — marks a elementary break with the previous. However they don’t seem to be appearing. After residing with straightforward cash for therefore lengthy, they discover it tough even to ponder a unique world. There’s a time period for this frame of mind: zeteophobia, or paralysis within the face of life-altering decisions.

So many individuals hold doing what they had been doing, hoping that someway they received’t must cope with change. On the idea that central banks will as soon as once more come to the rescue, traders are nonetheless pouring cash into concepts that labored up to now decade — tech funds, personal fairness and enterprise capital. Governments are nonetheless borrowing to spend and householders are refusing to promote as if straightforward cash was sure to return quickly.

However tight cash will not be a brief shock. The brand new customary for inflation is nearer to 4 per cent than 2 per cent, so rates of interest received’t be falling again to zero. As this section wears on, tycoons, corporations, currencies and international locations that thrived on straightforward cash will stumble, making means for brand new winners. Some issues will enhance. The time of lavishly ridiculous digital cash and TV exhibits will move. An age of extra discriminating judgment will form the traits of 2023.

1. Peak greenback

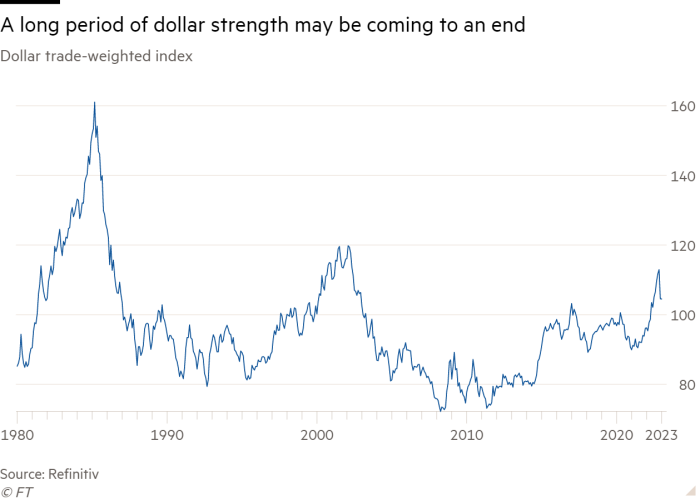

The greenback has been the world’s dominant foreign money for 102 years, eight years longer than common for its 5 predecessors going again to the fifteenth century, together with most lately the British pound. Decline is overdue. But the prevailing assumption stays that, missing severe rivals, the greenback can keep dominant — now and for the foreseeable future.

The greenback’s lengthy rule has been removed from a gradual climb, as an alternative rising and falling in lengthy cycles. Its two main upward swings — one beginning within the late ’70s, one other within the mid ’90s — lasted about seven years, but by October its newest upswing was 11 years outdated. The dollar is now as costly because it has ever been, on some metrics. Lifted by the greenback, New York rose to prime (collectively with Singapore) the record of the world’s most costly cities for the primary time in current historical past.

The greenback is overvalued by about 25 per cent, and that type of overvaluation foretells decline. The greenback began falling in October, turning at virtually precisely the identical level — 20 per cent above its long-term development — that has on common signalled multiyear falls up to now. This yr the financial system is anticipated to develop extra slowly and rates of interest are set to rise much less within the US than in different main nations. These indicators level to an extra fall for the greenback and fewer world buying energy for People, extra for everybody else.

2. Rise of the ROW

The ROW, or “remainder of the world”, has been residing within the shadow of US monetary markets for years and lots of imagine that this side of American dominance will proceed. In any case, the US has been the perfect performing market on the planet over the previous century and so, many argue, why hassle investing anyplace else?

However is anybody alive at this time ready for returns a century from now? Think about a extra sensible timescale. For the reason that second world battle, the US inventory market has tended to outperform the ROW one decade, then path behind the following. The Fifties, ’70s and 2000s had been nice many years for investing exterior the US.

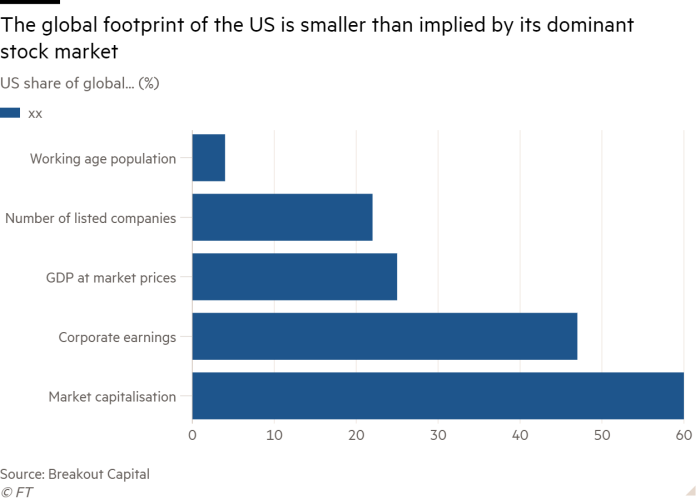

Within the increase of the 2010s, the worth of the US inventory market expanded, reaching 60 per cent of the worldwide complete in 2021, a full 15 per cent above its long-term common. In each different means, the worldwide footprint of the US is far smaller: lower than half of company earnings, 1 / 4 of financial output, one-fifth of listed corporations, and a mere 4 per cent of the inhabitants.

With US inventory valuations close to post-second-world-war highs in comparison with the ROW, traders sticking with American corporations are assuming that the US can enhance its place, not simply maintain it. That’s not a protected assumption, significantly now that the period of straightforward cash is over. By one estimate, half of the rise in US company profitability within the final decade may be attributed to decrease curiosity prices. True, straightforward cash was accessible in most international locations. However monetary engineering to spice up returns grew to become an American speciality.

3. Not-so Massive Tech

Massive many years for the US market are inclined to coincide with tech booms. Within the ’90s, the likes of IBM in software program and Cisco in web {hardware} led a rush of US corporations into the worldwide prime 10 by market worth. However corporations that make the highest 10 one decade not often final there the following, and tech is especially vulnerable to disruption.

Within the 2010s the main tech corporations rose in cellular web companies — buying, search, social media — however that mannequin is displaying indicators of exhaustion. Earnings are underneath strain from the legislation of huge numbers, regulators, rivals. Of the seven tech corporations within the world prime 10 as of 2020, three have fallen off. Two of these are Chinese language, Alibaba and Tencent. One is Meta, which has fallen out of the highest 20. The worth of the opposite American giants is shrinking too, though they nonetheless maintain on to prime 10 positions, for now.

The subsequent evolution of the knowledge age is dawning, and it’ll generate new fashions and winners. One chance: they are going to apply digital tech to serving business — biotech, healthcare, manufacturing — not particular person customers.

Whether it is nonetheless arduous for frozen imaginations to consider a time not dominated by at this time’s massive tech names, the arrival of tight cash makes churn on the prime much more possible. Simple cash inspired dangerous bets on costly however fast-growing shares, which up to now decade meant massive tech. Now that bias to bigness and progress at any worth is fading.

4. Much less cash, higher TV

Limitless entry to low-cost capital helped to gasoline what has been extensively hailed as a “golden age of tv”. Worldwide spending by the large streaming companies on new content material rose over the previous 5 years from underneath $90bn to greater than $140bn. The variety of new exhibits scripted for TV exploded.

However like most scorching traits of the simple cash period, TV was spoiled by an excessive amount of cash. The golden period tarnished itself, producing extra amount, much less high quality. The typical IMDb score for Netflix TV exhibits peaked within the mid-2010s at 8.5 out of 10, then fell steadily to six.7 in 2022. The topic of how and the place to search out the few riveting exhibits on this increasing menu of mediocre choices grew to become a staple of dinner desk conversations. For each gem like The White Lotus or Tehran, there have been dozens of duds like ‘Snowflake Mountain’ and, in fact, The Kardashians.

Viewers will really feel much less misplaced within the coming yr. In current months, the large streaming companies have shifted focus to creating a revenue, fairly than spending no matter it takes to get new subscribers. They’re ordering fewer new exhibits and — in line with the TV writers and producers I do know — imposing larger requirements on new pitches and scripts. This is likely one of the many ways in which much less cash may produce higher decisions within the new period.

5. Echo bubbles

Bubbles don’t essentially burst ; the declines are sometimes punctuated by massive rebounds — “echo bubbles”. These bounces cushioned the autumn of many well-known bubbles, from commodities within the Seventies to dotcoms within the late Nineties.

By early 2001, the Nasdaq had fallen almost 70 per cent, however it might stage two false rallies earlier than the yr was out. The echo bubbles appeared massive — with tech shares up as a lot as 45 per cent. However it was a mathematical phantasm. Bouncing off such a low backside, tech would have needed to rise 250 per cent to regain its earlier peak, and by no means got here shut in 2001. Tech lastly hit backside the following yr, and remained sluggish for the remainder of the last decade.

In the course of the pandemic, bubblets emerged inside the broad markets, showing in small cap shares, clear vitality shares together with Tesla, cryptocurrencies together with Bitcoin, Spacs or “particular goal acquisition corporations,” and tech shares that haven’t any earnings however embody well-known names (Spotify, Lyft). These bubblets have already suffered falls of fifty to 75 per cent, however the story will not be over. The fortunes of crypto kings and Elon Musk are nonetheless whirling wildly.

The psychology behind bubbles is highly effective. Individuals refuse to simply abandon the concept impressed the bubble. They purchase the dips and quit solely after their religion has been deflated repeatedly. 2023 is prone to see extra echo bubbles, together with in essentially the most hyped themes of the final decade: massive cap tech within the US and China. However don’t be fooled once more. The subsequent massive winners will probably be rising elsewhere.

6. Japan is again

The picture of “rising Japan”, unstoppable superpower, was so ingrained within the world creativeness that as late as 1992 US presidential candidate Paul Tsongas may proclaim that “the chilly battle is over, and Japan has received”.

In the present day, to the extent Japan has a picture, it’s outdated individuals and dangerous money owed, not superpowerdom. World traders barely give a thought to Japan, which is simply what its leaders ought to hope for. If hype surrounds international locations at a peak, and hate piles on in a disaster, these poised for fulfillment are shrouded in indifference.

Quietly, Japan is popping for the higher. Development within the working age inhabitants, which turned detrimental in Japan three many years in the past, is about to show detrimental throughout the developed world. Measured as a share of the financial system, personal debt is on common larger in different developed economies than in Japan.

Japanese households and firms diminished their debt load for a lot of the final decade, and will probably be much less arduous pressed in a decent cash period than many outsiders might assume. Revenue margins have been rising steadily. The price of labour, adjusted for employee productiveness, is now decrease in Japan than in China.

Japan is probably not again within the sense of a rising superpower, however it’s poised for a comparatively good 2023.

7. ‘Anyplace however China’

Couple rising labour prices with Beijing’s flip away from openness towards state management, and lots of overseas corporations seeking to outsource manufacturing now look, so it’s mentioned, “anyplace however China”. Within the US, there’s speak of producing coming “again house”, or shifting subsequent door to Mexico, however the massive winners to this point are subsequent door to China: Vietnam, Taiwan, India and South Korea.

Greater than half of US companies in China say that their first alternative for relocation could be different international locations in Asia; lower than 1 / 4 say again house; lower than a fifth say Mexico or Canada. These selections are guided by all method of dangers and prices, however a central benefit of Asia exterior China is wages.

The typical month-to-month manufacturing facility wage in Vietnam and India is lower than $300 — about half the extent of China, 1 / 4 decrease than Mexico, a small fraction of the $4,200 month-to-month wage within the US. No surprise American corporations are nonetheless seeking to offshore, simply not in China.

8. Return of orthodoxy

In November, amid a market sell-off extensively attributed to his beneficiant spending plans, Brazilian president Luiz Inácio Lula da Silva dismissed the sellers as “speculators, not severe individuals”. Traders have resumed the sell-off, forcing Lula aides to stroll again a few of his remarks.

Different international locations focused by market sell-offs in 2022 included Chile, Colombia, Egypt, Ghana, Pakistan, Hungary and even the UK. What they shared: excessive exterior and authorities deficits and unorthodox leaders who threatened to make these deficits worse.

The selection of targets was rational, not ideological. Promote-offs hit leftwing populists comparable to Lula, and conservatives like UK prime minister Liz Truss, who misplaced her job within the fallout. All needed to retreat in substance or tone. Colombia’s finance minister promised to “do nothing loopy”.

As cash tightens, the market grows much less tolerant of the unorthodox, and its goal record grows. In contrast with the roughly eight international locations focused final yr, the markets turned sharply in opposition to only some within the 2010s: most notably Greece, Turkey and Argentina.

Since then, Greece has minimize its deficits and money owed, and returned as a welcome borrower in world markets, however Turkey and Argentina haven’t. Count on extra of those battles in 2023.

9. Political reduction

What’s not occurring will form the political temper in 2023. For the primary time this century, no G7 nation is holding a nationwide election. There aren’t many election battles within the different G20 nations, both. As of late elections sow extra discord than unity, so the pause will come as reduction.

In election years, developed markets are inclined to lag their friends, however rising markets have a tendency to achieve, maybe on hope that new leaders can have a much bigger affect on financial progress in youthful nations. With few massive elections, the highlight might shine brighter on smaller ones. Two stand out as rife with chance.

In Turkey, President Recep Tayyip Erdoğan faces a severe problem after almost 20 years in energy. A basic case of a pacesetter who began sturdy however misplaced his means, Erdoğan is now maybe the world’s most financially unorthodox chief, a standing danger to his nation’s future.

In Nigeria, President Muhammadu Buhari made life worse. Poverty rose, corruption festered. Now Buhari is out, due to time period limits. Any of the 4 key contenders within the February election could possibly be an enchancment. Probably the most intriguing is Peter Obi, a political outsider with severe plans to wash up Nigeria’s oil theftocracy. A quiet political yr will really feel even higher if a number of elections produce brilliant new reformers.

10. Blue birds

Within the late 2000s, writer Nassim Nicholas Taleb popularised the “black swan”. Written as a principle of sudden occasions that may disrupt for higher or worse, the time period grew to become synonymous with detrimental shocks throughout the world monetary disaster of 2008. Individuals have been looking out for black swans ever since.

Now the concept of the great black swan might come again because the “blue hen” — a uncommon, unforeseeable occasion that brings pleasure. Geopolitical shocks and financial gloom have persevered since 2008, and will worsen within the tight cash period. Amid countless worries, the world might flip its danger radar towards constructive shocks that would carry reduction.

The subsequent blue hen may be a shock peace in Ukraine, which immediately lowers vitality and meals prices. A thaw within the US-China chilly battle, which boosts world commerce. A brand new digital know-how that revives productiveness, serving to to comprise inflation. None of this will appear possible, however then shock is the important nature of blue birds.

Ruchir Sharma is an FT contributing editor and chair of Rockefeller Worldwide

Discover out about our newest tales first — observe @ftweekend on Twitter

[ad_2]

Source link