[ad_1]

Eurozone inflation nearly definitely fell again into single digits for the primary time in three months in December, with information printed earlier this week exhibiting worth pressures eased by greater than anticipated in Germany, France and Spain in direction of the tip of 2022.

But the slowdown is unlikely to be sufficient to persuade the European Central Financial institution to cease elevating rates of interest simply but, with markets nonetheless pricing in a sequence of will increase by officers in Frankfurt over the course of 2023.

Franziska Palmas, senior Europe economist at analysis group Capital Economics, stated: “The ECB is more likely to keep on with its hawkish rhetoric within the close to time period regardless of the massive falls — and chance of additional sharp declines this 12 months.”

Why are the falls not sufficient to persuade the ECB to alter tack?

Whereas falls in gasoline costs and authorities subsidies to assist companies and households out with increased energy payments have lower headline inflation charges, underlying worth pressures stay sturdy.

Berlin paid most households’ fuel payments for December, which Commerzbank economists estimated knocked 1.2 proportion factors off the harmonised price of headline inflation. The speed fell to 9.6 per cent, down from 11.3 per cent the earlier month. However progress in the price of companies, an indicator of how lengthy worth pressures are more likely to endure, accelerated in December.

In Spain, core CPI inflation — which excludes actions within the worth of meals and vitality — rose within the 12 months to December, regardless of a sharper than anticipated fall within the harmonised headline price to five.6 per cent.

Though headline inflation within the eurozone fell from the ten.6 per cent file hit in October to 10.1 per cent in November, core inflation — at 5 per cent — remained at an all-time excessive. It’s anticipated to remain there in December.

“This 12 months can be principally about getting underneath the hood of inflation and seeing precisely what’s driving it,” stated Paul Hollingsworth, chief European economist at French financial institution BNP Paribas.

For the ECB to alter tack, rate-setters will wish to see a considerable fall within the core price and different measures of longer-term inflationary pressures, comparable to wage progress. They may even be looking out for indicators that governments’ help for households and companies battling excessive vitality costs is boosting demand.

Christine Lagarde stated in an interview with Croatian newspaper Jutarnji Record: “We should be cautious that the home causes [of inflation] that we’re seeing, that are primarily associated to fiscal measures and wage dynamics, don’t result in inflation changing into entrenched.”

What’s subsequent for inflation in Europe?

Economists polled by Bloomberg forecast a drop in eurozone inflation to 9.5 per cent in December, down from 10.1 per cent in November. The info, printed by the European Fee’s statistics bureau Eurostat, are out at 10am UK time on Friday morning.

Additional falls are anticipated within the coming months, following the slump in vitality costs because the begin of the 12 months. The affect of final 12 months’s surge in energy prices following Russia’s invasion of Ukraine may even quickly fall out of the index, reducing the headline determine considerably.

Carsten Brzeski, head of macro analysis at Dutch financial institution ING, predicted that euro space inflation may even drop again to the ECB’s 2 per cent goal by the tip of 2023.

If the latest falls in fuel costs proceed, the ECB will nearly definitely should downgrade its inflation projections for this 12 months. The central financial institution stated in December that costs would rise 6.3 per cent over the course of 2023, primarily based on assumption for pure fuel costs to common €124 per megawatt hour over the entire of this 12 months.

However the worth of the Dutch TTF benchmark European fuel contract has fallen about 10 per cent this week to only €69.70/MWh as of Thursday afternoon — a degree 80 per cent beneath the August excessive of €340/MWh.

“The ECB’s personal inflation projections are at the moment too excessive, simply judging from the technical assumptions for fuel and oil costs and the place these costs are at the moment,” stated Brzeski.

What does this outlook imply for rates of interest?

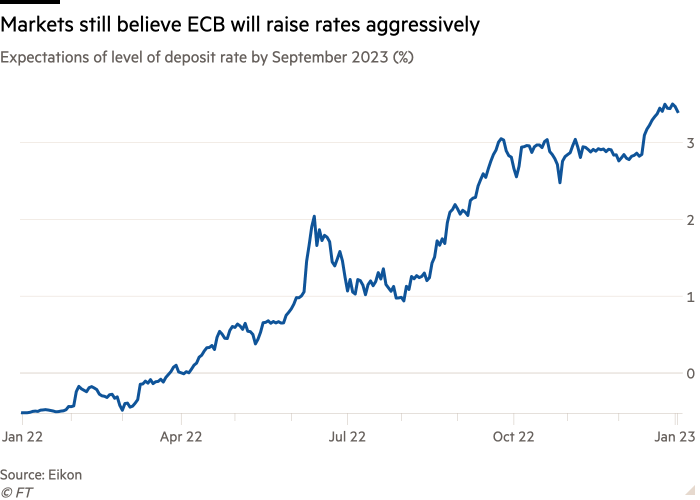

Final 12 months, the ECB responded to hovering inflation by elevating rates of interest at an unprecedented tempo, lifting its deposit price from minus 0.5 per cent in July to 2 per cent by the tip of the 12 months.

ECB president Christine Lagarde stated in December that markets have been underestimating how a lot increased borrowing prices would go, including: “We should always count on to boost rates of interest at a 50-basis-point tempo for a time period.”

Since then, traders have been pricing in about 1.5 proportion factors of price rises over the opening three quarters of 2023.

Two half-point price rises at officers’ subsequent two coverage conferences in February and March and some smaller strikes later within the 12 months stay the expectation, regardless of the sharper than anticipated falls in inflation this week.

With out sharper falls in measures of underlying worth pressures, markets’ and economists’ expectations for eurozone rates of interest are unlikely to shift by a lot.

“It’s all very nicely getting again to three or 4 per cent inflation,” Hollingsworth stated. “But it surely could possibly be more durable to get all the way down to 2 per cent, notably if there’s a milder than anticipated recession.”

He added: “We actually must see companies costs and wage progress cooling to persuade the ECB it has carried out sufficient.”

Further reporting by Valentina Romei

[ad_2]

Source link