[ad_1]

A have a look at the highest performers over the previous 24 hours reveals a pattern that would set off a increase amongst sure altcoins in 2023. We’re speaking about Lido Finance (LDO), which has risen 7% up to now 24 hours and 17% over the previous seven days, making it the thirty seventh largest cryptocurrency by market cap.

Lido Finance is a decentralized liquid staking software that enables customers to generate further yield for staking their belongings. The appliance at the moment presents help for 5 cryptocurrencies: Ethereum (ETH), Polygon (MATIC), Solana (SOL), Kusama (KSM), and Polkadot (DOT).

Of specific curiosity, nevertheless, is the first-mentioned altcoin, Ethereum. As Thor Hartvigsen, blockchain and defi researcher, explained, Liquid Staking Derivatives (LSD) altcoins might see a increase in 2023 because the second largest cryptocurrency by market cap implements the Shanghai improve.

Of all main layer-1 blockchains, Ethereum has the bottom staking ratio of solely 14%. In distinction, 90% of all BNB, 72% of all ADA, 68% of all SOL, and 62% of all AVAX are staked. The massive hole is probably going associated to the truth that ETH can not but be de-staked. Nevertheless, the Shanghai hard fork deliberate for March will change that.

Whereas the analyst expects a serious unstaking initially, the improve might set off huge development for liquid staking options in the long term. And Lido Finance (LDO) is at the moment the undisputed chief within the liquid staking of ETH, offering additional rocket gasoline for the LDO token.

Altcoins Poised To Skyrocket Based mostly On The Narrative

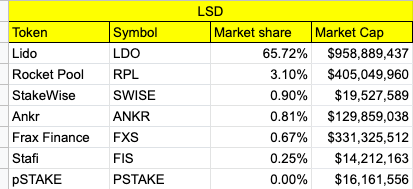

Nevertheless, not solely the LDO however quite small LSD altcoins may gain advantage from the brand new narrative. As nameless analyst “Karl” says, quite a few LSD options are poised to wobble on the throne of Lido Finance. At the moment, LDO’s market share is about 65.62%, adopted by Rocket Pool (3.10%), StakeWise (0.9%), Ankr (0.81%), Frax Finance (0.67%), and Stafi (0.25%).

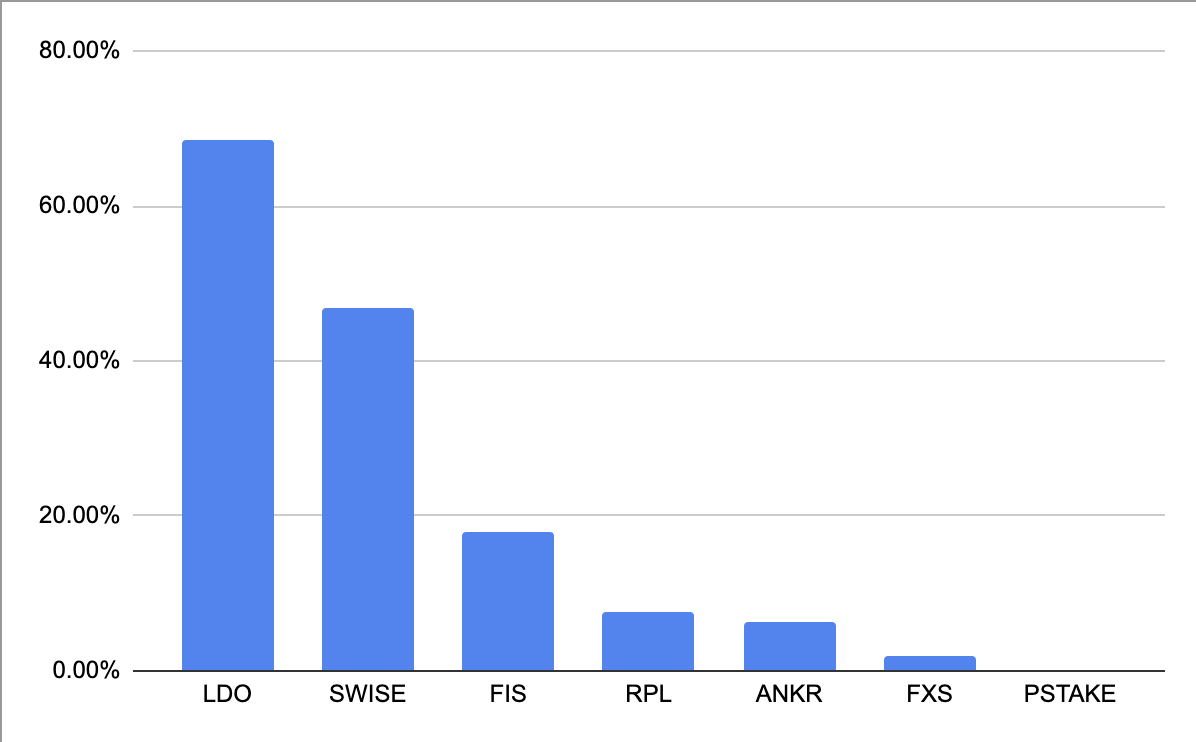

Because the analyst assesses, the market caps of the altcoins Stakewise (SWISE) and Stafi (FIS) are nonetheless under $20 million, although they management vital market share. “[T]inheritor tokenomics aren’t the very best although, as there’s nonetheless a substantial portion of the provision to be unlocked as workforce/traders’ allocation and liquidity mining rewards,” the analyst added.

A have a look at the market share/market cap ratio additionally exhibits that each SWISE and FIS tokens are shut behind the market chief, poised for future positive aspects.

Additionally outstanding is Frax Finance, which lately entered the LSD panorama of altcoins and has already managed to seize a major market share. Hartvigsen acknowledged that in lower than 2 months, Frax has managed to draw greater than 45,000 ETH (about $55 million TVL).

In line with the analyst, there are “no indicators of slowing down” as APRs are constantly at 9-10%, far outperforming any competitor. Frax Finance accomplishes this by giving customers frxETH when they’re both liquidity pooled on Curve (frxETH/ETH) or staked on Frax Finance (sfrxETH).

“Solely sfrxETH receives the ETH staking yield. This ends in the next APR as not the entire staked ETH is receiving the rewards as they’re within the curve pool as an alternative,” the analyst defined.

However Rocket Pool can also be a primary candidate to develop from the brand new narrative attributable to its relative dimension, current reputation development, and several other differentiators, Hartvigsen added.

Two Potential Spoilers For LDO

Nevertheless, within the close to time period, there may very well be two spoilers specifically for the worth of the Lido Finance token, LDO. Each Nansen and Chain EDGE on-chain information exhibits that “good cash” has been promoting LDO quite than shopping for it, Twitter person @AvaxGems identified.

I assume not all of us are bullish on LSD cash. Each @nansen_ai and @ChainEDGE_io(by @OnChainWizard) exhibiting “good cash” been promoting $LDO quite than shopping for. pic.twitter.com/9k0nt0tHpG

— rektGEMS

(@AvaxGems) January 3, 2023

A second issue for LDO may very well be Alameda. The ex-company of Sam Bankman-Fried sold 719,498 LDO on December 28, price about $717,451, for 601 ETH, and at the moment nonetheless has 1.86 million LDO left, the equal of about $1.81 million.

Featured picture from Nasa / Unsplash, Charts from Messari, Twitter, TradingView.com

[ad_2]

Source link