[ad_1]

Hedge fund supervisor Michael Burry, famed for forecasting the 2008 monetary disaster, says inflation has peaked within the U.S. however there might be one other inflation spike. He expects the U.S. economic system to be in a recession “by any definition.”

Michael Burry’s 2023 Financial Predictions

Well-known investor and founding father of funding agency Scion Asset Administration, Michael Burry, has shared his 2023 financial predictions. Burry is finest identified for being the primary investor to foresee and revenue from the U.S. subprime mortgage disaster that occurred between 2007 and 2010. He’s profiled in “The Massive Quick,” a ebook by Michael Lewis concerning the mortgage disaster, which was made right into a film starring Christian Bale.

Burry tweeted Sunday: “Inflation peaked. However it’s not the final peak of this cycle.” He continued:

We’re prone to see CPI decrease, probably unfavourable in 2H 2023, and the U.S. in recession by any definition. Fed will lower and authorities will stimulate. And we could have one other inflation spike. It’s not exhausting.

Many individuals on Twitter agreed with Burry. Lawyer John E. Deaton tweeted: “I imagine that is correct.” Economist Peter St. Onge wrote: “The good youngsters agree: decrease inflation might be transitory, then Fed cranks up the cash printers and does it once more.”

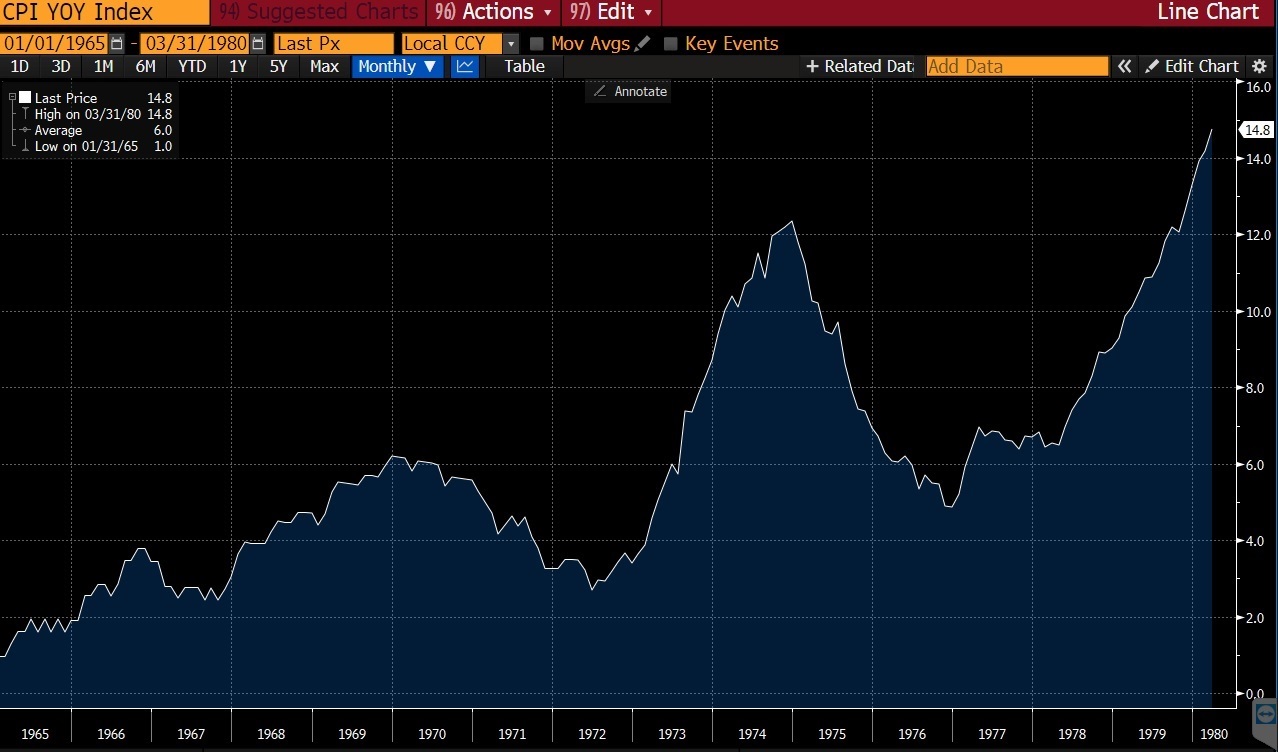

Funding specialist Karel Mercx commented: “Michael Burry has a degree … Inflation often is available in waves, and there’s not often one wave (see Nineteen Seventies CPI chart). The 5 most harmful phrases in investing are nonetheless: ‘this time it’s completely different.’”

Investor Kerry Balenthiran concurred with Burry, tweeting: “Agreed, however the subsequent inflationary spike might finish in a decade or extra. That is very very similar to the 1947 to 1965 secular bull market. In that case, there was a post-war inflation that quietened down, adopted by an inflationary atmosphere that finally peaked in 1980.”

Some individuals provided different viewpoints. Former dealer Rob Bezdjian, for instance, believes there might be deflation. “I’ll take the opposite facet of his inflation prediction … We might be in deflation for a very long time. Bubbles take a really very long time to re-inflate,” he opined.

Burry has shared quite a few warnings concerning the U.S. economic system. In November 2022, he warned of “an prolonged multi-year recession.” In Could, the Massive Quick investor cautioned a few looming shopper recession and extra earnings bother. In April, he said the Federal Reserve “has no intention of preventing inflation,” emphasizing: “The Fed’s all about reloading the financial bazooka so it could actually experience to the rescue & finance the fiscal put.”

Do you agree with Michael Burry about inflation and that the U.S. economic system might be in a recession? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link

Bonus up to 10000 Rupees

Bonus up to 10000 Rupees