[ad_1]

The UK will face one of many worst recessions and weakest recoveries within the G7 within the coming yr, as households pay a heavy value for the federal government’s coverage failings, economists say.

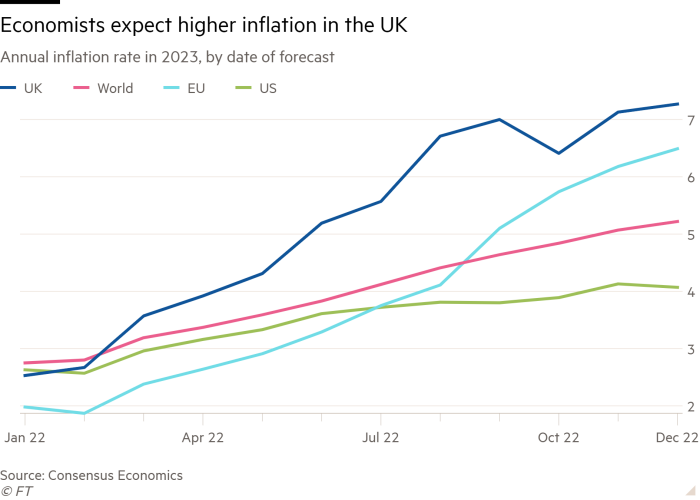

A transparent majority of the 101 respondents within the FT’s annual ballot of main UK-based economists mentioned the inflationary shock attributable to the pandemic and the Ukraine struggle would persist for longer within the UK than elsewhere, forcing the Financial institution of England to maintain rates of interest excessive and the federal government to run a decent fiscal coverage.

Greater than four-fifths anticipated the UK to lag its friends, with GDP already shrinking and set to take action for a lot or all of 2023.

The result’s anticipated to be an intensifying squeeze on family incomes, as greater borrowing prices add to the ache already attributable to hovering meals and vitality costs.

“The 2023 recession will really feel a lot worse than the financial impression of the pandemic,” mentioned John Philpott, an impartial labour market economist. Others described the outlook for shoppers — particularly these on low incomes or mortgage offers that had been set to run out — as “robust”, “bleak”, “grim”, “depressing” and “horrible”.

“The mixture of falling actual wages, tight monetary situations and a housing market correction are as dangerous because it will get,” mentioned Kallum Pickering, senior economist at Berenberg financial institution.

The UK is just not alone in dealing with these challenges: Kristalina Georgieva, the IMF managing director, warned on the weekend {that a} third of the worldwide economic system and half of the EU could be hit by recession this yr.

Most economists mentioned the economic system would at the least return to progress by the tip of the yr as inflation ebbs, with Paul Dales, on the consultancy Capital Economics, asserting: “2024 will probably be a lot better than 2023.”

However Britain’s downturn appears set to be each deeper and extra extended. Forecasts compiled by Consensus Economics present UK GDP shrinking by 1 per cent in 2023, in contrast with a contraction of simply 0.1 per cent for the eurozone as a complete and progress of 0.25 per cent within the US.

The UK is unusually uncovered to the worldwide surge in vitality costs and rates of interest — with a reliance on fuel that isn’t matched by storage capability, and a excessive proportion of mortgage obliged to resume fixed-rate offers in any given yr.

The UK can be uncommon within the extent to which its workforce has shrunk because the pandemic. Charlie Bean, a former BOE chief economist, mentioned excessive inflation was prone to be extra persistent within the UK than elsewhere, as a result of its labour market was “unsustainably tight even within the absence of the Ukraine shock”. Anna Leach, deputy chief economist on the CBI, mentioned this could “proceed to use a brake to progress for firms, drive industrial unrest and push up domestically-generated inflation”.

“The UK suffers from an vitality shock as dangerous as Europe’s, an inflation downside . . . as dangerous because the US and a singular downside of lack of labour provide from the mixture of Brexit and the NHS disaster,” mentioned Ricardo Reis, a professor on the London Faculty of Economics.

However even as soon as the restoration was underneath means, most mentioned Britain would proceed to lag due to basic issues that coverage errors had made worse — poor productiveness, weak enterprise funding, authorities neglect of public companies and the harm to commerce performed by Brexit.

“The UK is in a structural gap, not a cyclical downturn,” mentioned Diane Coyle, professor at Cambridge college, who noticed little prospect of an enchancment in residing requirements “except some sanity returns to our commerce relations with the EU” and “till we now have a authorities with an adequately long-term financial technique it might probably get by way of parliament”.

Many noticed similarities with the coverage missteps and industrial battle of Seventies and mentioned the restoration, as soon as it started, could be a feeble one, unfolding “within the lengthy shadow of Brexit” and within the absence of any plan to spice up long-term progress.

Greater than 1 / 4 of respondents mentioned Brexit could be a seamless drag on progress, with Jonathan Portes, professor of economics and public coverage at King’s Faculty, London, calling it a “gradual puncture for the UK economic system”. A number of mentioned its corrosive results would develop into more and more clear to voters.

“After they go to the EU on vacation, they are going to be shocked at how unable they’re to afford issues that they used to have the ability to,” mentioned John Llewellyn, associate on the advisory group Impartial Economics.

A big minority mentioned the UK was affected by ministers’ outright incompetence.

“By now, the economic system is in a lot deeper hassle than it wanted to be if it had been competently managed,” mentioned Panicos Demetriades, a former governor of the Cypriot central financial institution, calling the UK “the ‘sick man’ of the G7”.

Stephen King, senior financial adviser at HSBC, pointed to the “painful want to revive fiscal credibility within the mild of the Truss/Kwarteng fiasco” and Ray Barrell, honorary professor of economics at Brunel college, mentioned encouraging public sector strikes seemed like “the final bid for middle-class votes by a failing authorities”.

However whereas economists agreed on the UK’s bleak prospects, there was no consensus on what policymakers ought to do about it within the brief time period.

The Financial institution of England has warned that rates of interest will in all probability must rise once more in 2023 to return inflation to the two per cent goal, however by how a lot, or for a way lengthy, is much less clear.

Jagjit Chadha, director of the Nationwide Institute for Financial and Social Analysis, mentioned that with inflation set to fall quickly from mid 2023, a “gradual” improve needs to be sufficient to hit the goal in 2024, with “no want to leap in fast steps to one thing a lot greater than 4 per cent”.

Some concern the central financial institution may go too far. Kitty Ussher, chief economist on the Institute of Administrators, mentioned that as a result of it took time for greater rates of interest to take impact, folks wouldn’t “absolutely consider that inflation is falling” till mid 2023. This might make the BOE really feel “underneath strain to maintain taking motion, working the chance of . . . an unnecessarily harsh recession”.

Others warned that even when headline inflation fell quickly, it might be a “gradual grind” to achieve the two per cent goal. “The Financial institution will must be robust to dampen core inflation,” mentioned Jessica Hinds, economist at Fitch Scores.

The constant message from a number of former BOE rate-setters — together with Charlie Bean, Kate Barker, Michael Saunders and founder MPC member DeAnne Julius — was that wherever rates of interest peak, they’re unlikely to fall rapidly. “Crucially, the latest upward shift in inflation expectations must be reversed,” Barker mentioned.

With elections approaching, the federal government is not going to wish to elevate taxes once more after the huge fiscal consolidation introduced in October.

Some respondents felt this made large tax adjustments in 2023 unlikely, arguing that chancellor Jeremy Hunt had performed sufficient to placate markets. “Its personal fiscal guidelines are by no means constraining,” mentioned Vicky Pryce, chief financial adviser at CEBR, whereas Yael Selfin, chief economist at KPMG, referred to as it “counterproductive to extend the tax burden throughout a recession”.

However others mentioned even a small downgrade to the comparatively optimistic forecasts of the Workplace for Price range Duty, the fiscal watchdog, may power the chancellor to rethink, as it might erase his headroom in opposition to the goal to set debt on a falling path as a share of GDP.

The larger query, say the economists, is whether or not the federal government can resist the rising strain to lift public sector pay, given the spate of strike action, and prop up crumbling public companies.

“It’s probably that the federal government will ultimately cave into public sector wage calls for, wherein case tax rises are inevitable,” mentioned Martin Ellison, professor of economics at Oxford college.

Regardless of deep gloom over the UK’s long-term prospects, some respondents discovered silver linings. Silvia Ardagna, economist at Barclays, famous that unemployment was prone to keep low regardless of the recession, with employers hoarding labour after their latest struggles to recruit.

Bronwyn Curtis, a non-executive director on the OBR, was optimistic “that options to Russian fuel will speed up”, whereas monetary pressures may immediate labour market dropouts to return.

In the meantime, Susannah Streeter, an analyst at Hargreaves Lansdown, noticed “tentative indicators of better co-operation with Europe”, whereas Ussher mentioned that from spring onwards, there could be “a fillip to sentiment” from heating being turned off and advantages uprated consistent with inflation.

However regardless of these glimmers of hope, few anticipate the UK to put the foundations for long-term progress within the yr forward. Ian Plenderleith, a former MPC rate-setter, mentioned the restoration would look much less just like the emergence of inexperienced shoots, and extra like “a little bit of scrubland”.

Richard Davies, director of the Economics Observatory and a former Treasury adviser, predicted that even as soon as inflation had receded, costs would stay excessive and households could be underneath intense strain.

He added: “The actual roots of prosperity come from productiveness rising constantly. I’m much less optimistic right here.”

[ad_2]

Source link

Free spins for beginners

Free spins for beginners