[ad_1]

Italy is the eurozone nation most prone to a debt disaster because the European Central Financial institution raises rates of interest and buys fewer bonds within the coming months, economists say.

9 out of 10 economists in a Monetary Instances ballot recognized Italy because the eurozone nation “most susceptible to an uncorrelated sell-off in its authorities bond markets”.

Italy’s rightwing coalition authorities, which took energy in October beneath prime minister Giorgia Meloni, is making an attempt to observe a path of fiscal rectitude. It has budgeted for the nation’s fiscal deficit to fall from 5.6 per cent of GDP in 2022 to 4.5 per cent in 2023 and three per cent the next yr.

However Italian public debt stays one of many highest in Europe at simply over 145 per cent of gross home product. Marco Valli, chief economist at Italian financial institution UniCredit, mentioned the nation’s “increased debt refinancing wants” and “doubtlessly difficult” political state of affairs left it most susceptible to a sell-off in bond markets.

Rome’s borrowing prices have risen sharply for the reason that ECB began to extend rates of interest final summer season. The ten-year bond yield climbed above 4.6 per cent final week, virtually quadruple the extent of a yr in the past and a couple of.1 share factors above the equal yield on German bonds.

Meloni has expressed dismay on the ECB’s’ willingness to hold on elevating charges regardless of the dangers to progress and monetary stability. “It might be helpful if the ECB dealt with its communication properly . . . in any other case it dangers producing not panic however fluctuations available on the market that nullify the efforts that governments are making,” she mentioned at a press convention final week.

The brand new Italian authorities had “given traders few causes to fret for now”, mentioned Veronika Roharova, head of euro space economics at Swiss financial institution Credit score Suisse. “However considerations may resurface as progress slows, rates of interest rise additional and [debt] issuance picks up once more,” she added.

ECB rate-setters have insisted they’ll proceed to lift charges in half-point increments throughout the early months of this yr. Klaas Knot, Dutch central financial institution governor and one of many governing council’s hawks, informed the FT the central financial institution was solely simply beginning the “second half” of its rate-increasing cycle.

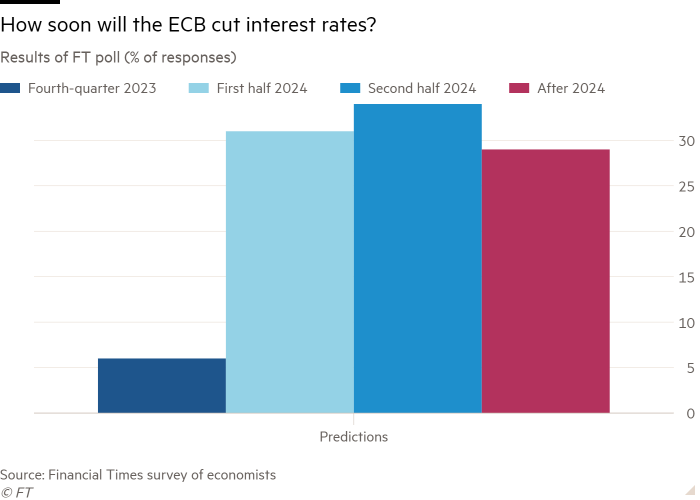

Nonetheless, analysts consider the ECB is overestimating the dangers to inflation — and underestimating the prospect of a recession. IMF managing director Kristalina Georgieva said on the weekend that half of the EU shall be hit by recession this yr. 4-fifths of the 37 economists polled by the FT in December forecast the ECB would cease elevating charges within the first six months of 2023 and two-thirds predicted it might begin slicing them the next yr in response to weaker progress.

On common they predicted that the ECB’s deposit price would peak at slightly below 3 per cent, beneath the extent traders are betting on as indicated by the value of rate of interest swaps.

A separate FT ballot of greater than 100 main UK-based economists mentioned that Britain would endure one of many worst recessions and weakest recoveries within the G7 in 2023.

Central banks world wide have been raising rates sharply to deal with inflation, which has surged to multi-decade highs in lots of nations, as power and meals costs soared following Russia’s invasion of Ukraine and the ending of coronavirus pandemic lockdowns pushed up demand for items and companies.

The ECB was slower than many western central banks to start out elevating charges, however since final summer season it has tightened coverage at an unprecedented tempo, lifting its deposit price from minus 0.5 per cent to 2 per cent in six months.

“The ECB was too gradual [in] recognising that inflation was not non permanent, however is now getting up to the mark,” mentioned Jesper Rangvid, professor of finance at Copenhagen Enterprise College. “I’m nonetheless afraid, although, that ECB is not going to tighten sufficient due to troubles this might trigger in Italy.”

The ECB is because of begin shrinking its €5tn bond portfolio by €15bn a month from March by solely partially changing maturing securities, placing additional upward strain on Italian borrowing prices. Ludovic Subran, chief economist at German insurer Allianz, mentioned the eurozone risked a repeat of the bloc’s 2012 bond market meltdown “as fiscal capabilities are completely different throughout nations with out the ECB’s heavy lifting”.

Italian cupboard ministers have criticised the ECB over its aggressive financial tightening. Defence minister Guido Crosetto wrote on Twitter that the ECB’s insurance policies “made no sense” whereas deputy prime minister Matteo Salvini mentioned increased charges “will burn billions in Italian financial savings”.

Silvia Ardagna, chief European economist at UK financial institution Barclays, mentioned Italy’s “excessive inventory of debt, elevated fiscal deficit and want of extra power help measures . . . makes markets very involved”.

The ECB has unveiled a brand new bond-buying scheme, often called the transmission safety instrument, which is designed to deal with an unwarranted rise in a rustic’s borrowing prices. Nonetheless, greater than two-thirds of the economists polled by the FT in December mentioned they anticipated the ECB to by no means use it.

Mujtaba Rahman, managing director for Europe for the consultancy Eurasia Group, mentioned a deeper than anticipated recession subsequent yr “may put high-deficit, high-debt nations beneath much more strain” including that this might “in all probability make for a softer path for financial coverage by the ECB”.

Extra reporting by Amy Kazmin in Rome

[ad_2]

Source link