[ad_1]

Black staff led the US return to work after the Covid disaster, however economists warn that their beneficial properties will reverse because the Federal Reserve makes an attempt to chill the financial system down with aggressive interest rate will increase.

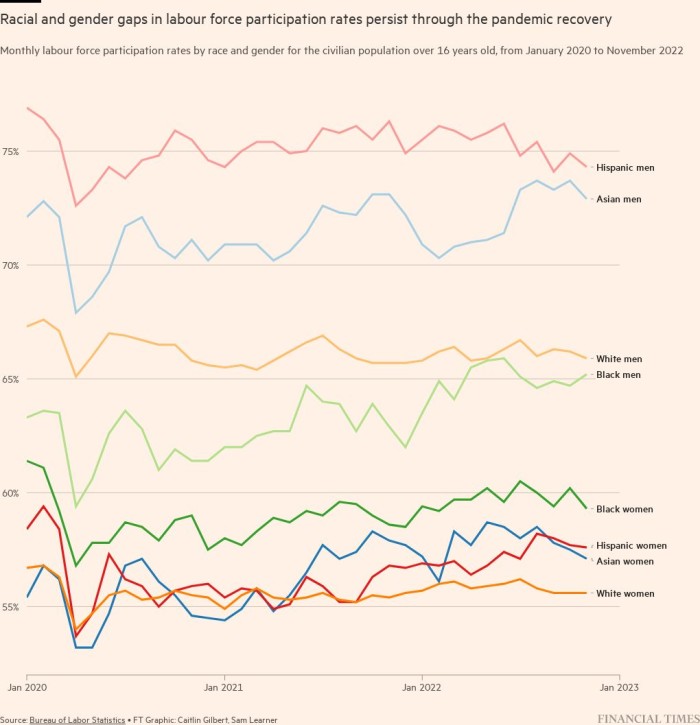

Earlier this 12 months, rising wages and a scarcity of staff pulled black staff into the labour market at file ranges. Black Individuals labored and regarded for jobs at increased charges than white Individuals in Might for the primary time since 1972, in line with labour division knowledge. Employers lowered job necessities, expanded upskilling programmes and diversified their recruitment schemes to fill their ranks amid workers shortages, offering new alternatives to traditionally deprived staff within the course of.

Whereas the unemployment and labour power participation charges for staff of color have remained comparatively secure in latest months, rising rates of interest and a worsening jobs market might reverse these beneficial properties. In latest months, employment has already dropped off in a number of industries that disproportionately make use of staff of color, together with retail, transportation and warehousing.

Between September and November, common merchandise shops, together with shops, misplaced 71,500 jobs, and the warehousing and storage business misplaced 41,000 jobs. Many of those industries depend on lower-wage staff, with imply annual wages usually starting from $30,000-$50,000 in retail and warehousing.

William Spriggs, a professor of economics at Howard College and the chief economist of the union AFL-CIO, mentioned the “second corporations stop hiring . . . the unemployment fee goes up as a result of the individuals who have been unemployed can’t escape unemployment. And that hurts black staff first.”

Spriggs added that “the large restoration in black labour power participation, which within the final six months has actually helped black staff . . . that goes away.”

Fears in regards to the US financial system tipping right into a recession have percolated because the Fed has ploughed forward with essentially the most aggressive sequence of rate of interest will increase for the reason that early Nineteen Eighties. In a bid to deal with decades-high inflation, the central financial institution in lower than a 12 months has raised its benchmark coverage fee from close to zero as of March to almost 4.5 per cent presently. Additional fee rises subsequent 12 months are anticipated, with prime officers forecasting the federal funds fee to peak at 5.1 per cent.

Policymakers imagine there’s a path for inflation to return to the Fed’s 2 per cent goal with out main job losses and a recession — a declare many economists throughout Wall Avenue and academia dispute. A recent poll performed by the Monetary Occasions in partnership with the College of Chicago’s Sales space Faculty of Enterprise discovered that an amazing majority of main economists expects a recession subsequent 12 months, which they warn might push the unemployment fee past 5.5 per cent from its present 3.7 per cent.

Most Fed officers presently forecast the unemployment fee will rise roughly 1 share level to 4.6 per cent subsequent 12 months and keep at that stage by the top of 2024.

Economists and policymakers acknowledge that people of colour are disproportionately harmed when the unemployment fee rises, particularly when there’s a recession, even a gentle one.

“Black Individuals by no means have low unemployment,” says Algernon Austin, director for race and financial justice on the Middle for Financial and Coverage Analysis, a Washington-based think-tank. “The unemployment fee ranges from excessive to very excessive to extraordinarily excessive.”

“It’s essential to recognise {that a} gentle recession means going from excessive unemployment to very excessive unemployment for black individuals.”

Previous to the pandemic — when the US labour market was in good well being — the unemployment fee for black Individuals was roughly twice that of white and Asian adults. In 2019, it stood at 6.1 per cent, in comparison with simply 3.3 per cent and a couple of.7 per cent for white and Asian adults, respectively. For Hispanic adults, it was 4.3 per cent.

On the worst of the Covid financial disaster, the black unemployment fee skyrocketed to almost 17 per cent. For white staff, it was barely decrease, at 14 per cent.

Fed officers have emphasised that inflation additionally hits these communities the toughest, and that as a way to revert to a wholesome financial system, they need to get costs again underneath management. Failing to take action within the near-term can even imply extra ache in a while, they argue, because the central financial institution can be pressured to slam the brakes on the financial system even tougher.

“With out value stability, the financial system doesn’t work for anybody,” Jay Powell, Fed chair, mentioned in mid-December at his ultimate press convention of the 12 months. “We is not going to obtain a sustained interval of sturdy labour market situations that profit all.”

Austin expressed issues about different components, such because the struggle in Ukraine and China’s Covid coverage, which can be exterior the Fed’s management however are having an outsized impact on the trajectory for inflation. He warned that the central financial institution was not solely “unnecessarily” imposing prices on essentially the most economically susceptible individuals, it was additionally undercutting their capability to deal with the value pressures they have been already struggling to beat.

“[Put] individuals into unemployment, then they received’t have the ability to deal with the inflation,” he mentioned.

[ad_2]

Source link