[ad_1]

International shares had been on Friday set to shut out the worst yr because the 2008 monetary disaster after the battle by central banks to tame inflation and the battle in Ukraine despatched highly effective waves dashing throughout asset markets.

The broad MSCI All-World index of developed and rising market equities has shed almost a fifth of its worth in 2022, with bourses from Wall Road to Shanghai and Frankfurt all notching up important losses.

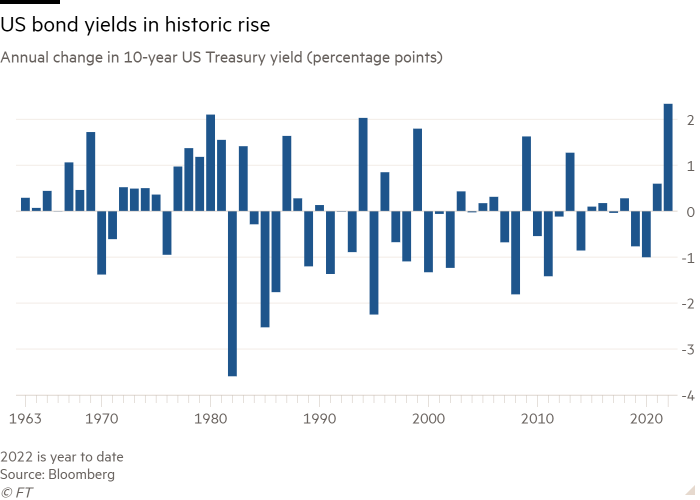

Bond markets additionally endured heavy promoting: The US 10-year authorities bond yield, a world benchmark for long-term borrowing prices, has shot as much as 3.8 per cent from about 1.5 per cent on the finish of final yr — the largest annual improve on Bloomberg data stretching to the Sixties.

A 9 per cent surge within the US greenback towards a basket of half a dozen main friends has positioned additional strain on many markets. Growing economies have taken an particularly huge hit since they usually borrow in {dollars} and plenty of key imports, akin to crude oil, are priced within the US forex.

The grim yr for monetary markets got here as central banks led by the US Federal Reserve ratcheted up borrowing prices in an try to regulate the worst spell of inflation in many years. Speedy will increase in rates of interest globally dealt a very highly effective blow to many high-growth corporations that prospered when central banks and governments offered a flood of stimulus measures to assist the worldwide financial system in the course of the 2020 coronavirus disaster.

Tesla, the electrical automobile maker, has shed nearly two-thirds of its worth this yr, whereas chipmaker Nvidia has dropped 50 per cent. US tech titans Apple and Microsoft have tumbled nearly 30 per cent, whereas Google mother or father Alphabet is off almost 40 per cent and Fb proprietor Meta has plummeted 64 per cent.

The worth of the cryptocurrency market has tumbled by $1.7tn because the begin of 2022, in line with Financial Times data, in an indication of how the speculative fervour that took maintain in 2020 has burst this yr.

China’s sprawling equities markets additionally sustained a blow because the nation’s financial system was disrupted by strict zero-Covid measures and is now battling an enormous wave of infections because it opens up once more. The CSI 300 measure of shares in Shanghai and Shenzhen fell 22 per cent in native forex phrases and 28 per cent in greenback phrases.

The MSCI Europe index is down about 16 per cent in greenback phrases, however a slimmer 11 per cent in euros.

Russia’s full-scale invasion of Ukraine in February additional sophisticated the image for traders, disrupting provide chains for key uncooked supplies and additional inflaming what had already been a extreme bout of inflation. Commodities have been among the many uncommon gainers in world markets this yr: the broad S&P GSCI gauge has rallied 7 per cent, with power and agriculture costs posting sturdy good points.

London’s FTSE 100, which is closely weighted in the direction of power, mining and pharmaceutical corporations, which have fared higher on this yr’s market shift, is up barely for the yr to this point.

The depth of this yr’s market swings highlights the dimensions of regime change confronted by world traders, who had grown accustomed to low rates of interest since central banks deployed extraordinary measures to prop up the world financial system in the course of the 2008 monetary disaster and the pandemic that adopted 12 years later.

Greater rates of interest dent the attraction of holding property akin to shares and riskier debt as a result of traders are in a position to earn greater returns in money or ultra-safe property akin to US, German or Japanese authorities bonds. Since greater charges make borrowing costlier, in addition they have a tendency to position strain on the broader financial system by tightening monetary circumstances for corporations and companies.

[ad_2]

Source link

Casino Welcome Bonus

Casino Welcome Bonus