[ad_1]

Its been 105 days since Ethereum transitioned from a proof-of-work (PoW) blockchain to a proof-of-stake (PoS) community and the variety of Ethereum validators is about to surpass 500,000 in 2023. In keeping with metrics, Ethereum’s issuance charge of recent cash has dropped significantly and solely 4,790.45 ether has been minted since The Merge happened on Sept. 15, 2022.

Ethereum’s Issuance Price Is 0.014% per Annum in Distinction to the Simulated PoW Inflation Price of three.58% per 12 months

The Ethereum (ETH) community has been working underneath its proof-of-stake (PoS) consensus algorithm for greater than three months and since then, 4,790.45 ethereum or $5.7 million in worth has been added to the availability. Statistics from ultrasound.money present that Ethereum’s present issuance charge of recent cash each year is 0.014%.

That’s an entire lot totally different than what it might be if Ethereum was nonetheless a PoW chain, based on ultrasound.cash’s simulation metrics. If ETH remained a PoW chain over the past 105 days, then the issuance score or inflation charge each year can be 3.58%. That may be roughly 1,247,674.60 ether added to the availability by 10:15 a.m. (ET) on Dec. 29, 2022. As an alternative of $5.7 million in worth added, a PoW ETH chain would have added greater than $1.5 billion in worth.

Along with the decrease issuance charge, Ethereum additionally has a burn mechanism, and information present roughly 658,000 ether is burned annually. To this point, 2,795,773 ether or $8.78 billion in U.S. greenback worth has been burned by destroying ETH because the Aug. 5, 2021 London Onerous Fork. Information from Dune Analytics signifies the largest chief when it comes to the variety of ETH burned is tied to conventional ethereum (ETH) transfers, which account for 247,008 ETH burned because the London Onerous Fork.

The non-fungible token (NFT) market Opensea and its customers are accountable for burning 229,928.53 ether and the decentralized trade (dex) Uniswap V2 has burned 143,394.07 ether since Aug. 5, 2021. Transferring the stablecoin USDT has equated to 123,014.14 ether burned to this point, and Swaprouter 02 accounts for the fifth largest burner with 110,868.70 ether destroyed.

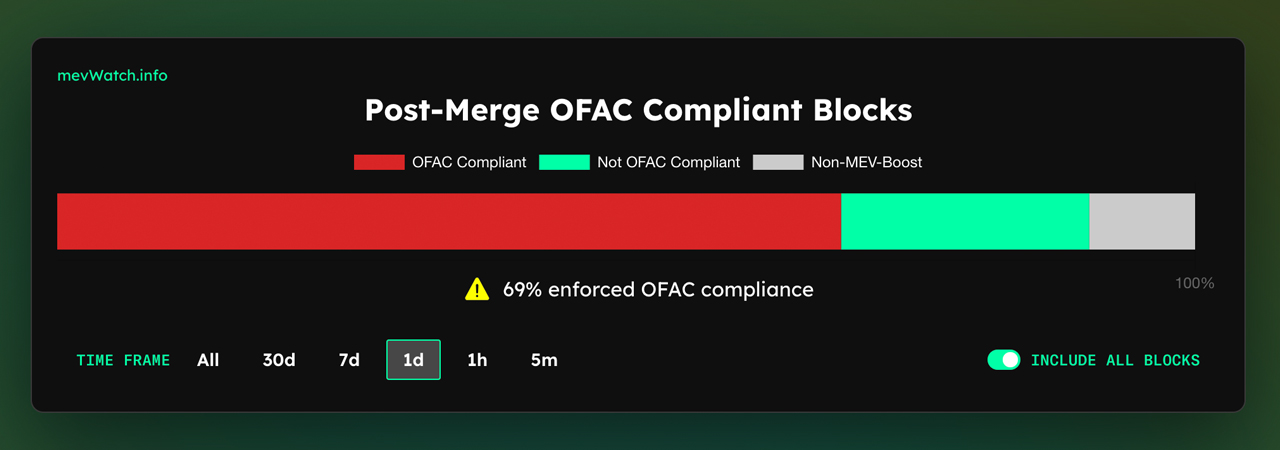

Moreover, the variety of validators validating consensus inside the Ethereum community is nearing 500,000, based on present beaconcha.in statistics. On Dec. 28, 2022, 492,863 validators have been recorded, which is a marked enhance from final 12 months’s variety of validators 12 months in the past, which was roughly 275,054. Information from mevwatch.info additionally exhibits that 69% of the blocks mined on the ETH community are enforced with the U.S. Workplace of Overseas Belongings Management (OFAC) compliance.

What do you consider Ethereum’s community issuance charge because it transitioned from proof-of-work (PoW) to proof-of-stake (PoS)? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link