[ad_1]

By the top of this yr bitcoin could have 13 consecutive years of recorded market worth beneath its belt. Seven of these years noticed Santa rallies all the best way up till New 12 months’s Eve, and 5 of the 13 years noticed bearish returns from Dec. 1 to Dec. 31. There’s nonetheless six extra days left till the top of 2022, however present market motion appears to level towards unfavorable returns this month.

13 Years of Bitcoin Costs in December

2022 wasn’t the best yr for bitcoin (BTC) when it comes to market worth measured in fiat. Initially of the yr, BTC was buying and selling for roughly $46K per unit and since then, the value has tumbled 63% because the first of Jan. 2022. In line with records, the primary recorded nominal worth of bitcoin in U.S. {dollars} was on Oct. 5, 2009 and it was promoting for $0.00764 per BTC on New Liberty Commonplace (NLS). At that fee, whoever was shopping for bitcoins at the moment by way of NLS might get round 1,309.03 BTC for $1.

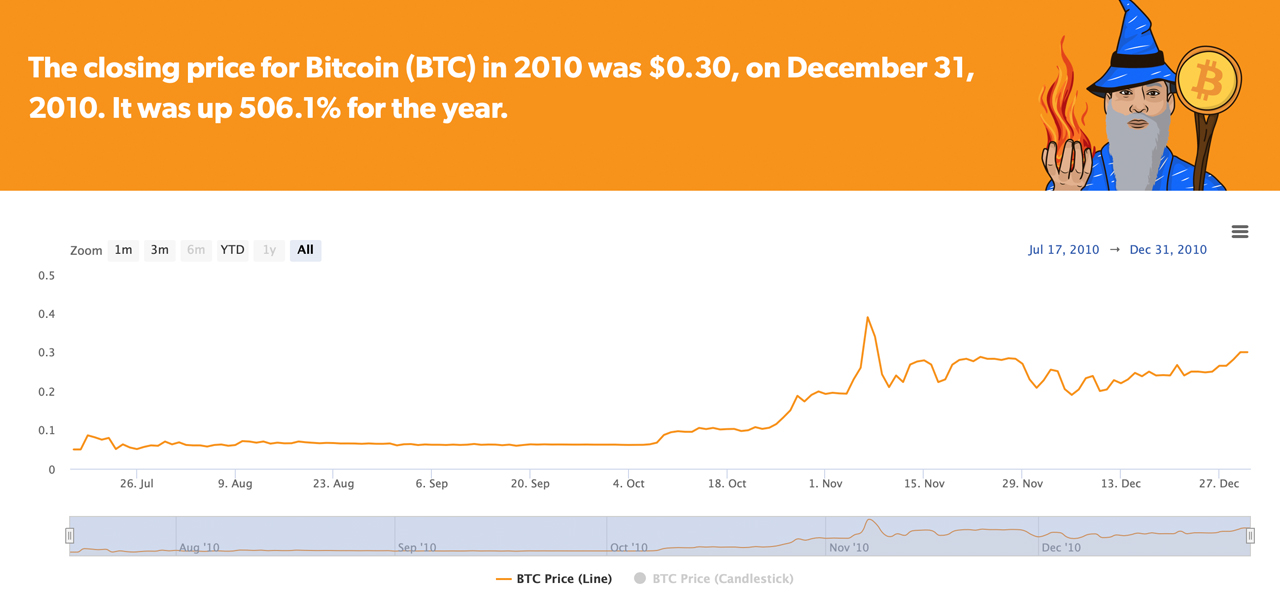

We cant really matter 2009, as seeing beneficial properties over the past month of the yr, as recorded costs are sporadic. Nevertheless, information present on Dec. 17, 2009, one might get round 1,630.33 BTC for for a single buck. On Dec. 28, 2009, NLS quotes are round 1,578.76 BTC for $1. In Dec. 2010, BTC’s value was a lot larger and on the primary day of the month, BTC exchanged arms for $0.21 per coin. By Dec. 31, 2010, a single bitcoin was 42.85% larger at $0.30 per unit. Bitcoin would additionally see beneficial properties over the past month in 2011, and 2012.

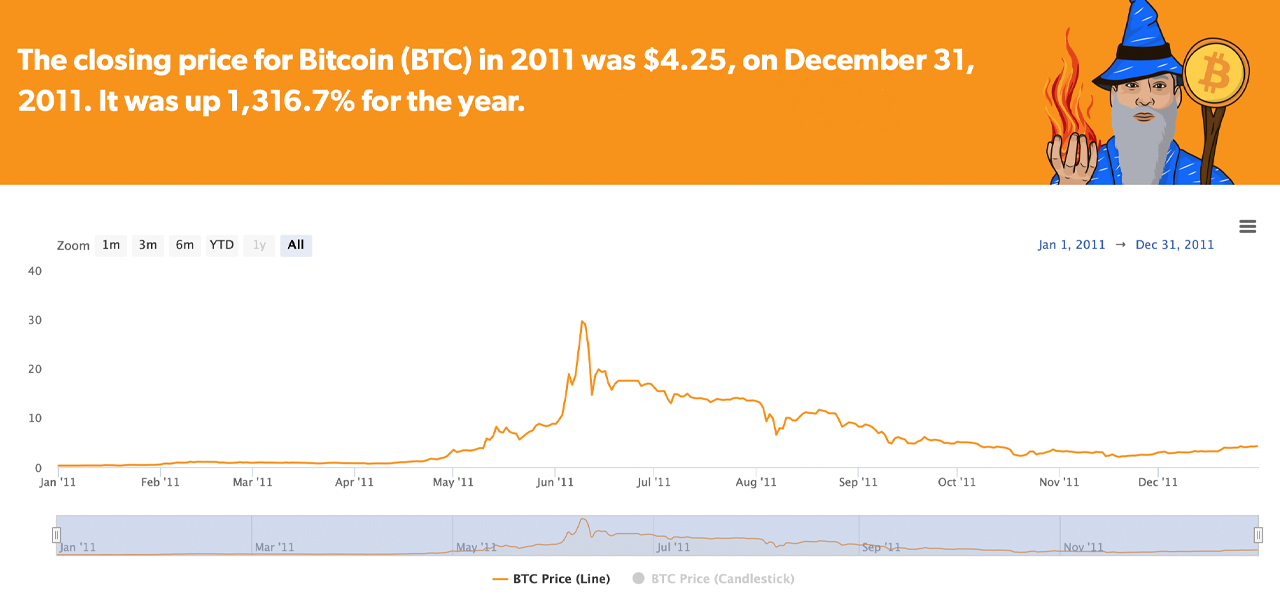

In 2011, BTC traded for $2.97 per unit on Dec. 1, and thirty days later BTC exchanged arms for $4.25 or 43.09% larger. On Dec. 1, 2012, BTC modified arms for $12.57 per coin and by the top of the yr, BTC was up 7% at $13.45 per unit. In the course of the subsequent two years, regardless of the bull run in 2013, BTC didn’t see Santa rallies. As an illustration, on Dec. 1, 2013, BTC was buying and selling for $955.85 per coin and by Dec 31, it was 21.11% decrease at $754.01 per unit.

2014 noticed a 15.57% loss as BTC traded for $379.25 on Dec. 1, and located itself altering arms for $320.19 by the yr’s finish. The final month of 2015, 2016, and 2017 all noticed Santa rallies. In 2015 on Dec. 1, bitcoin was buying and selling for $362.49, however by the yr’s finish it jumped 18.78% larger because it exchanged arms for $430.57 per unit. Equally, on Dec. 1, 2016, BTC was buying and selling for $756.77 and by Dec. 31, it was up 27.34% and was swapping for $963.74 per coin.

BTC additionally noticed beneficial properties in 2017 when it traded for $10,975.60 per coin on Dec. 1 after which ended the yr 28.98% larger at $14,156.40 per BTC. Historical past reveals that three out of the 4 subsequent Decembers noticed unfavorable returns. In 2018, BTC swapped for $4,194.39 on Dec. 1, and on Dec. 31, BTC was buying and selling for $3,740.23 shedding 10.82% in USD worth. The subsequent yr on Dec. 1, 2019, bitcoin was buying and selling for $7,449.52 and by the top of the yr, it was down 3.13% and traded for $7,216.10 per unit.

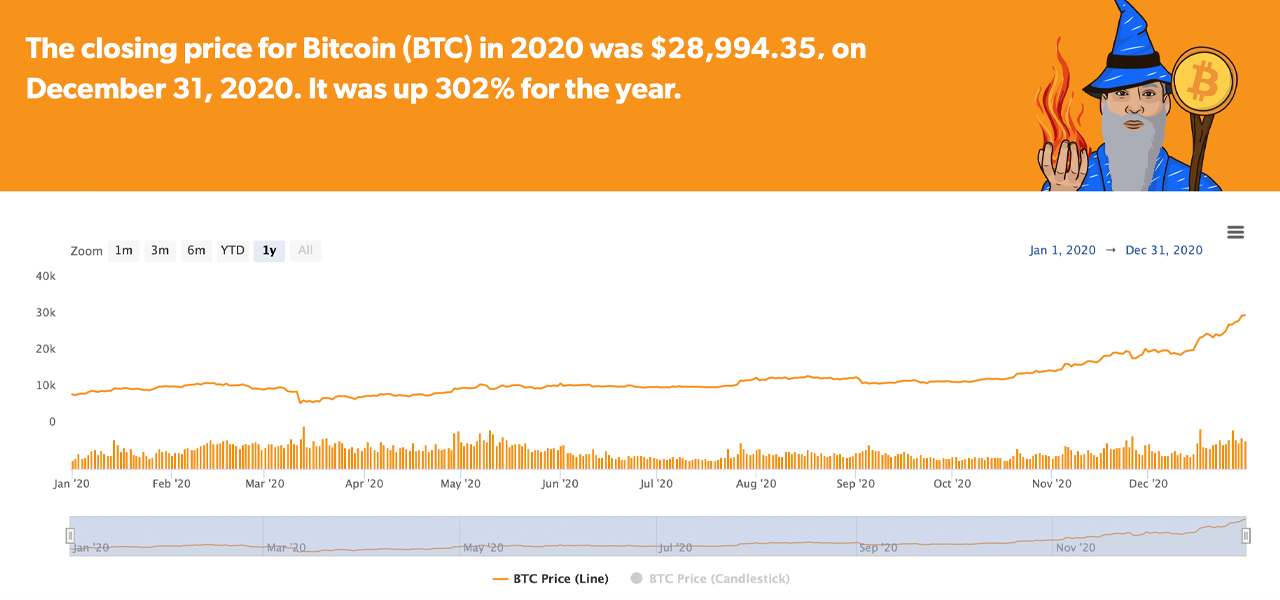

2020 was the most effective bitcoin Santa rally ever recorded as BTC jumped 53% larger over the past month of the yr. On Dec. 1, 2020, BTC swapped arms for $18,876.77 per coin and by the yr’s finish it was as much as $28,994.35. On the finish of 2021, BTC costs dropped over the past month, sliding 18.92% in USD worth throughout the course of 30 days.

On Dec. 1, 2021, BTC was buying and selling for $57,217.66 per unit and by the month’s finish, BTC was all the way down to $46,387.98 per coin. Final month, wasn’t the best for BTC because it was up above $20K per unit earlier than FTX collapsed. That particular occasion despatched shockwaves via not solely the trade, but it surely induced crypto markets to drop significantly in fiat worth as effectively.

As of proper now on Dec. 25, 2022, it doesn’t seem to be a Santa rally is within the playing cards for bitcoiners however you by no means know the way the yr might finish. Over the following week, BTC might bounce 10% or extra larger and finish 2022’s dismal bear market with a bang. Or we simply would possibly see what we’ve seen throughout the previous few weeks, which is an entire lot of lackluster actions, low volumes because the FTX aftermath subsided, and a substantial amount of consolidation.

What do you consider the final 13 years of bitcoin’s recorded worth? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link