[ad_1]

The final 12 months have been robust on digital foreign money traders because the crypto winter has brought about a big sum of worth to go away the once-bustling economic system. The privateness coin economic system, as an example, shed greater than 55% towards the U.S. greenback because it dropped from $11.7 billion in Jan. 2022 to the present $5.22 billion.

Privateness Economic system Loses 55% In opposition to the Buck, European Union Appears to Ban Anonymizing Cryptos

Privateness cash aren’t talked about like they was. Lately, the hype and discussions surrounding decentralized finance (defi) and non-fungible tokens (NFTs) have eclipsed privateness coin conversations.

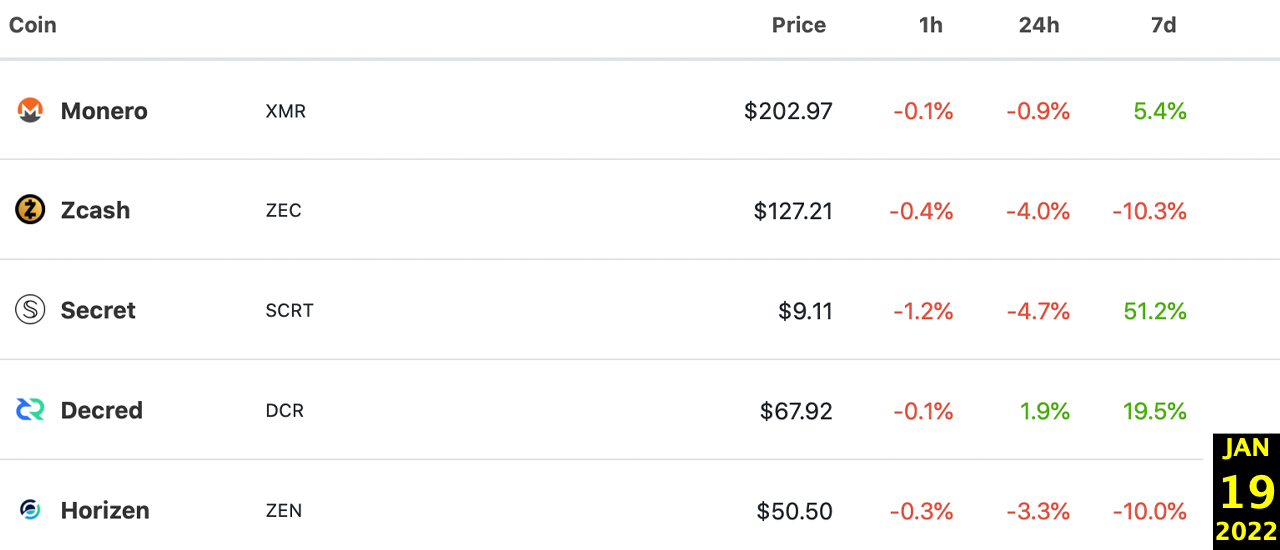

Moreover, over the past 12 months, the privateness coin economic system has dropped from $11.7 billion to at this time’s $5.22 billion. Final January, the highest two privateness tokens included monero (XMR) and zcash (ZEC).

On the time, monero was the biggest privateness coin by market cap and nonetheless is at this time. In Jan. 2022, XMR’s worth was round $202.97 per unit and it had a market valuation of round $3.66 billion on Jan. 19, 2022.

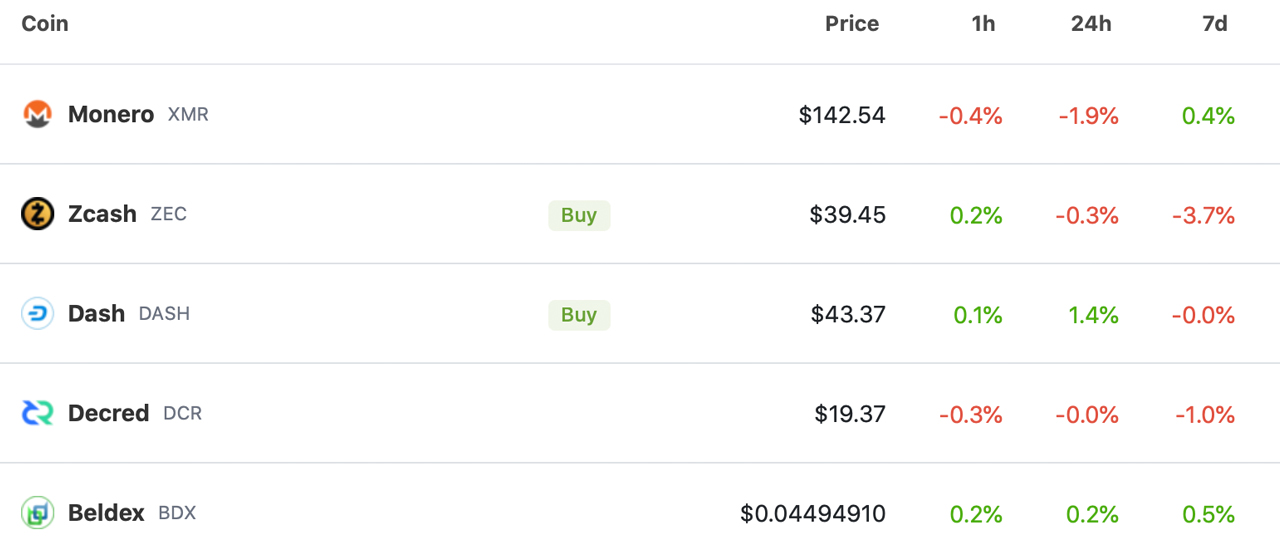

In the present day, XMR is exchanging palms for round $142.35 per coin and it has an total market capitalization of round $2.58 billion. Zcash holds the second-largest privateness coin market valuation this yr and in January it was round $1.53 billion.

On the finish of Dec. 2022, ZEC’s market cap is all the way down to $517 million. Jan. 2022’s high 5 privateness cash by market cap included monero (XMR), zcash (ZEC), secret (SCRT), decred (DCR), and horizen (ZEN).

December 2022 stats present the highest 5 privateness cash embrace monero (XMR), zcash (ZEC), sprint (DASH), decred (DCR), and beldex (BDX). XMR’s and ZEC’s market caps equate to roughly $3.1 billion which is 59.4% of the whole privateness coin economic system.

In Jan. 2022, XMR and ZEC had been valued at $5.19 billion and represented solely 44.36% of the whole privateness coin economic system. In the present day, the highest two privateness cash by market cap have much more dominance.

Final month it was reported that leaked EU plans may ban privateness cash like XMR, ZEC, and DASH. “The European Union may ban banks and crypto suppliers from dealing in privacy-enhancing cash resembling zcash, monero, and sprint beneath a leaked draft of a cash laundering invoice obtained by Coindesk,” the publication famous on Nov. 15, 2022.

Authorities coverage choices and proposed tips have brought about plenty of crypto exchanges worldwide to cease itemizing privateness cash like XMR and ZEC. The shortage of listings offers privateness cash so much much less liquidity which makes them extra prone to cost fluctuations.

What do you concentrate on privateness cash this yr and their market performances over the past 12 months? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link