[ad_1]

Good morning. This text is an on-site model of our FirstFT publication. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Good morning. The Financial institution of Japan surprised markets yesterday with a surprise change to its controversial yield curve control policy (YCC), triggering large swings within the foreign money, bond and fairness markets.

The BoJ is the final of the world’s key central banks to stay to an ultra-loose financial coverage and authorities bond purchases to stimulate development.

However like elsewhere on the earth, inflation in Japan has risen sharply this yr. Core inflation — which excludes unstable meals costs — has exceeded the BoJ’s 2 per cent goal for seven consecutive months, hitting a 40-year excessive of three.6 per cent in October.

Japan’s more and more excessive outlier standing has contributed to a huge fall in the yen this yr as markets have priced within the differential with the rate-tightening US Federal Reserve.

The central financial institution mentioned yesterday it might permit 10-year bond yields to fluctuate by plus or minus 0.5 per cent, as a substitute of the earlier 0.25 per cent. It saved in a single day rates of interest at minus 0.1 per cent.

The transfer triggered a sell-off in global government bond markets. The yield on the 10-year Japanese authorities bond rose to 0.47 per cent, its highest since 2015. The US 10-year Treasury yield rose 0.11 proportion factors to three.69 per cent whereas the equal UK gilt yield elevated by the same margin to three.6 per cent.

The yen jumped greater than 4 per cent to about ¥131.2 towards the US greenback whereas the Topix fairness index fell 1.5 per cent.

Outgoing BoJ governor Haruhiko Kuroda denied that the coverage change amounted to a tightening of financial coverage. He mentioned the change was meant to deal with elevated volatility in international monetary markets and enhance the functioning of Japan’s bond markets.

The BoJ’s efforts to defend its yield curve targets have contributed to a sustained discount in market liquidity within the Japanese authorities bonds market, resulting in what some analysts have described as “dysfunction”.

The central financial institution now owns greater than half of excellent authorities bonds, in contrast with 11.5 per cent when Kuroda turned governor in March 2013.

Mansoor Mohi-uddin, chief economist at Financial institution of Singapore, mentioned the announcement indicated the BoJ was contemplating a broader exit from its YCC coverage, likening it to the 1989 resolution to lift rates of interest that led to a long time of deflation.

Be part of FT Reside at Davos for numerous in-person and digital occasions alongside the World Financial Discussion board Annual Assembly January 16 by way of January 20. The periods will collect leaders in coverage, enterprise and finance to share insights into the large points being debated and the options which will pave the best way to renewed development, stability and resilience. View the events and register for free here.

5 extra tales within the information

1. Putin says battle in Ukraine is turning into ‘extraordinarily difficult’ As his invasion nears the 10-month mark, Putin known as the state of affairs in Ukraine “extraordinarily difficult”. That is the second time this month he has admitted that the battle in Ukraine — which he initially thought would take lower than per week — is set to go on for a long time.

2. China’s media promise ‘normalcy by spring’ China’s rest of zero-Covid insurance policies is being accompanied by an abrupt shift in official rhetoric on the virus. Now, the nation’s state media is searching for to painting an “exit wave” of coronavirus instances sweeping the nation as part of a pre-planned strategy.

3. FTX is hoping to claw again SBF’s political donations Crypto alternate FTX is making an attempt to recoup tens of millions of {dollars} in political donations made by Sam Bankman-Fried with a view to pay again collectors. Some recipients are already searching for to return cash, and the corporate’s new administration says it will take legal action to get again money that’s not voluntarily returned.

4. Union chief resigns in EU-Qatar bribery scandal Luca Visentini, the secretary-general of the Worldwide Commerce Union Confederation, has resigned lower than one month after taking workplace. He admitted late on Monday to taking thousands of euros in cash from former MEP Pier Antonio Panzeri. Panzeri is on the centre of a corruption scandal through which Qatar and Morocco allegedly sought to affect EU lawmakers by way of bribes.

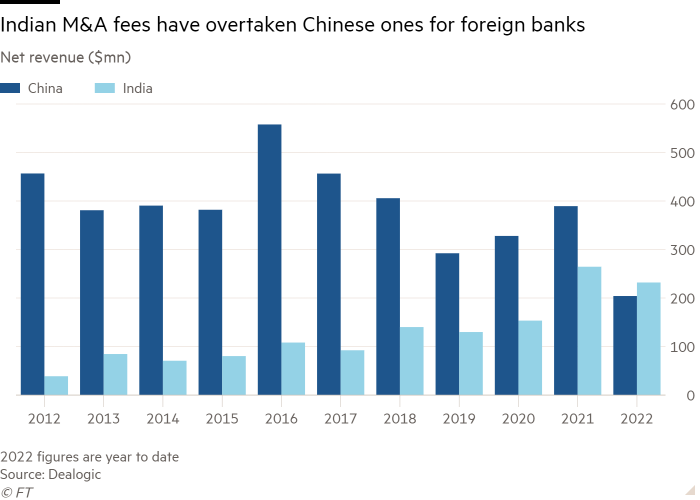

5. India overtakes China in M&A charges for western banks The world’s largest funding banks will earn extra dealmaking fees in India this yr than in China for the primary time. The milestone is indicative of a broader shift by western finance to diversify away from a decoupling Chinese language financial system.

The day forward

Ambulance staff strike within the UK Greater than 1,600 Unite union members on the West Midlands, North West and North East ambulance service trusts will stroll out over pay. Additionally, ambulance employees throughout most of England and Wales will strike over pay as a part of a co-ordinated walkout by the three predominant ambulance unions Unison, GMB and Unite.

Financial indicators Canada will publish its November shopper value index (CPI) inflation figures. Germany releases the GfK shopper confidence survey. The UK may have its November public sector funds information right this moment, and the US its Convention Board December shopper confidence figures

Company outcomes Carnival posts its This fall outcomes and Ceremony Help its Q3 outcomes right this moment. Bunzl will even have a buying and selling replace — the supplier of exhausting hats, beard guards and disposable cutlery is anticipated to verify a very good finish to its monetary yr with good income development, supported by quite a few acquisitions introduced over the previous 12 months.

What else we’re studying

The good inexperienced workplace crunch Buildings account for 39 per cent of world energy-related carbon emissions, and new environmental laws to sort out the issue are kicking in on the worst potential time. Acres of workplace house world wide, value lots of of billions, are now at risk of redundancy.

Non-public fairness strikes into hospital ERs For a non-public fairness trade that has made billions of {dollars} by assembling automotive washes, dentists’ places of work, and native companies into effectively run nationwide chains, a “roll up” of hospital emergency rooms appeared like a sound plan. But the titans of finance had not reckoned on the backlash from doctors.

Billionaire Oleg Deripaska’s Sochi lodge advanced seized A Russian courtroom has ordered the seizure of the $1bn Imeretinskiy lodge advanced and marina owned by billionaire Oleg Deripaska after the Kremlin asked the oligarch to stop criticising the war, the FT has been advised by folks conversant in the matter.

Silicon Valley start-ups race for debt offers in funding crunch A pointy decline in enterprise capital dealmaking and a closed marketplace for preliminary public choices have resulted in a funding crunch for a lot of personal know-how corporations, main start-ups which have historically relied on deep-pocketed Silicon Valley traders to show to alternative financing deals.

3M to finish ‘without end chemical substances’ manufacturing as stress builds The manufacturing conglomerate has mentioned it’ll part out Pfas — chemical substances utilized in merchandise akin to cell phones and non-stick pans — by the tip of 2025, citing pressure from regulators and traders over the buildup of the long-lived substances within the atmosphere. The transition is estimated to price the corporate as much as $2.3bn.

Finest pop albums of 2022

Pop critic Ludovic Hunter-Tilney picks his 10 favourite albums of the year.

Thanks for studying and keep in mind you’ll be able to add FirstFT to myFT. You too can elect to obtain a FirstFT push notification each morning on the app. Ship your suggestions and suggestions to firstft@ft.com

[ad_2]

Source link

Huge Games Selection

Huge Games Selection