[ad_1]

This text is an on-site model of our Unhedged publication. Enroll here to get the publication despatched straight to your inbox each weekday

Good morning. Ugly day for shares yesterday. We’d say it was the market lastly accepting our clearly right view of inflation and the Federal Reserve’s response operate, but when that have been the case, you’d see bonds shifting too. They didn’t. Ship us a greater concept: robert.armstrong@ft.com and ethan.wu@ft.com.

These of our readers who, like Rob, are occupied with garments and the enterprise of garments, ought to take a look at Lauren Indvik’s wonderful Vogue Issues publication. Here’s a pattern; and here is the sign-up hyperlink.

Three tales of companies inflation & wages

Jay Powell thinks inflation is worryingly excessive in non-housing core services. That clunky phrase captures costs from bus rides to hospital stays and, in Powell’s opinion, holds the important thing to inflation’s path ahead. He believes inflation on this class is pushed by wages. The massive inflation query, in different phrases, is whether or not the Fed can cool the labour market.

A standard sufficient view, but it surely’s value asking how labour market situations drive this sort of inflation. We see a minimum of 3 ways to have a look at it:

-

By way of enterprise prices. Powell’s stated justification is that “wages make up the biggest value in delivering these companies”. This story feels very intuitive. Providers, by definition, contain somebody serving you, and that individual must be paid. Fed research usually asserts the labour-intensity of companies with out additional clarification (if the Fed has achieved a extra detailed therapy someplace, ship it alongside!). If this account is true, the central financial institution should step in to cease a spiral of escalating prices and costs.

-

By way of labour-intensive enterprise prices. A distinct model of the price story, which accepts the premise that enterprise prices hyperlink wages and inflation, however distinguishes between larger labour-intensity companies (assume eating places) and lower-intensity ones (assume airfares, closely influenced by the price of jet fuel). Sturdy wage development lifts inflation however its affect is explicit, not common. It’s not a giant leap from right here to concluding that if inflation in particular wage-sensitive segments are offset by deflation elsewhere, general inflation seems much less menacing.

-

By way of consumption. The argument is that prime wage development sustains above-trend client spending. That is retaining demand properly above provide, leading to inflation.

We requested the FT’s Martin Wolf what he thinks and, ever the stalwart macroeconomist, he weighed in favour of 1 and three. Sturdy wage development raises consumption, letting corporations move larger wage prices on to unflinching customers by way of worth will increase — a basic wage-price spiral. Martin nodded to the truth that wage value stress is extra pronounced in labour-intensive sectors, however maintained that these wage pressures present up in every single place.

Over at The Overshoot, Matt Klein argues persuasively for 3. We quoted his put up earlier this month:

Employment revenue is the biggest and most dependable supply of financing for client spending. Wages can rise 1-3 share factors quicker or slower than client costs for a wide range of causes — together with however not restricted to compositional and definitional variations — however bigger gaps between the expansion charges of wages and costs mainly don’t exist outdoors of WWII and Korean battle rationing, the late Nineteen Nineties productiveness increase, and the primary 12 months of the pandemic.

His chart under sums it up. With uncommon exceptions, wage and worth development observe each other:

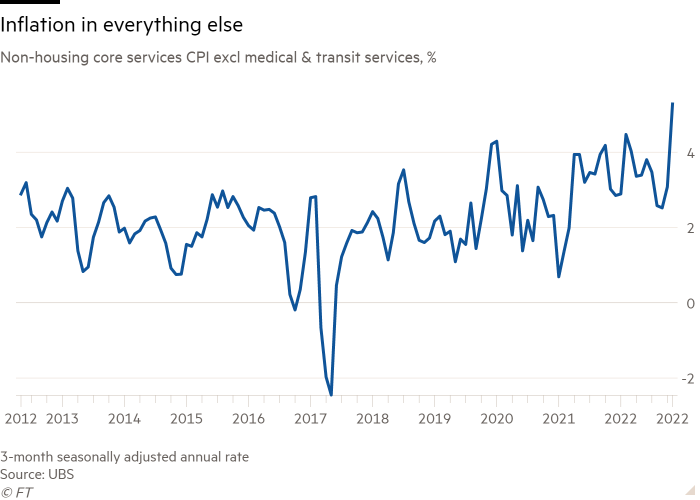

Lastly, Alan Detmeister, a former Fed researcher now at UBS, made the case to us yesterday that 2 (and a bit of three) is the very best clarification. He factors to how modest inflation seems within the lengthy tail of companies inflation, in distinction to a lot hotter inflation in labour-intensive companies akin to haircuts and laundry.

He exhibits this by taking Powell’s non-housing core companies inflation and stripping out medical and transportation companies. Broader companies inflation doesn’t look a lot hotter than earlier than the pandemic:

The exception, as you’ll be able to see above, is the final knowledge level: the placing uptick on this week’s November CPI report. However whereas a number of labour-intensive companies logged abnormally giant worth will increase in November, so did companies with out an apparent wage hyperlink, akin to cell phone plans. Detmeister suspects a blip. The underside line:

On this interval the best inflation was in items initially, then it moved to rents, now you’re seeing a little bit little bit of energy in a few of these different companies, which might imply we’re beginning to see a few of that [wage] value pass-through happen. Or it might simply be noise . . .

Is the slowing in items and rents going to be sufficient to offset these still-strong inflation numbers within the [labour-intensive parts of] non-rent core companies? The latest two [CPI] stories have been clear: it seems just like the slowing in items shall be sufficient.

Detmeister thinks the Fed is hammering the economic system a lot too arduous and was too keen to maneuver rates of interest into restrictive territory, given inflation that he figures will in all probability average by itself.

We’ve been sympathetic to Klein’s consumption account up to now. However the image just isn’t easy. Powell wants to raised clarify what he and the Fed imagine about companies and wages. The hyperlink just isn’t self-evident. (Ethan Wu)

Fin de siècle or only a cycle, revisited (with Howard Marks)

Some months in the past Unhedged posed this query:

After this era of acute inflation ends, will we return to one thing just like the pre-pandemic established order? Or will the pandemic mark the top of a 40-year regime of low inflation which, whereas it was punctuated by crises, featured lengthy regular stretches of excessive returns for each bonds and shares?

This challenge stays very a lot up within the air, so far as Unhedged is anxious. Howard Marks of Oaktree, who has been all over the FT in current months, has put himself within the “fin de siècle” camp in his newest memo to traders. Marks argues that we could also be seeing the third funding sea change of his profession. The primary two have been junk bonds getting into funding mainstream, opening the best way for the buyout wave and personal fairness, and Paul Volcker’s profitable battle on inflation, which ushered in 4 many years of falling charges.

The low charges period reached its apex within the decade earlier than Covid, with ultra-low charges and quantitative easing sending returns flying — so excessive, in actual fact, that it was not clear how a lot larger they might go. The end result was Marks’ “low-return world”.

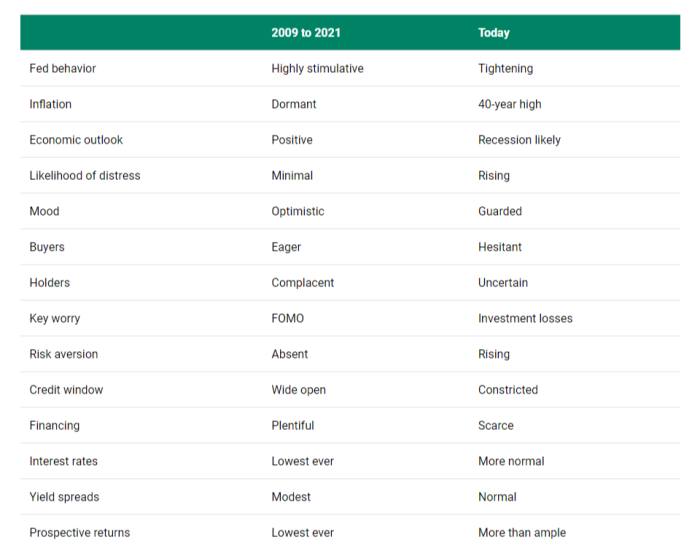

Now, nonetheless, inflation has put an finish to all that. Charges have risen and costs have fallen. He sums up the shift on this desk:

“These modifications could also be long-lasting, or they might put on off over time. However in my opinion, we’re unlikely to shortly see the identical optimism and ease that marked the post-GFC interval,” he writes. The shortage of ease pleases him. Excessive-yield bonds that yielded 5 per cent a 12 months in the past yield 8 now, so “they’re prone to ship equity-like returns, sourced from contractual money flows on public securities”.

My very own intestine feeling — it’s actually nothing greater than that — is that the modifications Marks paperwork in his memo will fade quick. Within the subsequent 12 months or two, inflation will succumb, and we’ll be again to the slow-growth, low-inflation, high-valuation world of pre-2020. My argument in its entirety: why wouldn’t this occur?

I requested Marks why the world shall be completely different after inflation subsides. He was characteristically modest about predicting the longer term (“Oaktree’s funding philosophy doesn’t prohibit having opinions, simply appearing as in the event that they’re proper.”) However he supplied up the next thought in regards to the US central financial institution:

Something can revert to the place it was once, besides I don’t assume we’re going again to zero on [policy] charges. I feel the Fed obtained trapped at zero for a very long time they usually regretted it, they usually gained’t wish to return there once more. I don’t assume the Fed needs to be on a extremely stimulative place on an ongoing foundation, they wish to be at impartial, which I imagine is [currently] outlined as 2.5 per cent.

I feel [Janet] Yellen was actually a dove and needed development, and [Jay] Powell is extra balanced. To routinely preserve charges at zero is like waking up each morning and giving your self a shot of adrenaline. You’ll be able to’t dwell on adrenaline.

I’m undecided I agree with Marks right here. Will the Fed emerge from the 2009-22 period much less certain that very low charges over lengthy intervals is a protected technique?

Actually the Fed doesn’t like being squeezed up in opposition to the zero decrease certain, which leaves it depending on quantitative consuming, a device it neither understands nor trusts. The arduous query (as Unhedged’s pal Ed Al-Hussainy of Columbia Threadneedle emphasises) is whether or not the Fed actually chooses near-zero charges — or is compelled into them, as an alternative. In an ageing, unequal, low development, low productiveness world, the pure fee of curiosity may simply be actually low, leaving the Fed with little room to manoeuvre.

One good learn

Harrison Ford, inexhaustible at 80, just wants to work.

[ad_2]

Source link