[ad_1]

In Nov. 2021, bitcoin’s market valuation managed to make it into the highest ten record of property ranked by market capitalization, because it was the eighth largest market cap final yr on Nov. 9. Since then, bitcoin is 75% decrease in worth in opposition to the U.S. greenback and the main crypto asset’s market capitalization has dropped right down to the twenty sixth largest place among the many most beneficial property and firms worldwide.

Bitcoin’s Market Cap Is Simply Beneath Chevron’s and Simply Above the Dwelling Depot’s Market Valuations

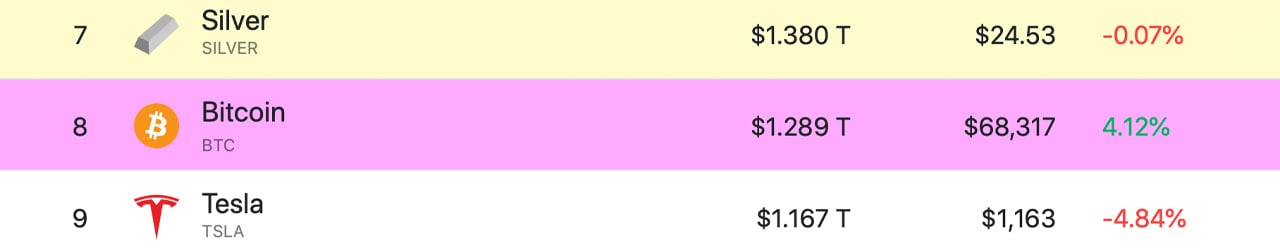

Simply over a yr in the past in Nov. 2021, bitcoin’s (BTC) market capitalization was the eighth largest out of a myriad of corporations and property traded globally. On the time, on Nov. 9, 2021, an archive.org snapshot collected from companiesmarketcap.com reveals BTC’s market valuation was $1.289 trillion as every unit was swapping for simply over $68K.

On that day, BTC’s market cap was under the dear metallic silver’s total valuation, which was $1.380 trillion on Nov. 9, 2021. The main crypto asset was simply above Tesla’s $1.167 trillion market valuation recorded 395 days in the past. Moreover, ethereum (ETH) was located within the high 20 positions of property ranked by market capitalization as ETH held the fifteenth largest market cap on Nov. 9, 2021.

On the time, ETH’s market valuation was round $570.45 billion as ether was swapping for $4,839 per unit. Ethereum’s market cap was under the corporate Tencent which had a market valuation of round $588.07 billion. The second main crypto asset’s market cap was above JPMorgan Chase’s valuation which was $499.61 billion 395 days in the past.

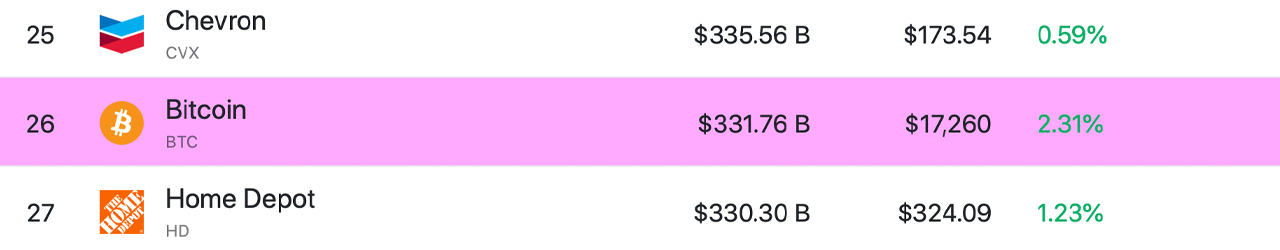

At the moment, on Dec. 9, 2022, the highest two main crypto property BTC and ETH have a lot decrease valuations than they did a yr in the past. Bitcoin isn’t represented within the high ten standings of property ranked by market capitalization because it’s now inside the high 30 positions and ranked at 26. The $331.76 billion market cap BTC holds immediately is slightly below Chevron’s market cap of round $335.56 billion.

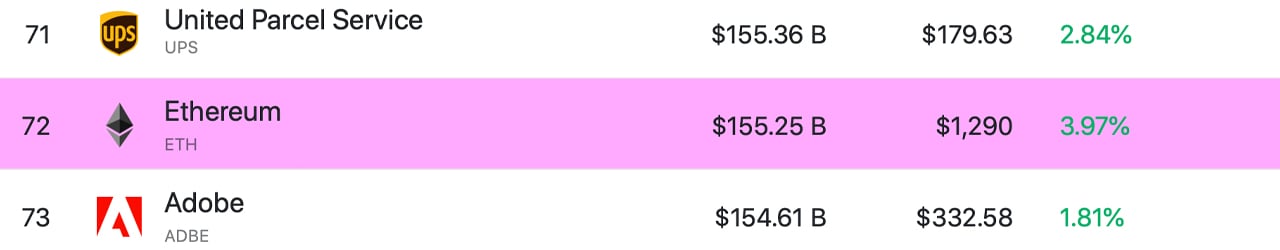

Additional, bitcoin’s market capitalization is simply above the general market valuation of Dwelling Depot, which is valued at $330.30 billion on Dec. 9. Ethereum has slid a terrific deal from the fifteenth largest place because it now holds the 72nd spot with a market cap of round $155.25 billion. Ether’s market cap is under the United Parcel Service (UPS) which is $155.36 billion, and it’s simply above the valuation of Adobe ($154.61B).

Ethereum’s present market worth is roughly 73.7% decrease than it was 395 days in the past on Nov. 9, 2021. Although BTC and ETH have seen their market caps drop decrease over the last yr, the identical may be stated for numerous completely different property and firms. Some property, like gold’s total market valuation, conversely recorded will increase over the past 12 months. Gold’s cap in Nov. 2021 was round $11.605 trillion, and immediately it’s value $11.910 trillion.

Microsoft was the second-largest asset a yr in the past, nevertheless it’s now within the third place as Microsoft’s valuation dropped from $2.53 trillion to immediately’s $1.844 trillion. Google’s or Alphabet’s market cap was round $1.98 trillion and within the fifth place 395 days in the past on Nov. 9, 2021, and on Dec. 9, 2022, it’s right down to $1.213 trillion. Silver’s place within the high ten record moved up from the seventh to the fifth place, however the valuable metallic’s market cap nonetheless dropped from $1.38 trillion to immediately’s $1.316 trillion.

What do you consider bitcoin’s fall from the highest ten most beneficial property and firms worldwide right down to the twenty sixth place? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, editorial photograph credit score: companiesmarketcap.com

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link