[ad_1]

This text is an on-site model of Martin Sandbu’s Free Lunch e-newsletter. Enroll here to get the e-newsletter despatched straight to your inbox each Thursday

The affect of the vitality disaster on European business continues to be debated hotly. Once I highlighted in last week’s Free Lunch how effectively the continent’s manufacturing has held up, the reactions assorted from denial to stunned delight. As economics professor Daniela Gabor said in a tweet echoing my very own sentiment, “I used to be very gloomy doomy about carbon shock remedy — and up to now, fairly incorrect. Good one.”

That’s not, in fact, what number of European leaders see it. Excessive vitality costs are as a substitute seen as an existential menace to the commercial base, which, to prime it off, is being lured away — so the argument goes — by unfair US inexperienced subsidies. (“We wished you to take local weather change significantly however not a lot that your corporations produce inexperienced expertise in competitors with us,” appears to be the view of some.) Cue a string of guarantees, from reassurances that Washington will tweak its insurance policies in order to go away Europe’s business unhurt, to a commitment to greater subsidies again at residence.

For the reason that debate rages on, it will probably’t harm to take one other dive into the information and what they need to imply for coverage.

Begin with Europe’s spectacular capacity to adapt to larger pure fuel costs. My colleague Shotaro Tani added to the proof of this, reporting on Monday that European customers cut consumption by one-quarter in each October and November, relative to five-year averages. This was largely accounted for by cuts in business demand for fuel.

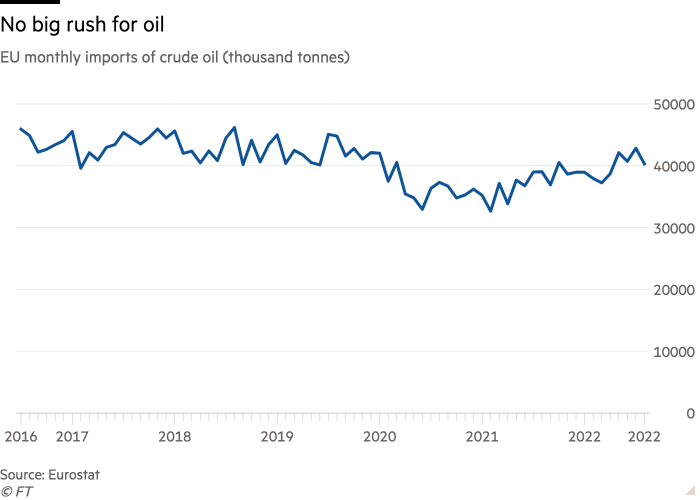

Some reactions to my celebration of this success have come from a local weather change angle. They argue that fuel reductions have solely been achieved at the price of consuming extra oil, or of substituting coal for fuel in energy era. So I went to take a look on the information, and I can reassure the sceptics. The chart beneath exhibits the EU’s oil imports, which look fairly flat over this 12 months and are, if something, beneath pre-pandemic ranges.

And whereas there have been studies of coal use growing, the numbers are clearly not sufficient to maneuver the needle at an economy-wide scale. Here’s a chart of coal consumption in EU electrical energy era; once more it stays beneath pre-pandemic ranges.

Others resist the interpretation that Europe’s business has weathered the disaster effectively, as I argued final week. And there are actually studies of some manufacturing shutting down. [German chemicals group BASF is a case in point.] However this must be seen in opposition to the background of general progress in manufacturing unit output in virtually each European nation, as I documented final week.

For extra element, take the most recent business numbers from Germany. “Business excluding vitality and development” — that’s largely manufacturing — produced 0.8 per cent extra in October than one 12 months earlier. Inside this, “energy-intensive branches” recorded a fall of 12.6 per cent over the 12 months (these are 5 sectors that account for one-fifth of worth added in business however three-quarters of its vitality use). So manufacturing that makes use of a variety of vitality contracted sharply, different manufacturing grew, mixed progress was optimistic — all of it appears simply how we would like an adaptable capitalist market economic system to behave.

Lastly, some object to evaluating manufacturing unit output at the moment with a 12 months in the past, given how the pandemic turned our economies topsy-turvy. Truthful sufficient. However taking the lengthy view absolutely means specializing in the very fact I highlighted final week, that the EU’s manufacturing output is larger than ever. If it is a disaster, it’s not a nasty one to have.

Admittedly, it’s a counterintuitive state of affairs. So it’s pure to be disorientated by the better-than-you-think story informed by the statistics (actually I used to be, as I anticipated issues to be worse). However it isn’t wholesome for the general public debate to be confused by concepts about what (as I channelled Mark Twain in one other context) we all know for positive that simply ain’t so.

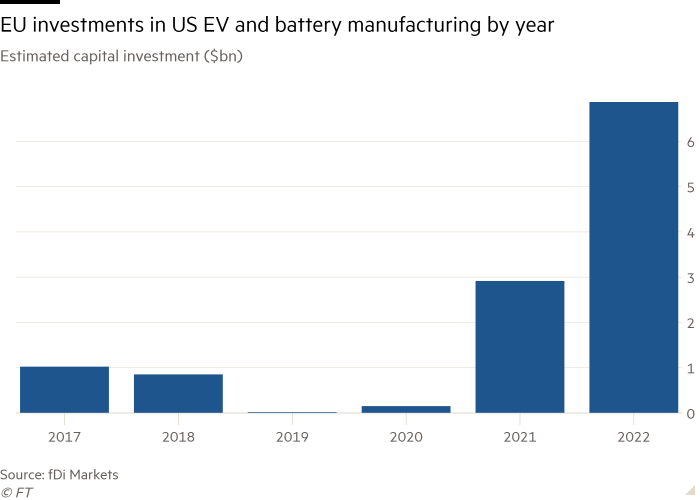

Take the widespread fear (eminently described by my colleagues over on the Energy Source newsletter, whose chart I reproduce beneath) that the US is stealing Europe’s bacon, or not less than its investments into batteries and different applied sciences of the longer term.

However there appears to be related angst about Chinese language corporations building lots of battery factories in Europe. Can you actually be complaining about each issues on the identical time? Possibly that is merely a narrative about enterprise leaders constructing batteries wherever there will probably be demand for them — which now consists of the US, and has clearly not stopped together with Europe. The extra the merrier.

After all, one can consider that for “strategic autonomy” causes it’s higher for European battery demand to be met by European-owned or European-controlled battery manufacturing located in Europe. But when that’s the case, it’s a bit wealthy to complain concerning the US making an attempt to realize exactly that with the clumsily discriminatory tax credit European leaders are so up in arms about.

What could be a extra clear-headed mind-set about Europe’s inexperienced industrial future? I had a stab at it in my column on Monday, the place I argued that the EU ought to draw the consequence of being a fossil energy-poor continent: particularly to not attempt to keep a fossil energy-intensive business. As an alternative focus each on accelerating the inexperienced transition, massively develop renewable energy era and transmission, and domesticate an business that may thrive in a renewable vitality system. That would imply pursuing manufacturing strategies which might be adaptable to the volatility of renewable energy — from aligning manufacturing phases with completely different vitality wants with energy worth fluctuations to incorporating thermal and vitality storage in manufacturing unit amenities.

I used to be happy to learn a punchy op-ed in our pages by Fatih Birol, head of the Worldwide Power Company, arguing alongside related strains: Europe should resist structurally larger fossil gas costs however it has a chance to construct an business geared to a decarbonised economic system. However that requires “a grasp plan for the longer term that goes past survival mode”.

And at last, learn the sharp evaluation by Georg Riekeles and Philipp Lausberg of the European Coverage Centre. They name for a new trillion-euro EU financing mechanism primarily based on frequent borrowing. One can quibble with the small print. However that’s the size of ambition that’s required.

Different readables

-

Ukraine’s President Volodymyr Zelenskyy is the FT’s Particular person of the 12 months. Our editor went to interview him.

-

This week the EU began its Russian oil import embargo, and the bloc and the G7 launched their worth cap on Russian oil bought wherever on the planet with their corporations’ assist. The EU’s announcement is here and the US Treasury’s reality sheet here.

-

The price of dwelling disaster is driving more women into sex work.

-

The EU-Western Balkans summit came about in Tirana this week. In a new report, the Vienna Institute for Worldwide Financial Research exhibits that it’s excessive time for the EU to start out taking the area significantly and velocity up its integration with the bloc.

-

The Financial institution for Worldwide Settlements warns that market crashes may complicate the tightening of financial coverage.

Numbers information

-

The share of multinational firms’ income squirrelled away to tax havens did not fall after policymakers started to deal with the problem after 2015, new analysis finds. Since world income continued to rise, so did the related tax loss.

-

Britons’ healthy life expectancy is worsening, writes Sarah O’Connor.

Really helpful newsletters for you

The Lex Publication — Meet up with a letter from Lex’s centres all over the world every Wednesday, and a evaluate of the week’s finest commentary each Friday. Enroll here

Unhedged — Robert Armstrong dissects an important market tendencies and discusses how Wall Avenue’s finest minds reply to them. Enroll here

[ad_2]

Source link