[ad_1]

The factor about macroeconomic forecasting is that it’s extremely complicated, as illustrated by the beneath chart from Morgan Stanley:

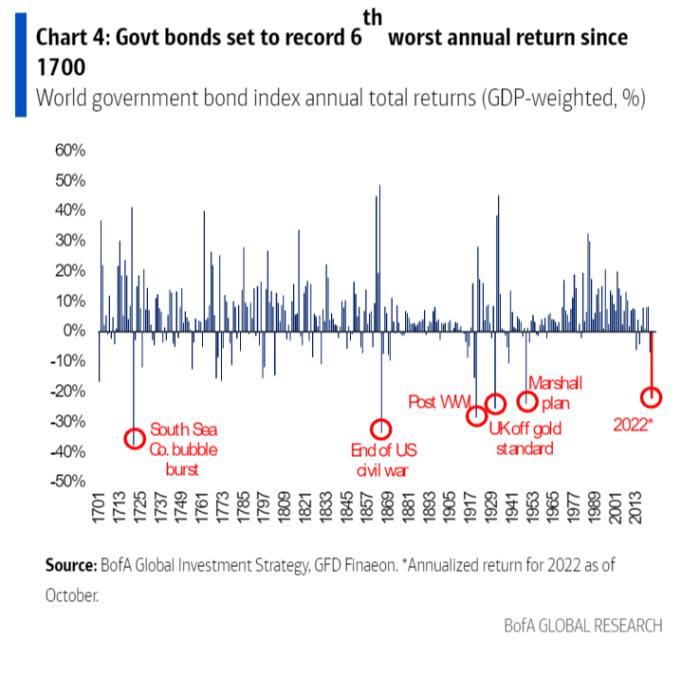

But even permitting for these many complexities, 2022 has been a difficult yr to foretell. Its outlier standing might be demonstrated by this 322-year knowledge snapshot from Financial institution of America:

Fortunately, the themes of 2023 seem like way more predictable. In truth, judging by the slew of year-end economics and markets technique previews touchdown in current weeks, they’re an identical to the present funding consensus.

Everybody appears to agree that international GDP development will maintain slowing, and that inflation will crest however stay sticky. Central banks will maintain tightening, albeit not fairly so rapidly. A Fed-induced recession will tame the US shopper spending binge, however family, company and financial institution stability sheets will all stay typically wholesome. In sum, meaning all the same old titles — The Nice Rotation; Welcome to the New Regular; At A Crossroads; The Sum of All Fears; Darkest Earlier than Daybreak; The Altering World Order — might be recycled as soon as once more.

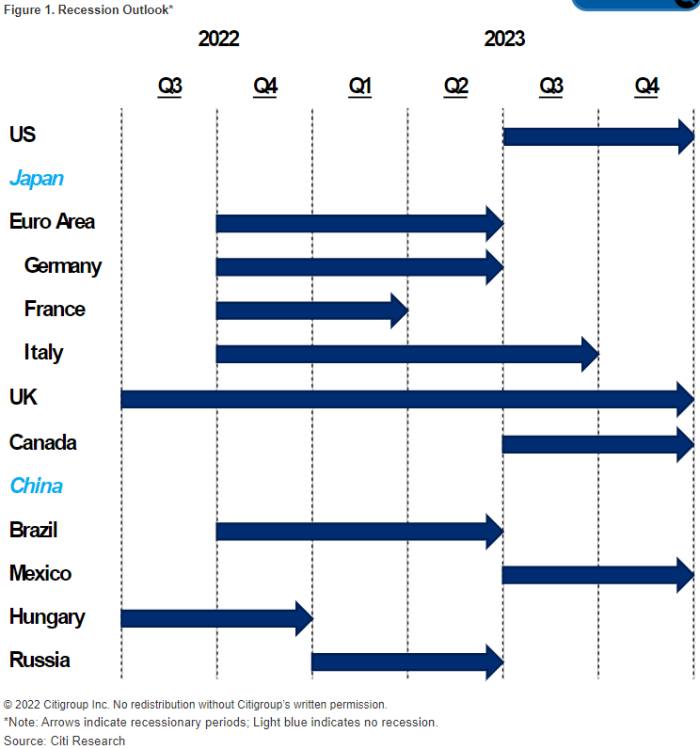

When opening a year-ahead preview it’s good be downbeat, reminiscent of with a reminder that recession is coming almost in every single place. The beneath chart by way of Citigroup makes use of the technically correct measure of two or extra quarters:

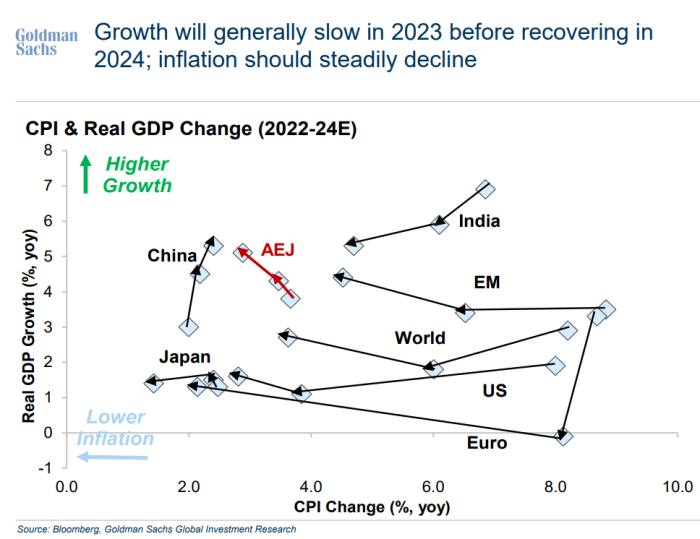

So for an investor, the important thing might be understanding the regional interaction between slowing development and slowing inflation. Enlightenment might be discovered someplace, by some means, inside this GDP/CPI zodiac constellation from Goldman Sachs:

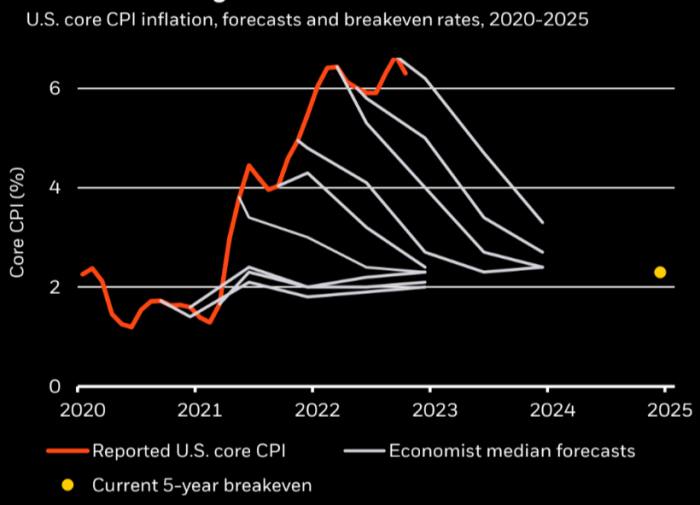

In fact, previous efficiency on inflation forecasting isn’t typically indicative of future returns. BlackRock gives the frond chart:

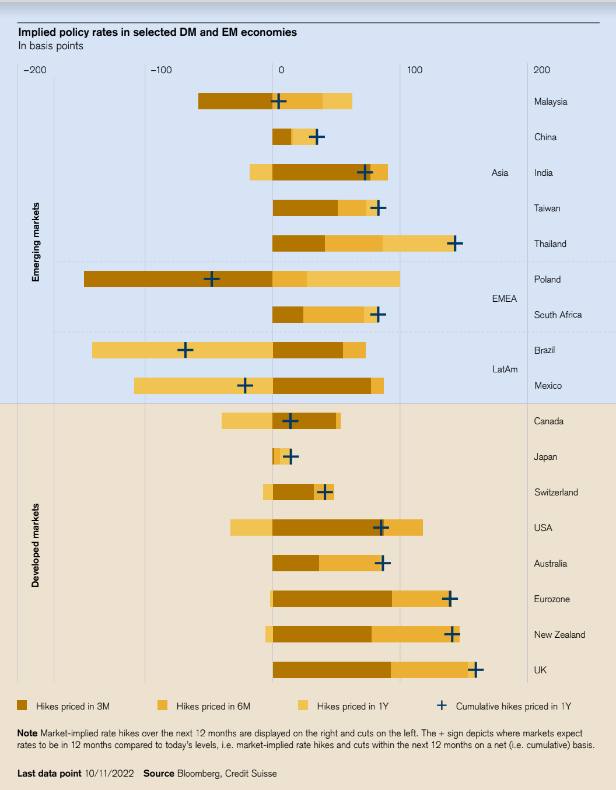

However there’s no arguing with charges markets. The cash says rates of interest are going to go up rapidly, besides the place they’re going up slowly or are happening, per Credit score Suisse:

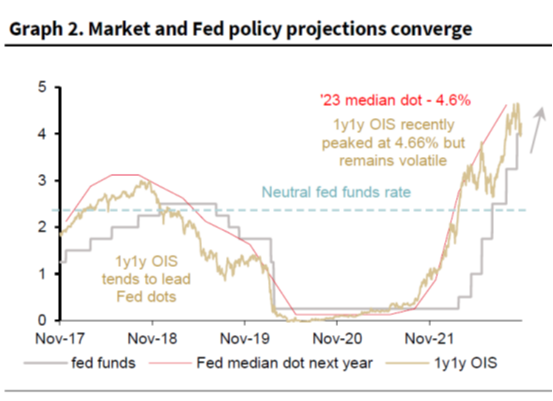

About now, a cynical reader may level out that cash markets are almost as unhealthy at predicting charges as economists are at predicting inflation . . .

Nonetheless! With international inflation (most likely) peaking, 2023 will (most likely) be the yr of the pivot.

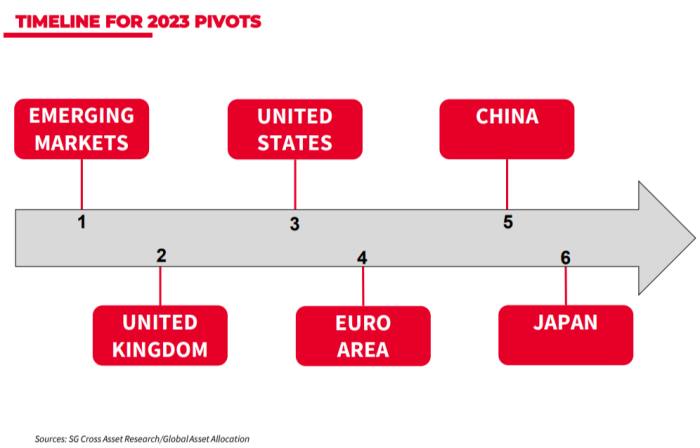

Predicting precisely when central banks pause is past the scope of any economist, it appears, however at the least some are prepared to have a stab on the order. That’s SocGen’s technique:

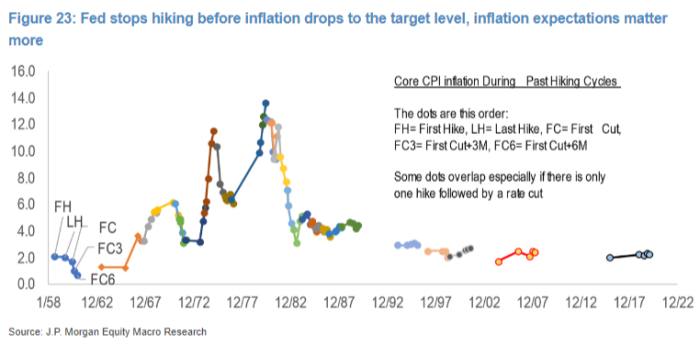

One other approach to method the timing query is to quote precedent. Beneath, apparently, is JPMorgan plotting of a Fed pivot round inflation expectations:

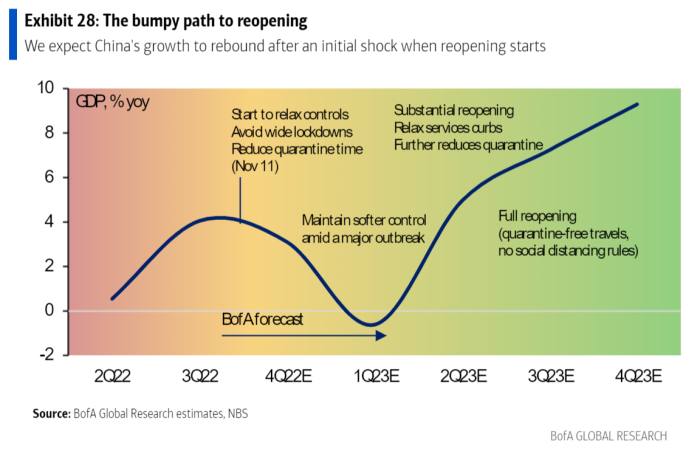

The largest identified unknown of 2023 is China. Economists are, typically talking, not skilled both in virology or political science. However like BofA beneath, they’re prepared to present each a bash:

Rising markets are largely depending on Chinese language policymaking so logic says they’re inconceivable to name. Fortunately, logic isn’t a prerequisite when producing client-focused content material. The consensus recommendation subsequently is to purchase in anticipation of China’s rebound together with a looser US financial circumstances, however don’t purchase any time quickly as a result of EM recessions might be deep and lengthy.

Citi illustrates the quandary of near-term warning round EMs with . . . an unshaven businessman with a ladder?

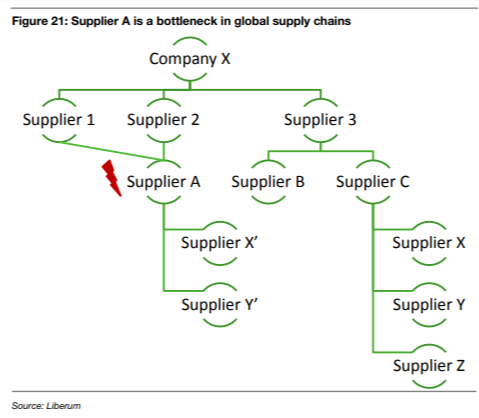

Additionally, China’s reopening is simply optimistic if provide chains begin working once more. However provide chains are complicated and fulminous, as illustrated right here by Liberum:

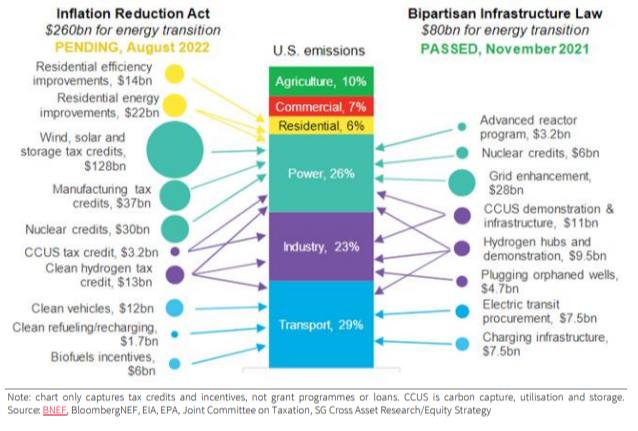

On the flipside, there’s at all times cash in greenwashing. Right here’s SocGen as an instance the place a few of that money may land:

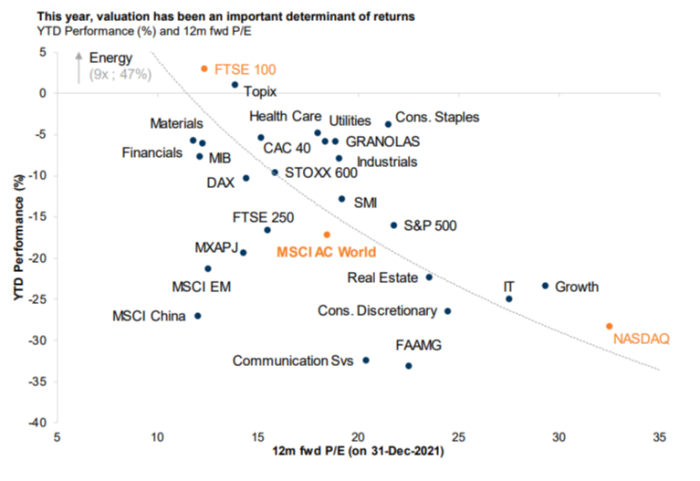

Valuationwise, some markets are trying low cost and others will not be.

OK — banks may say each single yr that now’s the time to be selective, favour high quality over issues that aren’t high quality, and so forth. However this time they actually imply it! Simply take a look at the scatter chart from Goldman:

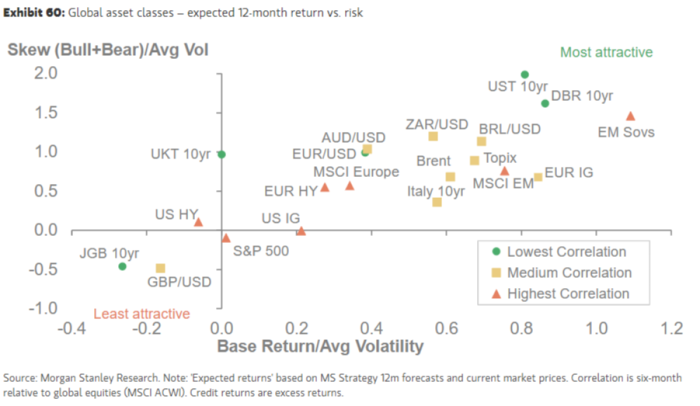

And take a look at this much more thrilling scatter chart from Morgan Stanley, which casts ahead the forecasts whereas including in correlations and relative volatility:

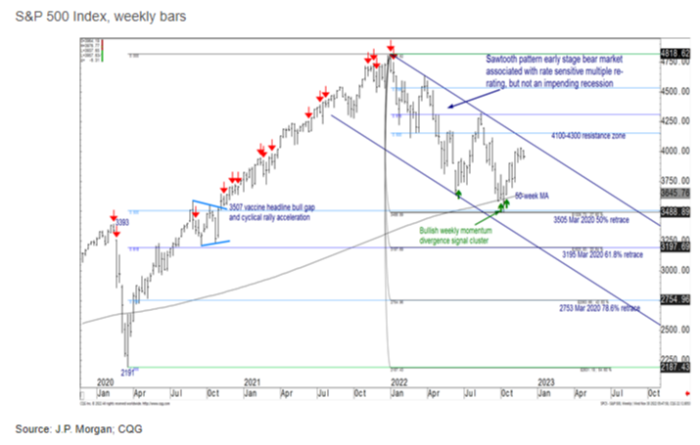

So in conclusion . . . wait, what? There’s nonetheless a technical analyst on the JPMorgan payroll? Effective. Let’s have it:

. . . so in conclusion, we’ll most likely must do greater than cherry-pick the weirdest trying graphs to write down a correct abstract of the year-ahead previews. Till time permits, nevertheless, it seems your choices for navigating the approaching 12 months might be summarised both by a paint sampler chart from BofA . . .

. . . or, from Credit score Suisse, by a practice dashing away from a QR code labelled “discover out extra”:

[ad_2]

Source link