[ad_1]

This text is an on-site model of our Unhedged e-newsletter. Enroll here to get the e-newsletter despatched straight to your inbox each weekday

Good morning. The US beat Iran on the World Cup and we’re unsure find out how to really feel. If the regime’s team misplaced, we’re blissful; if the loser was the staff of the brave folks of Iran, it’s bittersweet. In the meantime, markets churn on. Ship us your ideas: robert.armstrong@ft.com and ethan.wu@ft.com.

China unrest & international markets

It will appear that the zero-Covid protests that unfold throughout China in latest days have, for now, been suppressed. From the FT:

China’s well being authorities on Tuesday blamed native governments for his or her dealing with of coronavirus outbreaks as Beijing distanced itself from the disaster after unprecedented protests towards president Xi Jinping and his zero-Covid coverage.

The Nationwide Well being Fee reaffirmed Beijing’s dedication to the zero-Covid measures and pledged to spice up vaccination charges among the many aged, a day after police and safety forces appeared to have stamped out demonstrations throughout a minimum of 18 cities.

China’s home markets have recovered, after being shaken by information of the protests. The story might not be over, although. The scenario within the nation is plainly tense and finely balanced. One other medico-political disruption might come up at any time. How ought to international traders take into consideration this?

We had been struck by a considerate Twitter thread from William Hurst, a political-science professor at Cambridge who research China. To summarise crudely, Hurst thinks that the zero-Covid protests are a novel phenomenon and “probably fairly essential”.

Beforehand, protests in China had taken sure clearly distinct kinds — employees’ rights, rural residents’ rights, scholar protests, city governance protests and political dissent. The latest protests blur these traces and cross regional boundaries in an apparently co-ordinated manner, “crossing a boundary”. The (comparatively) reasonable power used within the state response can also be attention-grabbing; does it recommend some tacit elite help?

Hurst argues that three situations are attainable: the protests fizzle out; are decisively repressed; or the state makes some concessions. He says the primary is more than likely (most protests fizzle, most in all places), the second entails main prices and dangers and the possibilities of the third are “extraordinarily low”.

Hurst’s likeliest situation shouldn’t be precisely benign for traders. The danger of a fizzle and a sustained establishment is that, from the perspective of home demand, the established order shouldn’t be good. The chart beneath, from Capital Economics China economist Zichun Huang, illustrates properly how zero-Covid has crushed development in home demand, outdoors of on-line items:

Add in a collapsing residential property market, and the ensuing image is bleak. And neither the issue of insufficient vaccination nor the property mess appear amenable to a fast resolution, as we’ve argued before.

However international traders don’t have to fret a lot about this, until they’ve investments in public Chinese language corporations that serve home demand. The broader fear is whether or not China’s export machine can maintain buzzing. If it doesn’t (as Don Rissmiller at Strategas emphasised to us) it might simply trigger one other international provide shock, with penalties for each inflation and development. So — assuming, with Hurst, that the “concession” situation ain’t taking place — what international traders should give attention to is additional repression or safety measures which are extreme sufficient to close down what are, in impact, the world’s most essential factories.

What’s outstanding is how properly these factories have functioned regardless of the zero-Covid coverage and comparatively ineffective vaccines. Under are the nation’s manufacturing PMIs, which crashed with the preliminary outbreak, however have managed to stay round impartial since (in PMI surveys, over 50 is growth, beneath 50 is contraction):

Right here is the year-over-year change within the China export commerce, which is slowing with international demand, however has thus far averted a decline:

China’s “closed loop” or moderately “closed loop-ish” inside provide chains look like doing a ok job, for the needs of the worldwide economic system and international markets. Is there a danger that unrest, pushed by zero-Covid insurance policies, might trigger a harsh sufficient official response to alter that? Our intuition is that the unrest must be fairly spectacular, however as we’re at all times at pains to say, we’re not China specialists. We’re eager to listen to from readers who’re.

How sturdy is the financial momentum?

Our previous two newsletters mentioned the peppy efficiency of commercial/cyclical shares however solely glancingly hit on the larger query: how is the enterprise cycle going?

Yesterday we confirmed you this striking printout from the Atlanta Fed’s real-time GDPNow development estimate:

But on Monday we confirmed you a rather gloomier chart of latest manufacturing orders survey knowledge. New orders are bellwethers for sturdy items demand and have been softening throughout the board:

How does a bumper GDPNow studying match with contracting new orders? Partly, the 2 fail to suit as a result of GDPNow is a measure of quarter-on-quarter actual output development, and this quarter has introduced a smattering of surprisingly punchy knowledge in areas like new home sales and durable goods orders. Match what GDPNow predicts for the fourth quarter right into a longer-term chart of actual output and it appears much less spectacular:

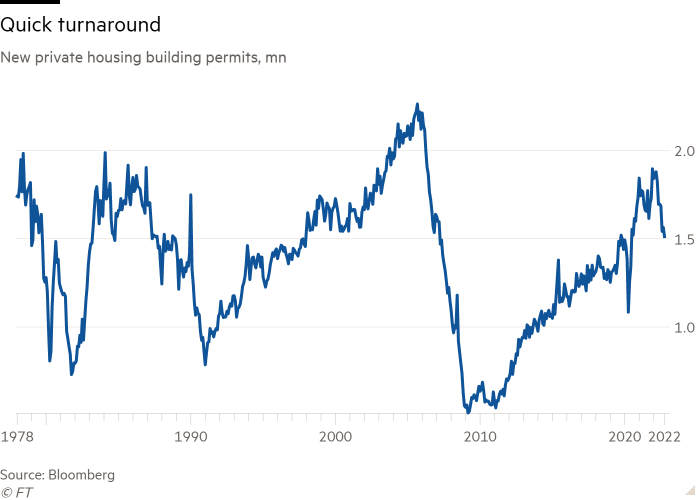

GDPNow additionally has a penchant for large swings, particularly if all the nice knowledge comes at first of 1 / 4. Different forward-looking knowledge are turning over. The Convention Board’s index of main indicators has fallen 3.2 per cent between April and October, which traditionally has signalled recession. Dreadful shopper confidence is a giant purpose why, however so is extra tangible knowledge like new orders. Right here’s one other indicator the Convention Board makes use of, new permits for personal housing building:

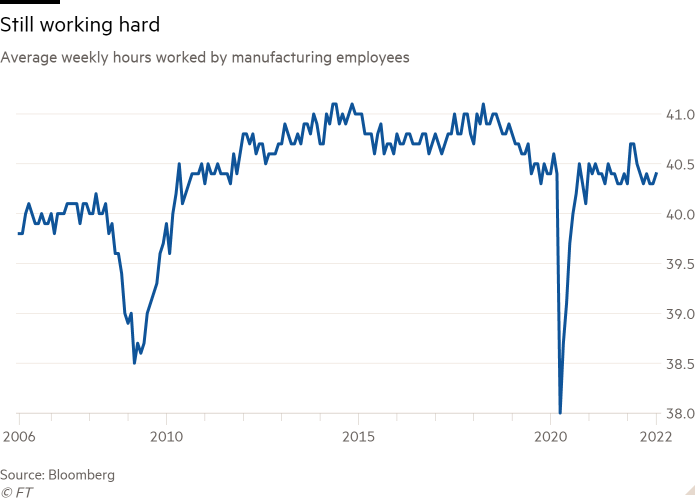

A number of different main indicators are holding up, although. Hours labored in manufacturing are standing pat; so long as there are items to be made and bought, somebody has to man the machine. Examine the regular decline all through 2008 to right now’s stability:

That is per how sturdy consumption nonetheless is:

As we’ve rattled on about earlier than, the economic system simply isn’t doing that badly proper now. A number of main indicators are evident menacingly, however with shopper spending nonetheless excessive, actual output is however a hair beneath its pre-pandemic development (whereas nominal output has overshot). The enterprise cycle is popping, however has not but totally turned. We’re completely not in a recession.

You can also make the case the cycle is popping utilizing chosen main financial indicators, however the far stronger argument is simply how excessive the federal funds fee is, and how briskly it’s gotten there. Financial coverage works by throwing a moist blanket on demand, and although that course of is gradual, it should work. That’s basically what bond markets are betting on, sending yield curves deep into inverted territory regardless of a moderately resilient economic system. The bond market sees the writing on the wall. Do shares? (Ethan Wu)

One good learn

A pleasant piece from James Waterproof coat concerning the essential relationship between inequality and inventory costs (see additionally here and here).

[ad_2]

Source link