[ad_1]

That is the primary half in a brand new FT sequence, Brexit: the subsequent part.

Nearly two years after Britain left the EU, economists have reached a consensus: Brexit has considerably worsened the nation’s financial efficiency.

They agree that the vote to go away the bloc has made households poorer, that negotiating uncertainties have taken their toll on enterprise funding and that new limitations to commerce have broken financial hyperlinks between the UK and EU.

Whereas economists and officers don’t agree on the exact magnitude of the Brexit impact, they take into account it to be massive. Additionally they agree that new commerce agreements with nations resembling Australia and regulatory freedoms gained from leaving the bloc don’t come near offsetting the injury.

Andrew Bailey, Financial institution of England governor, instructed MPs this month that the central financial institution assumed that Brexit would trigger “a long-run downshift within the degree of productiveness of a bit over 3 per cent” — most of which had already occurred. “We’ve got not modified our view on that to date,” he stated.

The Workplace for Finances Accountability, the fiscal watchdog, expects the UK financial system to finish up 4 per cent smaller than it will in any other case have been — a £100bn a yr hit to prosperity — leaving the general public funds much less sustainable partly because of “a major adversarial impression on UK commerce”.

Some former officers have gone further. “Put it this manner, in 2016 the British financial system was 90 per cent the scale of Germany’s,” stated Mark Carney, former BoE governor. “Now it’s lower than 70 per cent.”

The Canadian former governor has been extensively criticised for his use of this statistic, with Jonathan Portes, professor of economics and public coverage at King’s School London, saying the apparently dramatic contraction stemmed from foreign money actions, not Brexit. However Portes additionally acknowledged that there is no such thing as a doubt that the detrimental results of Brexit could be seen each in UK financial knowledge and in-depth educational work.

Earlier than the 2016 referendum, Brexiters resembling Lord Daniel Hannan, an adviser to the Board of Commerce, anxious that having shut commerce ties with EU held again the UK financial system. Britain was “shackled to a corpse”, he stated.

However because the eve of the coronavirus pandemic, the UK’s financial system has underperformed in contrast with each different G7 counterpart and it’s the just one to not have recovered to its dimension in late 2019.

The OECD expects the UK’s efficiency over the subsequent two years to be worse than some other superior financial system bar Russia.

Although these comparisons present many headlines, educational economists fear that such abstract statistics is perhaps polluted by particular UK-related Covid-19 weak point or power shock results.

To establish particular Brexit financial impacts, they use numerous strategies to construct a so-called counterfactual — a simulated historical past of the UK if it had stayed within the EU — after which evaluate it with the fact of Britain’s financial system after the Brexit referendum.

In two areas, there’s now a transparent consensus permitting them to say with certainty that the Brexit hit to UK prosperity was, as Swati Dhingra, an exterior member of the BoE’s Financial Coverage Committee, lately remarked, “plain”.

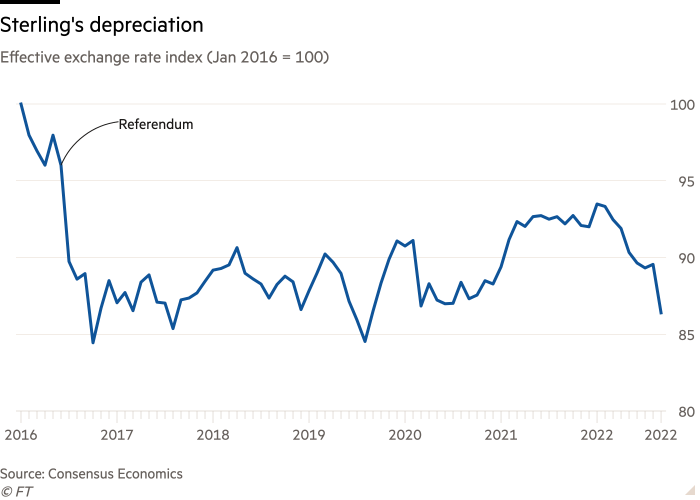

First, sterling depreciated greater than 10 per cent after the Brexit vote in 2016 and has remained at this degree ever since. This drop raised import costs, enterprise prices and inflation, however failed to spice up wages, exports or the competitiveness of the UK financial system. The Decision Basis estimated that the depreciation raised import costs and general inflation. It calculated that consequently real wages fell 2.9 per cent, costing households £870 yearly on common.

The second clear impact has been on enterprise funding, which has flatlined in actual phrases since after 2016 earlier than falling in the course of the pandemic.

Simon French, chief economist at Panmure Gordon, stated that Brexit resulted in an increase in the price of capital for UK corporations as traders anxious about diminished prospects of doing enterprise in Britain. Whereas he stated different nations additionally noticed weak enterprise funding in the course of the pandemic, the impact was a lot worse within the UK and taking a look at EU and US developments “suggests a cloth undershoot [of investment] of round £60bn a yr”.

A lot of the newest educational efforts have tried to quantify the commerce impression of Boris Johnson’s Brexit deal, the Commerce and Cooperation Settlement, which got here into power at the beginning of 2021.

This work has been pissed off by statistical businesses in each the UK and EU altering the gathering of import and export knowledge and by disagreements on how finest to establish a Brexit impact. However the outcomes of research now showing counsel very massive drops in commerce between the UK and the EU, a decline within the number of items traded, a lack of buying and selling relationships between corporations and comparable patterns in companies.

“There may be robust proof the TCA has diminished the UK’s commerce with the EU round 15 per cent to date,” stated Thomas Sampson, affiliate professor on the London Faculty of Economics. However he famous that the UK’s commerce with the remainder of the world had additionally decreased by comparable quantities, main him to be “not 100 per cent satisfied we’ve seen a [Brexit] impact on exports to date”.

Different teachers are much less anxious concerning the cut up between commerce with the EU and the remainder of the world, saying that there was a definitive UK-specific drop in commerce efficiency coinciding with Brexit.

Martina Lawless, a analysis professor in Eire’s Financial and Social Analysis Institute, stated Brexit had been “considerably detrimental” for the UK together with her estimates displaying declines in EU imports and exports of “shut to twenty per cent”.

Nearly each nation besides the UK noticed a commerce growth in 2021, she famous. “If one thing hadn’t occurred in January 2021, UK commerce must also have grown.”

Probably the most subtle statistical modelling has been happening at Aston Enterprise Faculty, the place professor of economics Jun Du has discovered that imports to the UK from the EU have largely recovered. Nevertheless, she estimates that exports to the bloc at the moment are 26 per cent decrease than they might have been with out the brand new limitations to commerce.

The impact of this may be seen most clearly in items commerce, resembling meals exports, the place there are technical limitations and extra stringent border checks. There has additionally been a big drop within the variety of items traded, with varieties dropping to 42,000 from 70,000 earlier than the brand new guidelines got here into impact.

In line with Du, smaller corporations have been hardest hit as a result of the limitations are a extra important price relative to the worth of commerce, which bodes ailing for the longer term. “[Small companies are] not simply unproductive corporations, but in addition new corporations — that’s why we’re anxious about future development — once you lose that, your pipeline breaks,” she stated.

“There may be little dispute that commerce has been broken [by Brexit] massive time,” she added.

Comparable proof is rising within the companies commerce, economists stated. Dhingra instructed MPs this month she may very well be much more sure there was a “stagnation” in exports as a result of the commerce knowledge for the sector had not been distorted by modifications in assortment methodology in the way in which it had for items commerce.

To date, ministers have rejected the financial proof. Jeremy Hunt, the chancellor, stated final week that he didn’t settle for the OBR’s estimate that Brexit had induced a 4 per cent hit to the UK financial system.

“There are massive alternatives for us to turn into rather more rich than we’d in any other case have been,” he added, citing regulatory freedoms and commerce offers that may very well be struck with different nations.

The federal government has not quantified these potential features, and the place it has — resembling for the Australia commerce deal — they have been estimated to be tiny, elevating output by simply 0.08 per cent.

Economists say that is scant compensation for the financial losses the nation has suffered to date.

“We all know now that Brexit has made UK households worse off by elevating the price of residing and it has made life more durable for UK corporations [by increasing trade barriers], and this has made the UK poorer,” stated Sampson.

[ad_2]

Source link