[ad_1]

Welcome to the “polycrisis” — a world wherein, as historian Adam Tooze says, “financial and non-economic shocks” are entangled “all the way in which down”. Now we have an inflation shock that emanates from the disruptions brought on by a pandemic, the coverage responses to that pandemic and an power shock brought on by a warfare. That warfare in flip is expounded to the breakdown in relations amongst nice powers. Gradual development, rising inequality and over-reliance on credit score have undermined political stability in lots of high-income democracies. The credit score increase led to a fantastic monetary disaster whose final result included a decade of ultra-low rates of interest and so much more monetary fragility worldwide. Including to those stresses is the specter of local weather change.

It’s certainly handy to consider the world in mental silos, focusing in activate macroeconomics, finance, politics, social change, politics, illness and the setting, to the exclusion of the others. In a fairly secure world, this may increasingly even work properly. The choice of fascinated with the interactions amongst these features of expertise can also be too onerous. However typically, as now, it turns into inescapable.

It’s not simply theoretically true that all the pieces will depend on all the pieces else. It’s a fact we will now not ignore in observe. As my colleague Gillian Tett usually warns, silos are perilous. Now we have to assume systemically. Economists need to recognise how the financial system is interconnected with different forces. Navigating at the moment’s storms compels us to develop a wider understanding.

This isn’t an argument in opposition to detailed evaluation of particular person components within the image. Economists ought to nonetheless look fastidiously on the issues they learn about, as a result of they’re each complicated and essential in themselves. Thus the info and evaluation within the OECD’s latest Economic Outlook proceed to be each invaluable and illuminating. However, inevitably, additionally they omit very important features.

Think about, then, what the report tells us in regards to the financial state of affairs.

First, the power disaster itself is really enormous. The share of OECD members’ GDP spent on end-use of power is near 18 per cent, double what it was in 2020. In Europe, the will increase should be far greater than this. The final time the ratio was this excessive was within the early Eighties, in the course of the oil shock brought on by Saddam Hussein’s invasion of Iran.

Second, inflation pressures are each sturdy and widespread. Once more, this has echoes of the inflation within the early Eighties, which adopted the excessive and variable inflation of the Seventies. At the moment, the power value shock brought on by the warfare in Ukraine adopted the damaging shocks to produce and optimistic shocks to demand triggered by Covid. This mixture of provide and demand shocks with large reductions in actual wages and losses of nationwide incomes in web energy-importing international locations makes the job of central banks vastly troublesome.

Third, there may be prone to be a pointy slowdown in world financial development between 2022 and 2023. The latter is forecast at 2.2 per cent. Furthermore, the overwhelming bulk of that development shall be generated by Asian economies. The British and German economies are forecast to shrink slightly, whereas the eurozone and US economies are forecast to develop by solely 0.5 per cent.

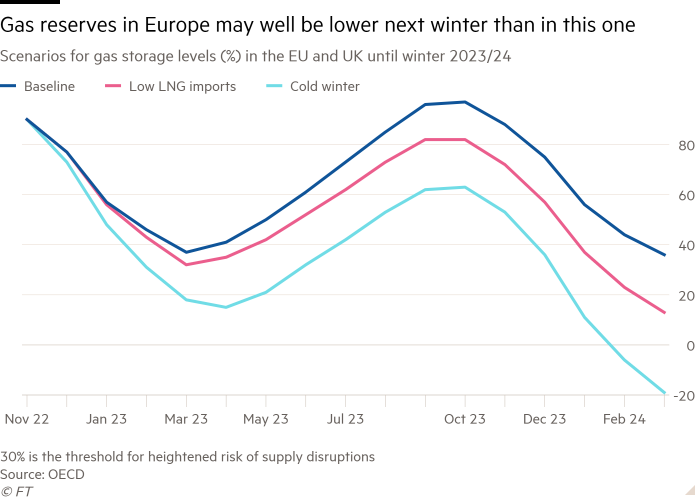

Fourth, though that is, unsurprisingly, an sad image, it might end up far worse. The power outlook is itself extremely unsure, with a considerable danger that gasoline reserves in Europe shall be smaller subsequent winter than this one, particularly if winters are chilly or imports of liquefied pure gasoline too small. Rising rates of interest would possibly set off extra monetary upheaval and deeper downturns than now foreseen. Meals shortages would possibly trigger deeper misery in growing international locations than anticipated, particularly in a financially restrictive setting.

The OECD’s view, which I share, is that central banks should not take a peak in inflation as an indication their job is finished. It’s important that inflation be introduced firmly again below management. On this context, it’s also very important that fiscal coverage be focused at supporting these worst hit by excessive power costs. Simply as essential is a push on increasing provide of renewable power and bettering power effectivity. That’s the “dwelling entrance” in Europe’s battle with Russia.

But even that is an incomplete image. Different components are the doable developments within the Ukraine warfare itself and what’s wanted to deliver it to a passable finish. One more is how China will escape the entice of its zero-Covid coverage. Final however not least is discovering methods to assist growing international locations via their looming monetary woes, whereas supporting their local weather transition.

The purpose is that we have to analyse inside the silos, whereas additionally analysing systemically throughout them. The OECD, to its credit score, created in 2012 a unit known as the New Approaches to Financial Challenges so as to do this. As this unit’s most up-to-date and apparently remaining report notes, we’ve got to analyse interactions amongst social, financial, political, geopolitical, well being and environmental developments in addressing the challenges we confront. Humanity has created a world so interdependent that no different method is feasible. After all, such an method is troublesome. It’s certain to annoy skilled specialists working comfortably of their silos. However ever for the reason that monetary disaster and fairly significantly over the previous three years, it has turn out to be clear that such narrowness is folly. It’s to be exactly incorrect moderately than dare to be roughly proper.

So what has the OECD completed with this enterprise? Apparently, it is closing it. This can be a mistake. If the NAEC will not be adequate, make it higher. The world we all know now doesn’t divide into neat silos. Our pondering should not stay caught narrowly inside them both.

[ad_2]

Source link