[ad_1]

Alameda Analysis reportedly withdrew probably the most funds from FTX US, the U.S. arm of FTX, days earlier than the crypto alternate filed for chapter. The vast majority of the withdrawn cryptocurrencies have been despatched to wallets owned by FTX Worldwide, “suggesting that Alameda could have been working to bridge between the 2 entities,” crypto intelligence agency Arkham stated.

Alameda’s Withdrawal Evaluation From FTX US alternate

Crypto intelligence agency Arkham shared an evaluation Friday displaying that Alameda Analysis withdrew probably the most funds from FTX US, the U.S. arm of FTX, days earlier than the crypto alternate collapsed. Arkham tweeted:

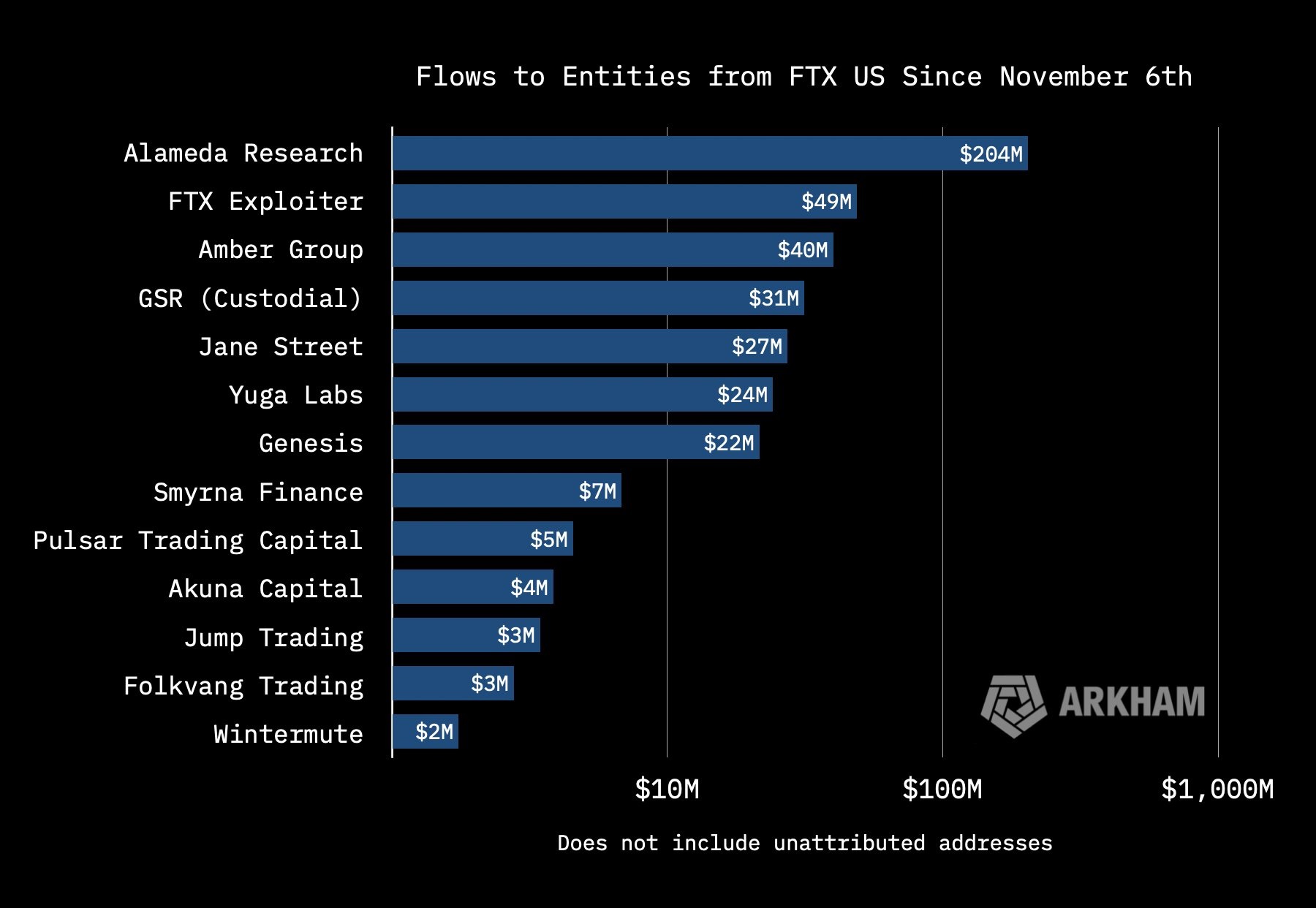

Arkham analyzed flows from FTX US within the ultimate few days earlier than the collapse, discovering that Alameda withdrew probably the most funds, at $204M.

Arkham added that it has recognized eight completely different addresses the place Alameda Analysis transferred the crypto belongings it withdrew. The crypto intelligence agency famous that of the $204 million:

$142.4M (69.8% of the whole) was despatched to wallets owned by FTX Worldwide, suggesting that Alameda could have been working to bridge between the 2 entities.

After Nov. 6, Alameda solely withdrew USD stablecoins, wrapped BTC, and ether from FTX US. Furthermore, of the $204 million withdrawn, $38.06 million was in BTC (18.7%), $49.39 million was in ETH (24.2%), and $116.52 million was in USD-denominated stablecoins (57.1%).

“The withdrawn wBTC was despatched to the Alameda WBTC Service provider pockets, after which bridged in its entirety to the BTC blockchain,” Arkham detailed, including that of the ETH withdrawn, $35.52 million was despatched to FTX and $13.87 million was despatched to a big energetic buying and selling pockets. The crypto intelligence agency famous:

The USD-stable tokens have been break up amongst USDT, USDC, BUSD, and TUSD.

Arkham additional shared that $10.04 million in USDT was despatched to Binance and $32.17 million in USDT was swapped to USDC and despatched to FTX. As well as, $47.379 million in USDT, $10.151 million in USDC, $16.285 million in BUSD, and $500K in TUSD have been despatched to FTX.

FTX and about 130 affiliated corporations, together with FTX US and Alameda Analysis, filed for Chapter 11 chapter on Nov. 11. John J. Ray, III, who changed Sam Bankman-Fried (SBF) because the CEO of the FTX group, told the chapter court docket: “By no means in my profession have I seen such a whole failure of company controls and such a whole absence of reliable monetary data as occurred right here.”

What do you consider Alameda withdrawing $204 million from FTX US days earlier than the crypto alternate collapsed? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link