[ad_1]

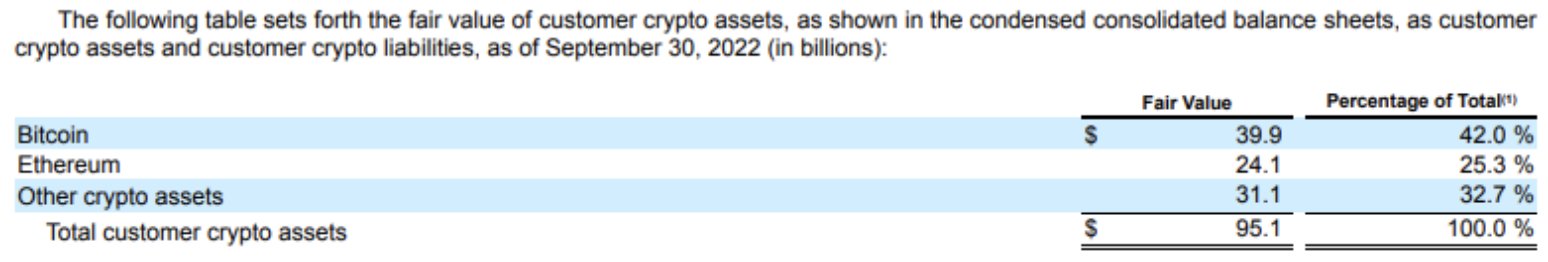

In keeping with Coinbase CEO Brian Armstrong, as of Sept. 30, 2022, the corporate holds 2 million bitcoin value $39.9 billion. The information Armstrong shared comes at a time when most of the people is trying instantly at alternate balances following FTX’s turbulent collapse.

Coinbase Co-Founder Shares Firm’s Q3 Shareholder Letter — Says as of Sept. 30, Agency Holds 2 Million Bitcoin

Two days in the past, Bitcoin.com Information reported on Binance’s alternate reserves and on the time the buying and selling platform had near 600,000 bitcoin, in keeping with cryptoquant.com metrics. As of Nov. 20, 2022, cryptoquant.com stats point out that Binance holds roughly 584K bitcoin. On the identical day, data shows that Coinbase Professional, in any other case often called Coinbase Trade, holds roughly 532K bitcoin.

Moreover, our newsdesk additionally reported on Grayscale discussing its steadiness sheet, because the fund supervisor famous that “all digital property that underlie Grayscale’s digital asset merchandise are saved underneath the custody of Coinbase Custody Belief Firm.” Between Coinbase’s completely different companies, just like the alternate and custody options, the publicly-listed firm holds an excessive amount of bitcoin (BTC).

On Nov. 22, 2022, Coinbase (Nasdaq: COIN) co-founder and CEO Brian Armstrong tweeted concerning the agency’s BTC stash in an effort to dispel any ‘concern, uncertainty, and doubt’ (FUD). “Should you see FUD on the market – bear in mind, our financials are public (we’re a public firm),” Armstrong said on Tuesday. “We maintain ~2M BTC. ~$39.9B value as of 9/30.” The Coinbase co-founder added:

All of us want to come back collectively to construct this trade in a accountable method going ahead. Be cautious of false data.

Armstrong additional shared the corporate’s shareholder letter, which highlights a consolidated listing of Coinbase property. The Coinbase CEO’s statements on Twitter observe the conversations regarding proof-of-reserves and monetary audits.

The proof-of-reserves subject has gained traction and a handful of exchanges have announced upcoming proof-of-reserve audits. For example, on Nov. 21, 2022, Bitstamp detailed that the corporate has been audited since 2016.

“Bitstamp Group and our authorized entities have been audited by an enormous 4 world accounting agency on an annual foundation since 2016,” Bitstamp mentioned on Monday. “They are going to be releasing our proof of reserves audit and the corresponding proof of liabilities. These will present our prospects with an independently carried out verification of their Bitstamp balances, and the reassurance that Bitstamp has the property to cowl them absolutely.”

Whereas Coinbase International shares are down 82% year-to-date, COIN shares gained 5.24% simply earlier than the closing bell on Wall Road on Nov. 22. COIN shares are presently buying and selling for $43.39 per share on Tuesday afternoon (ET). “The transparency and fast response is way wanted and appreciated atm,” one particular person replied to Armstrong’s tweet about Coinbase’s bitcoin holdings on Tuesday.

What do you concentrate on the Coinbase CEO explaining that as of September the agency held 2 million bitcoin value $39.9 billion? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss prompted or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link