[ad_1]

In the course of the week of Jan. 30 to Feb. 5, 2022, the search time period “NFT” had a Google Tendencies (GT) rating of 90 and at this time the GT rating has dropped a fantastic deal right down to a rating of 12. Not solely has curiosity declined, however blue chip non-fungible tokens (NFTs) don’t maintain the worth they as soon as did firstly of 2022. As an illustration, statistics present the Bored Ape Yacht Membership (BAYC) assortment’s market valuation based mostly on ground values was value $2.33 billion on Feb. 3, 2022 — 291 days later and the gathering’s market cap is now value $615 million. Celebrities holding blue chip NFTs like BAYCs and Cryptopunks have seen their NFTs lose quite a lot of worth over the past 9 months.

Blue Chip NFT Market Caps Slide Considerably Decrease For the reason that Begin of the 12 months

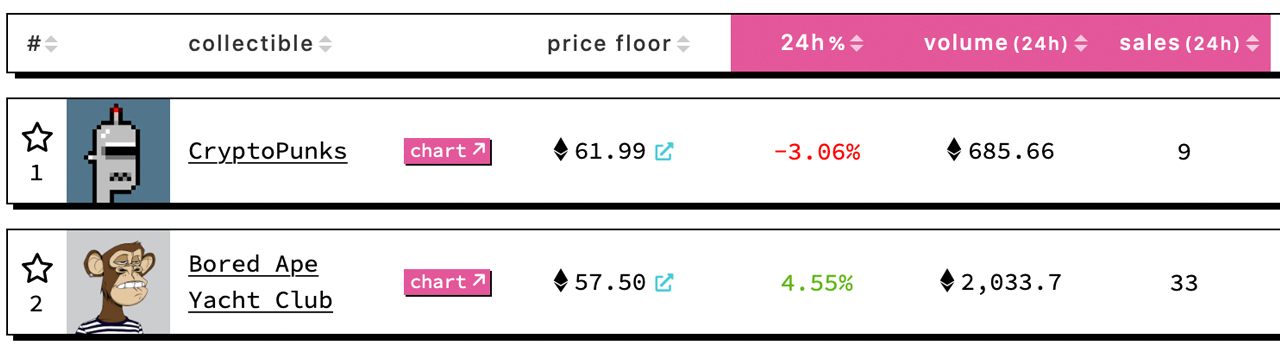

Common non-fungible tokens (NFTs) stemming from particular collections like BAYC, Cryptopunks, Clonex, Mutant Ape Yacht Membership (MAYC), Azuki, and Moonbirds are nonetheless expensive digital collectibles. As an illustration, the bottom valued Moonbird NFT is round 7 ether or $7,906, whereas a BAYC NFT will price 57.50 ether or $63K.

Statistics from nftpricefloor.com present that on Nov. 22, 2022, the Cryptopunks assortment held the most important market capitalization of round 619,900 ether. That’s not a lot lower than the Cryptopunks ground capitalization the gathering had on Feb. 3, 2022, when it was 650,000 ETH.

Nonetheless, the worth of ethereum per unit on Feb. 3 was roughly 2,667 nominal U.S. {dollars} per ether. Meaning whereas the ground capitalization was value $1.73 billion 9 months in the past, at this time the market cap is right down to $685.16 million.

This implies the Cryptopunks NFT assortment dropped by 60.47% over the past 9 months. The identical may be mentioned about BAYC’s NFTs because the market cap has dropped from 875,000 ether value $2.33 billion on Feb. 3, to at this time’s 556,900 ETH value $615.53 million.

NFTs Owned by the Wealthy and Well-known Misplaced Large Quantities of Worth in 9 Months

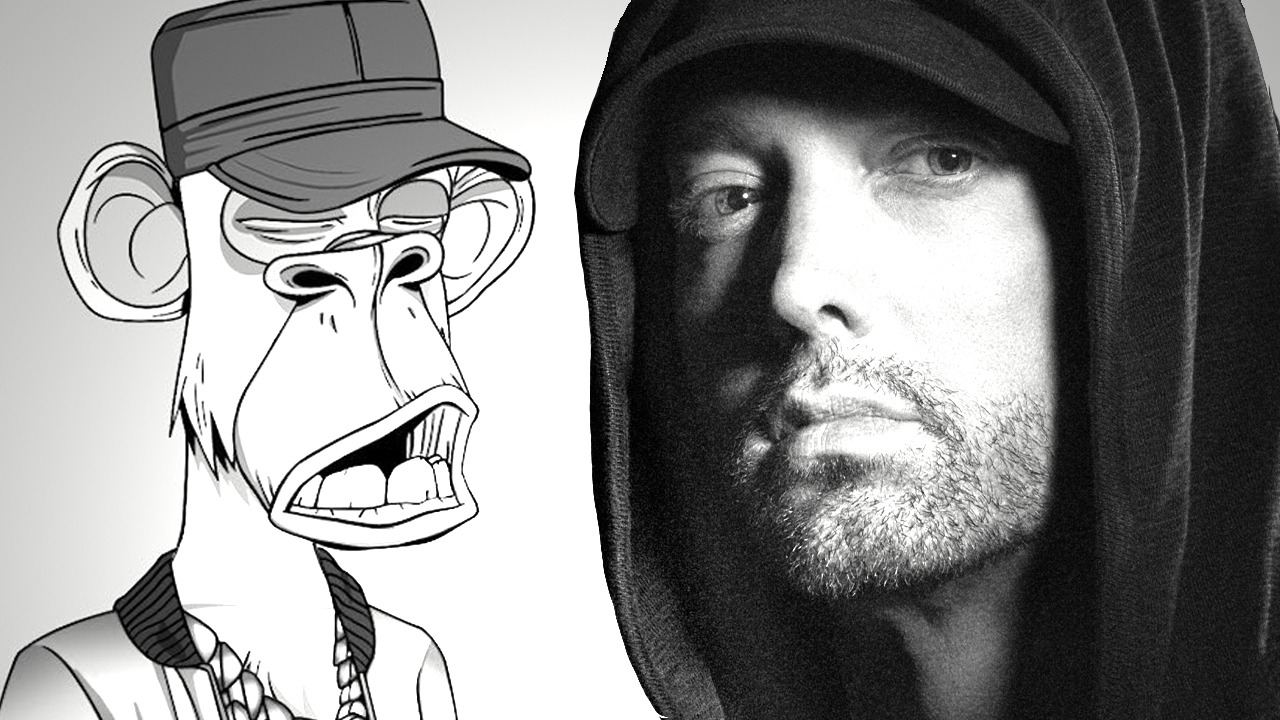

The information reveals over the past 9 months, BAYC’s assortment dropped by 73.62% towards the U.S. greenback. On Jan. 2, 2022, the rap star Eminem purchased BAYC #9055 for 123.45 ether and on the time, it was value roughly $452K.

Eminem moved his BAYC from the “Shady_Holdings” account he makes use of on Opensea to the tackle “0x79f.” Dappradar.com estimates present Eminem’s BAYC is barely value 57.96 ETH at this time or $63,934.

Eminem’s NFT at that estimated worth means BAYC #9055 misplaced 85.85% in worth since he first purchased the NFT. Pop star Justin Bieber acquired Bored Ape #3001 for 500 ETH which was value $1.3 million on the time. At the moment, Bieber’s BAYC NFT is value lower than 60 ETH or roughly $69K.

Socialite Paris Hilton leveraged the corporate Moonpay to purchase Bored Ape #1294 for 119 ether or $317K. On the finish of November 2022, Hilton’s BAYC #1294 is barely value $63,783 in keeping with present estimates.

The identical may be mentioned for a myriad of celebrities that personal BAYCs or Cryptopunks NFTs, together with house owners like Shaquille O’Neal, Jimmy Fallon, and Gwyneth Paltrow. It’s secure to say that NFTs have misplaced much more worth than the wonderful artwork a few of these celebrities personal, as wonderful artwork costs haven’t seen values fall by 60% to 80% in 9 months’ time.

What do you concentrate on the decline in blue chip NFT values because the begin of the 12 months? What do you concentrate on the NFTs owned by celebrities shedding important worth since they had been bought? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link