[ad_1]

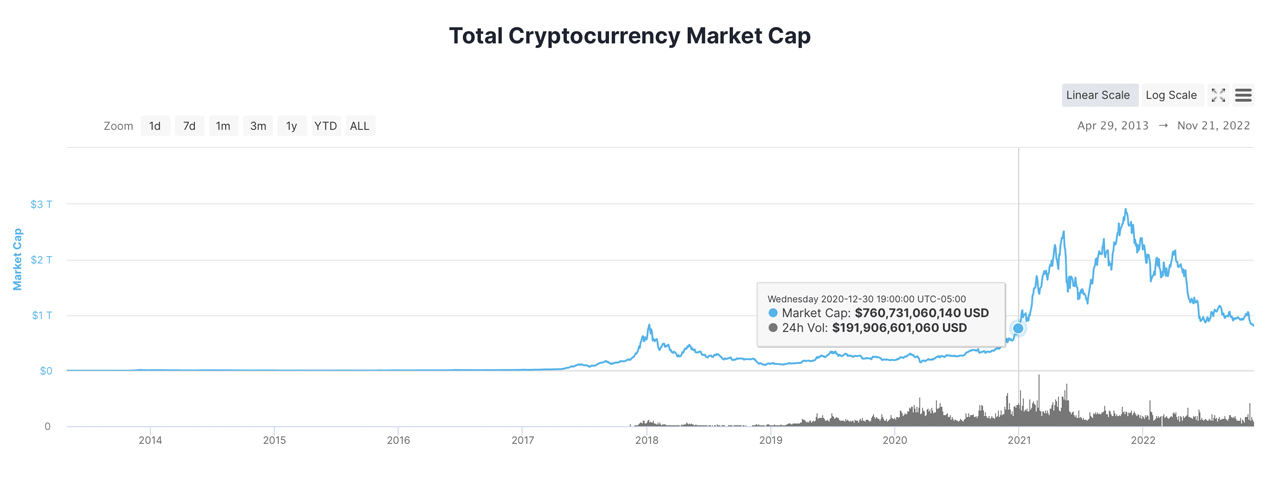

The worldwide cryptocurrency market capitalization has dropped under the $800 billion area for the primary time in 691 days or since December 30, 2020. Bitcoin has dipped under the $16K area dropping 5.12% over the previous 24 hours, and the second main crypto asset ethereum shed 7.61% on Monday, dropping under the $1,100 vary.

Crypto Financial system Sheds Extra Than 4% during the last day, Bitcoin Drops Under $16K, Ethereum Slips Under $1,100

Cryptocurrencies had a tough Monday as all the digital asset market capitalization noticed a 4.37% lower during the last day. Moreover, the U.S. greenback valuation of all of the crypto property in existence fell under the $800 billion zone, the bottom worth seen since December 30, 2020.

Whereas cryptocurrency commerce volumes rose to $150 to $225 billion through the FTX market mayhem, world commerce volumes dropped drastically right down to $66.66 billion in 24-hour commerce quantity on November 21, 2022. Bitcoin (BTC) dropped to a low of $15,588 per unit on Monday underneath the $16K vary and it’s at present coasting alongside at $15,721 per unit at 3:30 p.m. (ET).

Ethereum (ETH) is buying and selling for $1,091.14 per unit after shedding 7.61% in USD worth over the last 24 hours. A number of the greatest losers on Monday embrace close to protocol (NEAR) down 12.6%, terra luna basic (LUNC) misplaced 11.1%, and solana (SOL) shed 10.7% in 24 hours.

Cash like huobi (HT), ethereumpow (ETHW) and apecoin (APE) noticed beneficial properties immediately between 1.7% to 7.3% with HT main the pack. Presently, BTC’s dominance among the many complete crypto financial system’s digital property is 38.7% on Monday, whereas ETH’s dominance is 17.1%.

Concerning the worldwide commerce quantity on Monday, tether (USDT) dominates the books with $53.73 billion of the $66.66 billion in worldwide commerce quantity. Moreover, because the crypto financial system’s valuation shrank on Monday, USDT’s dominance elevated to eight.102%.

Usd coin’s (USDC) market valuation equates to 5.485% of the $786.27 billion crypto financial system worth on Nov. 21, 2022. Along with crypto property, fairness markets within the U.S. shuddered as all 4 main indexes (NYSE, Nasdaq, Dow, S&P 500) have been down for many of Monday’s buying and selling periods.

Valuable metals have been down on Monday in addition to gold slid 0.69% and silver dropped by 0.48%. Platinum occurred to extend by 0.41% in opposition to the buck, however palladium dropped by 3.74% throughout immediately’s New York spot prices notice. By 4:15 p.m. (ET) on Monday, BTC’s worth managed to climb to $15,900, whereas ETH’s worth managed to leap again above the $1,100 zone.

What do you concentrate on the crypto financial system dropping under the $800 billion vary? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link